Rather than using cap-weighted, index-based equity ETFs, some advisors are building portfolios using factor ETFs. Factor ETFs, which CFRA considers part of the smart-beta ETF universe, are built by owning companies with traits that have shown persistence in generating either above-average returns or reduced risk. These include lower volatility (stocks that have risen or fallen less than the broader market), momentum (stocks with relative performance strength), quality (companies with strong balance sheets), size (companies that are smaller and often overlooked) and value (stocks that are relatively cheap). While ETFs tracking the S&P 500 Index, the Russell 2000 Index and other broad benchmarks have some of these characteristics, there is a wide array of ETFs providing more targeted exposure.

Bryn Talkington, managing partner of Requisite Capital Management, a Texas-based registered investment advisor, explained to CFRA that to gain factor exposure she prefers ETFs, as she wants the ability to monitor that the asset management firm is following the factor methodology through the daily disclosure of holdings. She added that mutual funds are required to disclose holdings only quarterly. However, not all factor ETFs are created equally, and it is crucial to know what is under the hood, noted Douglas Walters, chief investment officer of Strategic Financial Services. Walters added that to invest in factor funds, you have to take the time to ensure the methodology matches the exposure you are trying to achieve before you can consider other attributes, such as expense ratios, issuers and assets under management.

CFRA’s star ETF ratings combine holdings-level analysis with key fund attributes. To rate equity ETFs, we review the underlying securities from multiple valuation and risk considerations, including our proprietary fundamental and forensic analytics, as well as relative cost and performance metrics. We think some investors rely too much on past performance when it is also important to understand how the fund is likely to perform in the future.

Talkington and Walters both incorporate macroeconomic factors to determine what factors to invest in. Walters noted that his strategy is tactically overweight momentum and value, using iShares Edge MSCI U.S.A. Momentum Factor ETF (MTUM), iShares Edge MSCI U.S.A Value Factor ETF (VLUE) and Vanguard U.S. Momentum Factor ETF (VFMO). He said the U.S. is in the middle of an economic expansion, which is when those factors have tended to outperform. In contrast, Talkington owns iShares U.S. Small Cap Value Factor ETF (SVAL), which combines the size and value factor but also excludes companies based on debt leverage and high volatility. She noted that the U.S. is in uncharted waters with respect to monetary policy, inflation and the lack of fiscal discipline, which lends itself to a portfolio that has more optionality to various outcomes.

At CFRA, we believe the ETF holdings of MTUM and VFMO are uniquely constructed and have different return and risk traits. For example, at the holdings level, index-based MTUM has more exposure to financials and less exposure to consumer discretionary companies than actively managed VFMO.

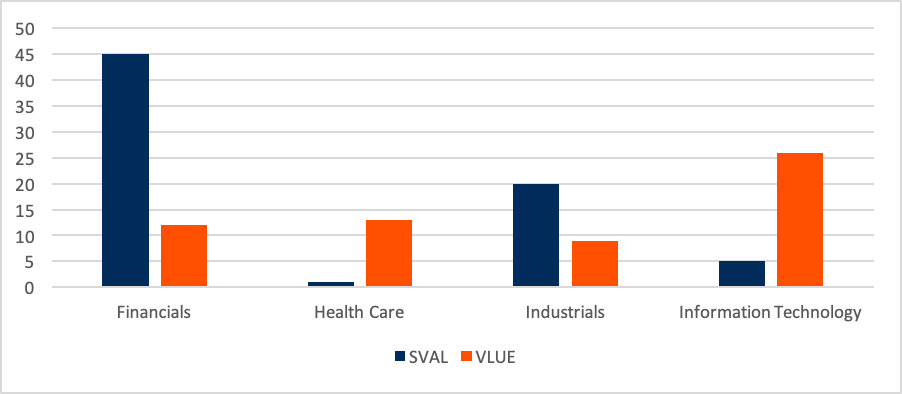

While SVAL and VLUE both earn CFRA three-star ratings and are managed by BlackRock, they are also built differently. VLUE owns large- and mid-cap stocks that have relatively low valuations within each of the 11 sectors, which provides a relatively diversified portfolio, led by information technology (27% of assets) and health care (13%). Meanwhile, small-cap-focused SVAL is more targeted to the financial (45%) and industrial (20%) sectors.

Figure 1: Sector Exposures of Two Value ETFs (% of Assets)

Factor ETFs can help advisors tilt their clients’ portfolios toward companies with certain attributes while allowing for the use of daily disclosure to keep track of exposure. But it is important to use ETF data to understand what using factor ETFs does to a portfolio. For example, Talkington shared that owning SVAL resulted in a portfolio underweight to the information technology sector and overweight to the financial sector relative to the S&P 500 Index.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.