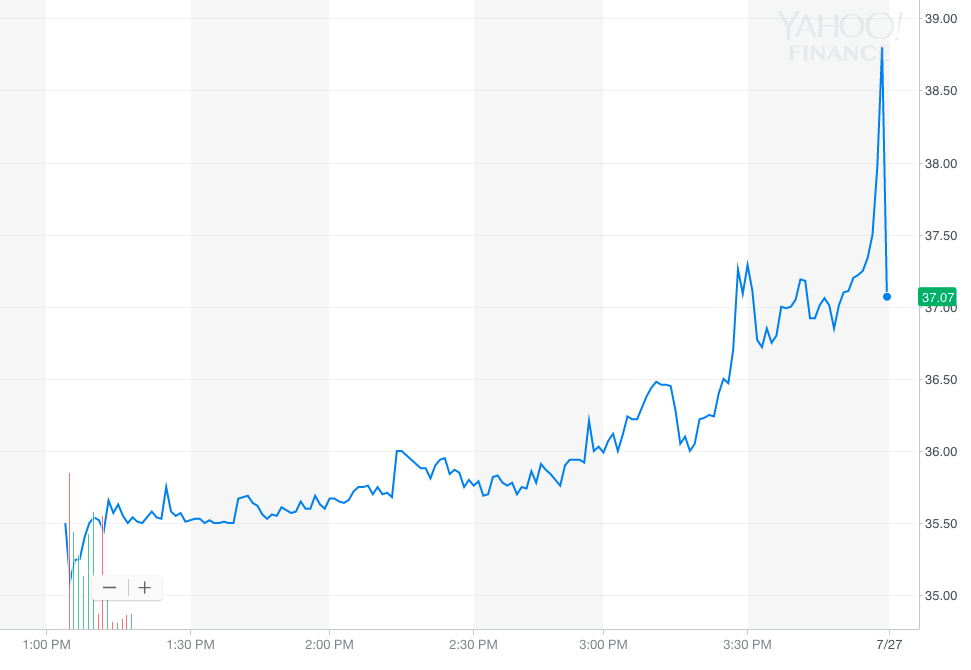

Focus Financial Partners, an acquirer of registered investment advisory firms, ended its first day of trading up 13.8 percent or $37 per share on Wednesday, smack-dab in the middle of the price range it estimated in its filing for the initial public offering.

The stock inched its way from $33 start to as high as $38 in the afternoon before dipping just before the market closed. At $33, the stock began the day just under the expected $35 to $39 range it anticipated in a prospectus dated July 16.

Focus offered 16,216,217 shares of Class A common stock on the NASDAQ Global Select Market under the ticker symbol FOCS.

At $33 per share, the company expected the IPO to raise $535.1 million and possibly as much as $615.4 million if underwriters exercised their option to purchase additional shares in full. Had the shares debuted at the top of the range at $39, the company stood to raise an additional $97 million. But investors helped it raise more than $600 million on Wednesday, pulling the price per share to $37.

The offering includes only part of Focus Financial’s Class A common stock. Including shares from the IPO, there are now a total of 39,427,831 Class A shares, the majority of which were convertible preferred units owned already by stakeholders, and 21,727,198 shares of Class B common stock which entitle owners to voting rights but not economic rights.

The aggregate number of shares priced at $33 would have valued Focus at more than $2 billion.

The firm reported revenue $663 million in 2017, up 37 percent from 2016, and fees paid by its 51 registered investment advisors account for the majority of it (93 percent). But the company reported a net loss of $48 million last year, a significant swing from the income of $16 million in 2016.

Compensation and related expenses were up 49 percent, half of which was related to the 23 business acquisitions closed in 2017, twice as many as the year prior. Management fees paid to advisors at the acquired firms also increased 42 percent to $164 million. Focus has also paid $41 million in interest on nearly $1 billion in debt from its credit facilities, almost twice the interest expense they paid in 2016. The initial Form S-1 the firm filed with the Securities and Exchange Commission revealed other details as well.

Focus, founded in 2006, by Rudy Adolf, a veteran of McKinsey & Company and American Express, had previously planned to go public in 2016 but put the IPO on hold. Shortly after, in the spring of 2017, private equity firms Stone Point Capital and KKR acquired about a 70 percent stake in the firm, valuing Focus at about $2 billion.

“When you’re bringing two of the most sophisticated private equity houses in the world into an investment like this, obviously it’s unlikely that you’ll immediately flip into an IPO; that would not make sense as a strategy,” Adolf said told WealthManagement.com shortly after the deal.

Stone Point Capital will have the right to nominate two members to the Focus board of directors as long as it maintains at least 50 percent of the equity stake it owns in the company. At the time of its IPO filing, Focus stated that Stone Point Capital had nominated James Carey and Fayez Muhtadie, both principals at the private equity firm, to the board.

KKR will also have the right to nominate a director to the Focus board as long as the firm maintains at least a 5 percent equity stake. Initially to serve on the board, KKR nominated Chris Harrington, a member of the firm’s financial services team that worked on the Focus deal.

Focus has also recently been an investor in firms within the wealth management industry. In June, the company led a $28 million fundraising round for SmartAsset, which plans to use the investment to further develop its fast-growing, client-lead generation tool for financial advisors. Javelin Venture Partners, TTV Capital, IA Capital, Contour Venture Partners, Citi Ventures were among others who took part in the round of funding.