While the past decade has marked a challenging period for value stocks, the tide has seemingly turned in recent months. The Russell 1000 Value Index has outperformed the Russell 1000 Growth Index by over 10% year to date (January 1 to March 31) and by over 16% for the six months ending March 31, 2021, according to FactSet. We believe this is due in part to investors’ reactions to an improving economy and the progress of COVID-19 vaccinations.

If history is any indication, we believe the resurgence of value may further benefit from an increase in inflation and the economic environment contributing to it. An increasing number of economists are now expecting robust growth thanks to the prospects for further economic reopening, record government stimulus and increased consumption from post-pandemic demand. Accordingly, many economists are also expecting higher levels of inflation, with some debate about the magnitude or duration of this inflation.

Inflation Has Historically Been a Tailwind for Value

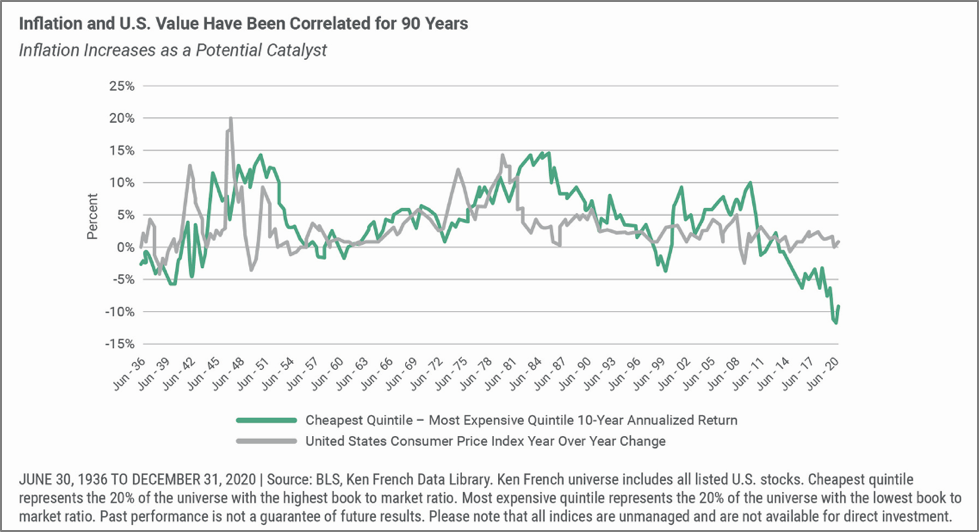

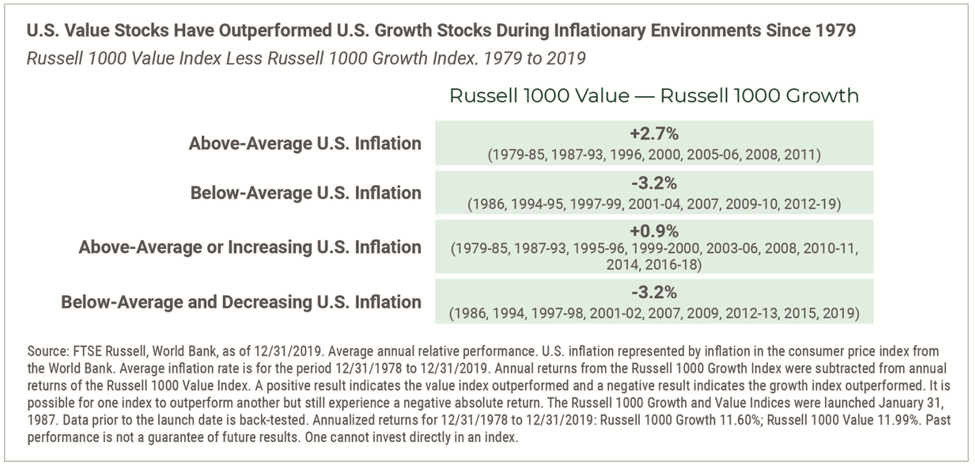

Historically, periods of above-average or increasing inflation have tended to benefit the relative performance of value stocks versus growth stocks.

Rising inflation has also tended to be accompanied by rising interest rates. If that occurs, the present value of growth stocks’ distant cash flows can decline, whereas value stocks with more immediate cash flows could be less impacted. While a material increase in interest rates may be a risk to the broader equity market as well as to fixed income, rising interest rates have historically shown a positive correlation with the relative performance of value stocks, according to FactSet.

Given their historical correlations with inflation and interest rate movements, we believe the current environment bodes well for value stocks, based in part on past market data points. U.S. value stocks have outperformed in periods of above-average or rising inflation since 1979 (see table below).

What’s Behind the Inflation-Value Correlation?

We believe several factors explain the correlation between inflation and the performance of value stocks.

Financial Stocks: Financial firms comprise the largest component of many value indices. They tend to benefit from a higher and more upwardly sloping yield curve because: i) financial institutions are able to borrow short duration (e.g., deposits) and lend longer duration, potentially boosting the spread between the rates they pay on their liabilities and the rates they earn on their assets, and ii) higher rates have the potential to benefit their shorter-term investments.

Cyclical Stocks: Value stocks in general (including financials but also industrials, energy and other sectors) tend to be sensitive to the economy. Rising inflation and interest rates have often signaled a strengthening economy, which has tended to favor economically sensitive value stocks.

Investor Sentiment: During times of significant economic uncertainty (of which the pandemic is a prime example), we have often seen investors willing to “pay up” for the earnings visibility provided by economically independent growth stocks. But, as the economy strengthens and inflation rises, investors typically become more comfortable buying economically sensitive value stocks with the expectation that their prospects will improve.

Discount Rate: Rising interest rates typically increase the discount rate with which long-duration growth stocks are valued. Using a higher discount rate in calculating the present value of distant cash flows for growth companies means those cash flows are worth incrementally less compared with value stocks’ more immediate cash flows.

Beyond Inflation, Other Forces Are Positive for Value

In addition to the positive correlation between inflation and value, there are several other reasons to hold an optimistic outlook for value stocks. Even after value’s impressive outperformance versus growth recently, value stocks still trade at a wide discount to growth stocks, according to Bloomberg.

As investors continue to recognize the appreciation potential of value stocks, predominantly “growth” and momentum funds may increasingly allocate to “value” stocks, as the Russell 1000 Value Index is now forecast to have faster earnings-per-share growth in each of the next two years as compared with the Russell 1000 Growth Index, according to FactSet. Additionally, technology stocks are the biggest component of the growth index (over 40% of Russell 1000 Growth as of March 31, 2021). The potentially heightened regulation of tech companies, coupled with proposed tax changes that could weigh more heavily upon them, may dampen the enthusiasm for tech (and therefore growth) stocks, while increasing the relative appeal of value stocks.

The current “value rally” is not without some potential risks. Chief among these risks would be a resurgence of the pandemic, a related slowdown in the economic recovery, or a material worsening of trade conflicts. Also, while value stocks in general are still trading at big discounts to growth stocks, that gap has closed for some industries. Thus, individual stock selection may be becoming more important than simply following a value style.

Looking Ahead

After a long drought for value investing, the economic environment seems to be favoring value. For the six months ending March 31, 2021, U.S. value stocks outperformed U.S. growth by a wide margin. Although past performance is no guarantee of future results, we believe the current environment will continue to bode well for value stocks, given their historical correlations with inflation, and, more importantly, their current valuations compared with growth stocks. As we mentioned above, even after their recent outperformance, value stocks continue to trade at what we consider appealingly high discounts to growth stocks.

In summary, we believe there is still room to go for value’s performance relative to growth—and there are a variety of reasons investors may want to consider increasing their allocation to value stocks.

Brent Fredberg is director, investments group at Brandes Investment Partners L.P.