“The ladder of success,” claimed Ayn Rand, “is best climbed by stepping on the rungs of opportunity.” Investors in the municipal bond market have long sought their own success with laddered maturities. Recently, though, as bonds have matured in this low-yield environment, reinvestment opportunities have been disappointing.

In June and July alone, as much as $150 billion in muni coupons and principal redemptions become available for reinvestment. According to Catherine Stienstra, head of Municipal Bond Investments at Columbia Threadneedle Investments, it may be time for investors to rethink their ladder strategies and seek out better opportunities for yield and diversification.

Working against reinvestment now is a dearth of supply in the face of rising demand. General obligation (GO) debt, particularly in the smaller states, have been pretty well picked over. “Issuers are flush with cash and have had better-than-expected cash revenues,” says Stienstra. “State and local governments are in a very good shape, so they’re holding off on issuing debt.”

Demand for munis, meantime, is mushrooming as “the threat of increasing income taxes and potential for higher capital gains rates has drawn investors to the asset class,” says Joe Gotelli, co-head of Municipal Bond Investments at American Century Investment Services. "The economic recovery, coupled with record fiscal stimulus and direct federal aid to state and local governments continues to provide a strong fundamental backdrop for municipals."

The Biden administration’s infrastructure push for large expenditures to build roads, bridges and rail lines is also creating opportunities for muni investors in a number of revenue bond sectors.

“Those sectors that were hit hardest during the pandemic are now recovering,” says Columbia’s Stienstra, pointing to tightening spreads—a feature of improving economic conditions—in the entertainment, airport and hospital segments. “In fact,” she explains, “most sectors have recovered to pre-pandemic levels. We think that returns are going to come from security selection now that most of the spread tightening in the sectors has taken place.”

This makes for a harrowing reinvestment environment for muni ladder investors and their advisors. Many are hesitant to lock themselves into individual bonds at low yields, especially as the shadow of inflation lengthens. Negative returns are a real possibility.

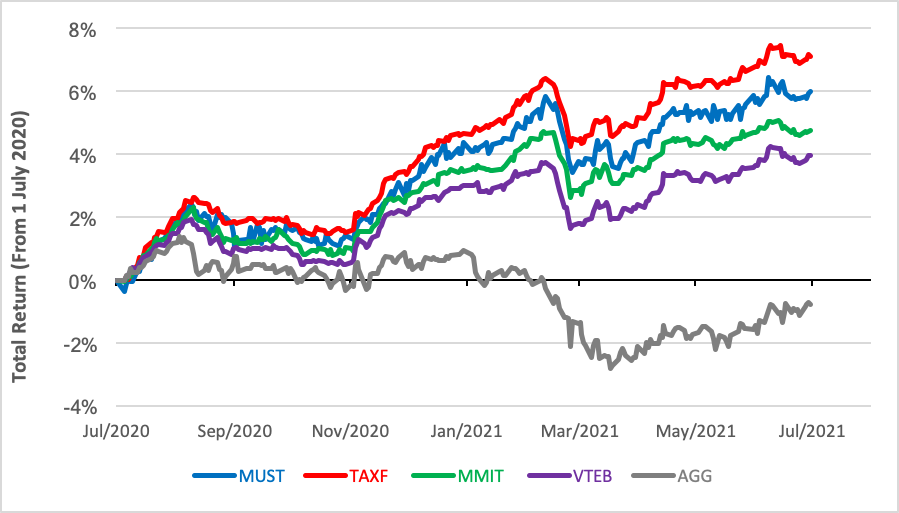

Equitizing the cash received from maturing bonds into a muni ETF could provide investors the opportunity to increase yield and obtain sector as well as geographical diversification. Four such ETFs offer a moderate degree of interest rate risk, expressed as durations in the five- to six-year range. All have, to varying degrees, outperformed the iShares Core U.S. Aggregate Bond ETF (AGG), a portfolio tracking the Bloomberg Barclays U.S. Aggregate Bond Index, which produced a negative total return of 0.77% over the past year.

- Columbia Threadneedle’s approach to the national muni market is expressed in its “strategic beta” product, the Columbia Multi-Sector Municipal Income ETF (MUST) which tracks the Beta Advantage Multi-Sector Municipal Bond Index. The fund has fixed-weight exposure to five sectors, the weightiest being “core” revenue consisting of power, transportation, education, and lease revenue bonds, followed by health care revenue bonds, high-quality bonds (mainly housing and water/sewer revenue issues), and equally small dollops of GO bonds and high-yield debt. Overall, credit quality tends to be high while maturities skew long. MUST earned a 6% total return over the past year.

- The American Century Diversified Municipal Bond ETF (TAXF) is an actively managed portfolio that primarily holds investment-grade bonds, but may invest as much as 35% of its portfolio in high-yield/lower-quality issues to take advantage of prevailing market conditions. TAXF managers can throttle the portfolio’s duration in the three- to seven-year range to balance interest rate risk and yield. Total return for the TAXF portfolio has been 7.11% over the past 12 months.

- Also actively managed, the IQ MacKay Municipal Intermediate ETF (MMIT), like TAXF, invests principally in investment-grade securities. Considering a variety of macroeconomic factors, the fund’s managers use fundamental analysis to select bonds for the portfolio. The fund’s average duration can vary within a range of three to 10 years in response to market conditions. No single state represents more than 30% of the portfolio’s capitalization. The fund’s 12-month total return clocks in at 4.74%.

- An industry benchmark, the Vanguard Tax-Exempt Bond ETF (VTEB) attempts to emulate the S&P National AMT-Free Municipal Bond Index, providing broad exposure to the muni bond market across several states and projects. The fund’s index methodology permits selection of investment-grade debt only but of any maturity. Bonds are market-value weighted in the portfolio and rebalanced monthly. Over the preceding 12 months, VTEB’s produced a total return of 3.96%.

One-Year Performance: Bond ETF Total Returns

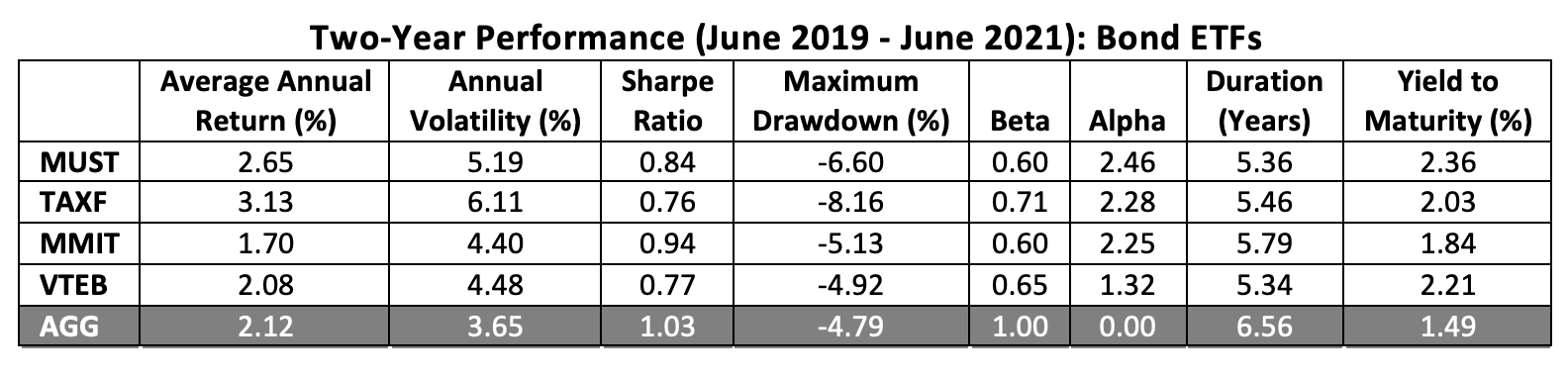

Over the longer run, the nearly 3-year-old MUST portfolio offers the highest alpha against AGG as well as the highest yield to maturity. While the equally old TAXF fund earned a higher average annual return over the past two years, it’s more volatile, subjecting investors to an 8% drawdown in 2020.

The high beta-adjusted returns of the MUST and TAXF funds is in great part explained by their light exposure to GOs. Columbia’s Stienstra says many market-cap weighted muni ETFs are “flawed” because of their tilt toward large state GOs. “We excluded California as well as market-weighted, lower income opportunities. California is the largest issuer in the municipal market; it makes up a pretty significant portion of the muni indices. Because of the high taxes in California, though, they trade at a premium; the yields are extremely low.”

American Century’s Gotelli concurs, stating: “Market-weighted benchmarks are inherently exposed to large state and local GO issuers. As active managers, we are underweight these areas in favor of more spread-centric sectors. While we’re not avoiding any specific issuers, we find better relative value opportunities outside of the general obligation space.”

Stienstra’s fund goes further yet. MUST’s exclusions extend to “Puerto Rico, territories and tobacco because of their volatility,” she says, adding, “something we include and what others exclude is AMT. After tax reform, a lot of individuals are not exposed to the Alternative Minimum Tax like they were before.” Because of their higher yield, AMT bonds offers better Sharpe ratios nowadays, according to Stienstra.

Financial advisors and investors may well wish to consider these ETFs as complements to their muni ladders, more or less as parking spaces for maturing principal until rates stabilize and supply improves. But going forward, it’s worth pondering the potential effect of inflation and rising rates on these portfolios.

Columbia’s Stienstra sums it up succinctly: “To some extent, duration will lose in a rising rate environment but credit wins, so this should work very well in an alpha-driven market.”

Brad Zigler is WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.