While value strategies have outperformed growth in the first half of 2021, the trend has reversed in the second half.

Broad market U.S. equity benchmarks, such as the Russell 1000 Index and the S&P 500 Index, have growth and value subset indexes based on earnings-to-price ratios, earnings growth, and other metrics. The ETFs tracking two value subset indexes, iShares Russell 1000 Value ETF (IWD) and iShares S&P 500 Value ETF (IVE) , rose 17% and 16% respectively in the first six months of the year. That's ahead of the 13% and 14% gains for their growth-oriented alternatives iShares Russell 1000 Growth (IWF) and iShares S&P 500 Growth ETF (IVW).

However, thanks to strong performance in recent weeks, S&P 500 based IVW pulled ahead of IVE (20% vs. 17%) year-to-date through Aug. 6, while Russell 1000 based IWF pulled in even with IWD at 18%.

Strong second-quarter earnings results for growth stocks as well as the re-emergence of COVID-19 concerns likely have played a role. While this might indicate to some that the time to focus on value has passed, CFRA thinks investors need to broaden the field of value ETFs they should consider, as we have unfavorable ratings on IWD and IVE based on holdings-based and fund-specific characteristics.

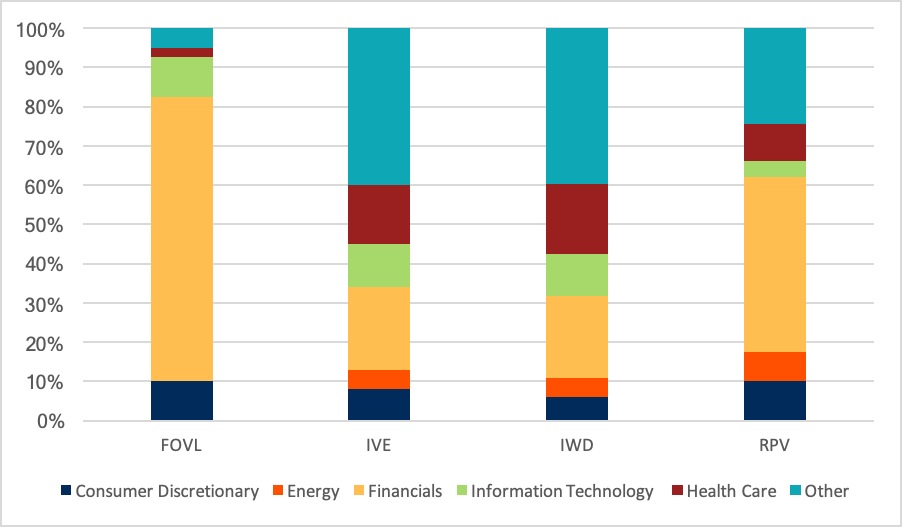

Invesco S&P 500 Pure Value ETF (RPV) is a more targeted value approach using the S&P 500 as its starting point. Like IVE, RPV holds shares of companies with relatively appealing book-value-to-price, earnings-to-price, and sales-to-price metrics. But instead of owning 433 positions that include Johnson & Johnson and Walt Disney, and including companies with a blend of value and growth, RPV has just 121, tightly focused on the companies with deepest value traits. RPV has heftier weights in financials (44% of assets vs. 21%) and energy (7% vs. 5%) and lighter ones in information technology (4% vs. 11%) and health care (9% vs. 15%). CFRA has buy recommendations on many of RPV’s holdings including Ford Motor Company, Lincoln National Corp. and MetLife. The ETF has a 0.35% expense ratio.

In the first half of 2021, RPV rose 27% ahead of the 16% for its broader value and S&P 500 based cousin IVE. In the subsequent weeks, RPV has held steady and year-to-date through Aug. 6 had a 26% total return. Rated as a CFRA five-star based on risk, reward, and cost factors, we think the fund is well positioned for continued success over the next nine months.

iShares Focused Value ETF (FOVL) is a more concentrated, value-focused version of IWD. Holding just 40 stocks, FOVL’s construction starts by removing 20% of the Russell 1000 Index based on elevated volatility or high leverage and then excluding any company with negative prospective earnings. The remaining companies are then ranked based on composite of four value metrics—price-to-book, price-to-dividend, price-to-earnings and price-to-cash-flow-fromoperations. The current portfolio is heavily weighted to financials (72% of assets) but has some diversification through information technology (10%) and consumer discretionary (10%) stocks. CFRA has buy recommendations on many of FOVL’s holdings including Dick’s Sporting Goods, Everest Re Group, Hartford Financial Services and New York Community Bancorp. FOVL has a 0.25% expense ratio.

Figure 1: Select Sector Exposure of Value ETFs

CFRA ETF database. As of August 6, 2021

In the first half of 2021, FOVL rose 30%, gaining more ground than the 17% for its broader value cousin IWD. Since then, FOVL has risen modestly and was up 32% year-to-date, more than 1,000 basis points ahead of IWD. FOVL also earns a CFRA five star rating based on fund-level characteristics and its holdings, despite only being nearly two-and-a-half years old.

Conclusion

After being overshadowed by growth in recent years, value investing has gained popularity in 2021. As a result, some advisors are questioning how long the trend can last and how they should position their client portfolios. CFRA will be hosting a webinar for financial professional to discuss this and other related topics on August 12. To register, visit https://go.cfraresearch.com/Value_Growth

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.