For the last couple of years, the independent broker/dealer channel has been in a tough spot. Some small firms were consumed by the blow-ups of problematic alternative investments. At the same time, many small shops haven’t been opening up new broker/dealers at all, because of the high barriers to entry, including regulation and compliance burdens.

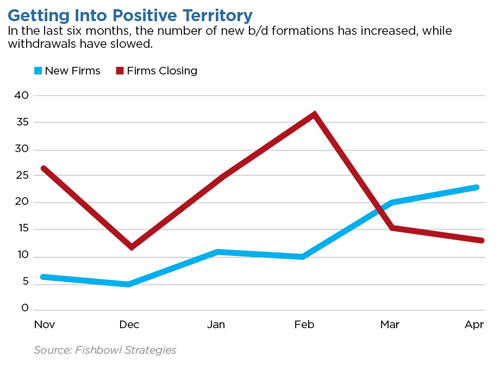

But in April, the number of new b/d formations (17) outpaced the number of withdrawals (13) for the second straight month, according to a new report by Fishbowl Strategies, which tracks changes in registrations. In March, there were 20 new b/ds, and 15 withdrawals. Prior to March, there has only been three other net positive months in b/d registrations, the latest being October 2011.

“The markets are up so much that it’s a more healthy economic situation right now,” said David Alsup, founder of Fishbowl Strategies.

“As the consolidations continue, little firms that are two-man shops are now six-man shops or eight- or 10-man shops. So they’re moving up in numbers, they can accommodate more overhead.”

There are currently a total of 4,191 FINRA member firms, Alsup said. That said, some bankrupt firms, such as Lehman Brothers and MF Global, still carry CRD numbers. Alsup has predicted that the b/d industry will shrink to 4,000 by 2015.

“Although I predicted 4,000, this strong economy may slow the withdrawals down,” he said.

Indeed, longer trends also show the pace changing. Over the past twelve months, there has been a net loss of 115 firms. That compares to a net loss of 143 firms in 2013 and 177 firms in 2012. A total of 13 firms closed up shop in April, versus 16 in April 2013 and 23 in April 2012.

“If we have another positive month, it will portend that maybe we finally got a bottoming out for a while.”

Alsup, who also tracks SEC-registered investment advisors, found that the number of new RIAs is growing. In April, there were 183 new RIA firms, the highest Alsup has seen since he started tracking it six months ago.