Demand for municipal bond ETFs has increased in 2021. After pulling in $14.6 billion of net inflows in 2020, municipal bond ETFs gathered $8.6 billion of new money in the first five months of 2021 according to CFRA’s ETF database. The net inflows have been broadly based with 13 ETFs gathering more than $100 million and 60 of the 66 available funds gathering fresh assets. Investors have gained more comfort in using fixed income ETFs, which offer transparency, liquidity and diversification benefits relative to mutual funds and/or individual bonds.

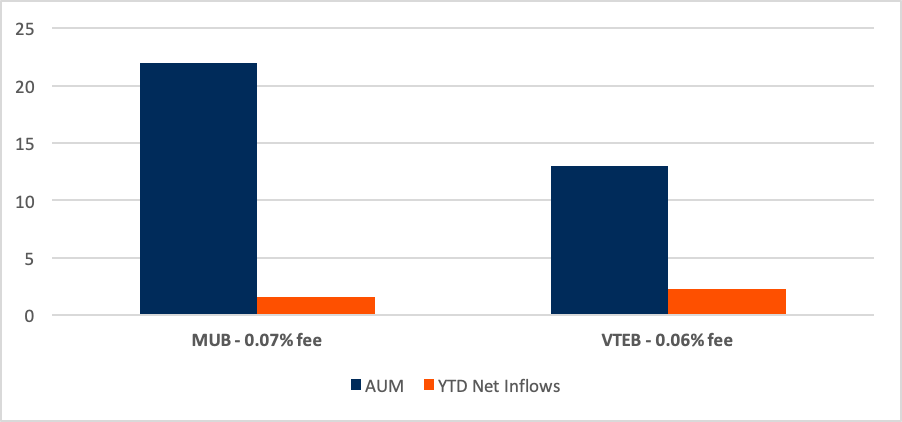

Fees are a driver of fund flows when it comes to fixed income ETFs. The two largest municipal bond ETFs, iShares National Muni ETF (MUB) and Vanguard Tax-Exempt Bond ETF (VTEB), track the same S&P National AMT-Free Municipal Bond Index with nearly 5,000 investment-grade-rated bonds inside. These ETFs have overlapping investment exposure, but VTEB charges a 0.06% expense ratio that is one basis point less than MUB. That fee difference appears to have helped. Year to date through May, VTEB gathered $2.3 billion of net inflows, $713 million more than MUB, modestly narrowing the asset gap. MUB launched eight years before VTEB and had $22 billion in assets compared with $13 billion for VTEB.

Figure 1: A Look at the Two Largest Municipal Bond ETFs ($B)

CFRA’s ETF Database. As of May 28, 2021. AUM stands for assets under management.

iShares has the cheaper short-term municipal bond ETF. iShares Short-Term National Muni Bond ETF (SUB) is the third-largest municipal bond ETF, with $4.8 billion in assets, a mere $14 million more than short-term index-based peer SPDR Nuveen Barclays Short Term Municipal Bond ETF (SHM). In the first five months of 2021, SUB pulled in nearly double SMH’s net inflows ($775 million vs. $392 million) aided in part from its lower fee. SUB tracks a different index with slightly lower average duration and incurs modestly elevated, but still investment-grade credit risk. Yet we think for some investors SUB’s 0.07% expense ratio, less than SHM’s 0.20%, is what makes it more appealing. Both funds are essentially flat in the past year and year to date through May 2021.

Figure 2: A Look at Two Largest Short-Term Municipal Bond ETFs ($B)

CFRA’s ETF Database. As of May 28, 2021.

High-yield municipal bond ETFs invest in more than below-investment grade bonds. Unlike in the corporate bond ETF arena, where high-yield bond funds own only bonds rated BB (or equivalent) or lower, municipal bond ETFs own some investment-grade rated securities, speculative-grade ones as well as bonds that are not even rated. The $3.6 billion VanEck Vectors High Yield Municipal Bond Index ETF (HYD) recently had 25% of its assets in investment-grade, 34% in high-yield-rated and 42% in nonrated securities. In contrast, SPDR Nuveen Bloomberg Barclays High Yield Municipal Bond ETF (HYMB) had more investment-grade exposure (32% of assets) and less in nonrated bonds (35%), with the remainder in high-yield rated securities. Both ETFs have 0.35% expense ratios, but HYMB outperformed HYD in the first five months of 2021 due to its distinct exposure.

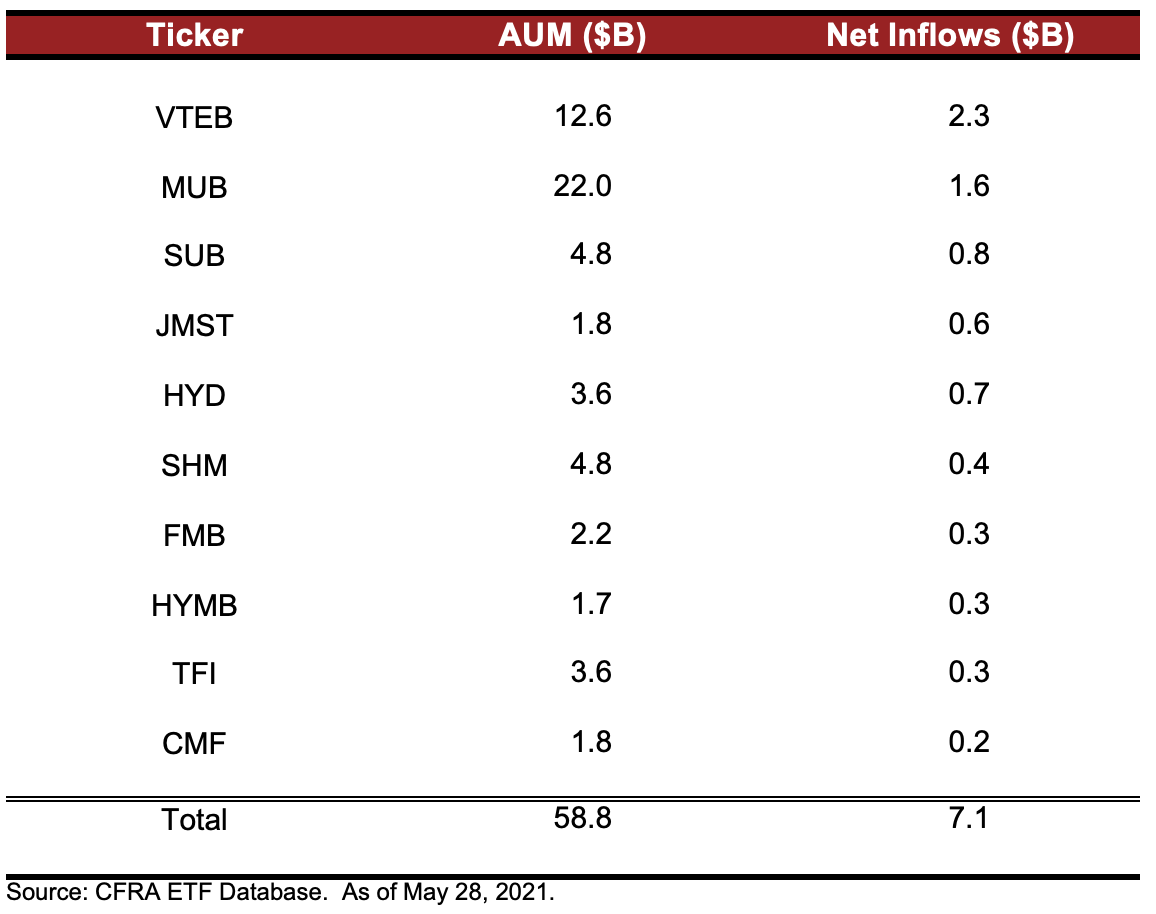

Actively managed municipal bond ETFs gaining traction. JPMorgan Ultra-Short Municipal Income ETF (JMST) and First Trust Municipal Bond ETF (TFI) had two of the 10 largest net inflows among municipal bond ETFs to start 2021 with the potential benefits of security selection. The 27 active municipal bond ETFs collectively gathered $1.6 billion of new money this year and manage $7.2 billion (approximately 10% of municipal bond ETF assets). IQ Mackay Shields Municipal Insured ETF (MMIN) and PIMCO Short Term Municipal Bond ETF (SMMU) were also among the ETFs to gather more than $100 million of net inflows thus far in 2021.

Asset managers have increased the municipal bond ETF supply in recent years and hopefully they will be patient. JMST recently managed $1.8 billion of assets, despite launching in just October 2018. However, JMST is the lone municipal bond ETF, out of a total of 30, that launched since the beginning of 2018 and ended May with more than $250 million in assets. In recent years, iShares and Invesco have built out target-maturity muni-bond ETF lineups, such as iShares iBonds Dec 2024 Term Muni Bond (IBMM) and Invesco BulletShares 2024 Municipal Bond ETF (BSMO) as an alternative to individual bond laddering. Meanwhile, American Century, Avantis and BlackRock launched actively managed municipal bond products. We think investors will increasingly turn to ETFs to meet tax-free income objectives rather than paying a premium for less liquid mutual funds.

Figure 3: Largest U.S. listed Municipal Bond ETFs

Conclusion

While many investors still gain exposure to the municipal bond market using mutual funds, we expect recent demand for cheaper active or index-based ETF alternatives to continue to gain in popularity. CFRA provides star ratings on bond ETFs combining performance metrics, costs and portfolio-level analysis to sort through the growing number of choices. Our quantitative research currently favors ETFs that incur credit risk like HYD over those that reduce interest rate sensitivity like SHM.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.