John Mauldin has some good news and some bad news for financial advisors. The bad news: half of them will be looking for a new line of work in the next decade. The good news: those still in the business will be the ones who figure out how not to do the same old “buy and hold” strategies of the past. Talking with Hedgeye TV, financial expert and best-selling author Mauldin says advisors have more tools than ever, but they need to educate their clients about dynamic portfolios. “What I’m doing with my clients is I’m saying we’re diversifying trading strategies, we’re not diversifying asset classes and buying and holding.”

Finances, Impact Are Sticking Points for Donors

Sixty-four percent of donors say they would like to give more to charity, but their financial circumstances and questions about the impact of giving are preventing them to do so, according to a new study by Fidelity Charitable. Seventy-two percent of the 3,200 donors surveyed cited their personal finances were a barrier to giving, while 65 percent said concerns about impact was a top barrier. Nearly half said a greater tax benefit or the ability to take a larger tax deduction would cause them to give more. Two-thirds of donors indicated that they would give more if they had a better understanding of the impact.

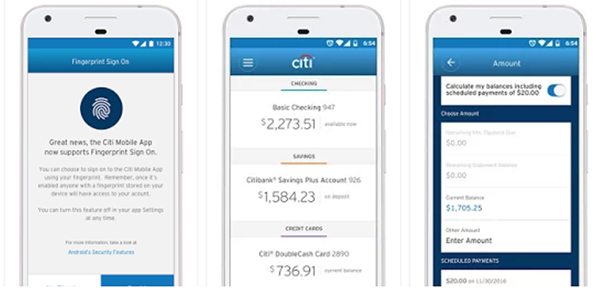

Wealth Management Comes to Citi Mobile App

Users of Citi’s mobile app for Android can now access wealth management services, the bank announced Friday. Customers with Android devices will now be able to open Citi Personal Wealth Management brokerage accounts on their phones. The app also includes a “click to call” feature that instantly connects users with their Citigold relationship managers, their personal wealth managers or a 24-hour service center. Carey Kolaja, the chief product officer at Citi FinTech, said “delivering an elegant user experience is paramount” as the bank’s app competes for the attention of customers on their devices.