If you’ve been invested in gold this year, you must feel pretty smug right now. Several bullion-based ETFs occupy high spots on the year-to-date return table. But not the tippy-top spots. No, that distinction actually belongs to online retail funds.

It’s no wonder. Shelter-at-home orders and social distancing mandates have compelled many consumers to opt for online ordering of food and other goods in lieu of visiting brick-and-mortar retailers. Clearly, the pandemic has changed consumers’ buying dynamics. As people get more and more accustomed to online activity, the greater the likelihood of this mode persisting in the post-pandemic world.

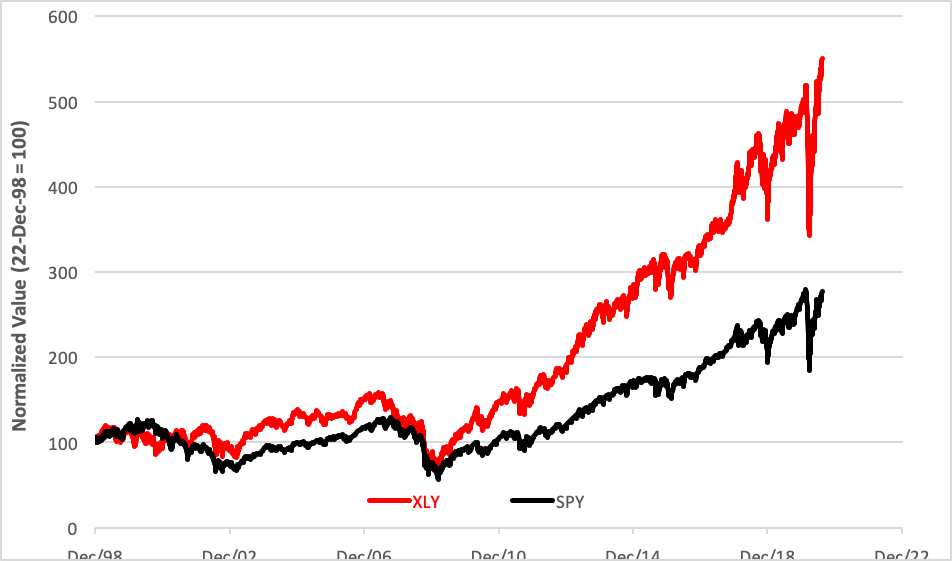

Consumer spending has long been a mainstay of the U.S. economy, contributing 70% of the nation’s GDP. Consumer stocks, particularly cyclicals, are also powerful drivers of the broad equity market. Cyclicals, led by Amazon.com, account for 11% of the capitalization of the S&P 500 as proxied by the SPDR S&P 500 Trust (NYSE Arca: SPY). And you can see how these issues, represented by the Consumer Discretionary Select Sector SPDR (NYSE Arca: XLY), led SPY out of the Great Recession in the chart below.

Amazon is the 800-lb. gorilla in both ETFs’ portfolios, taking up nearly 5% of SPY’s heft and 24% of XLY’s. That degree of concentration makes some advisors absolutely dyspeptic. For good reason. Just look at the drawdowns suffered by the two ETFs in February. XLY’s was 200 basis points worse than SPY’s.

For those looking to tap into online retailing’s future without undue exposure to a single entity, there are three ETFs that may offer more diverse coverage of the sector.

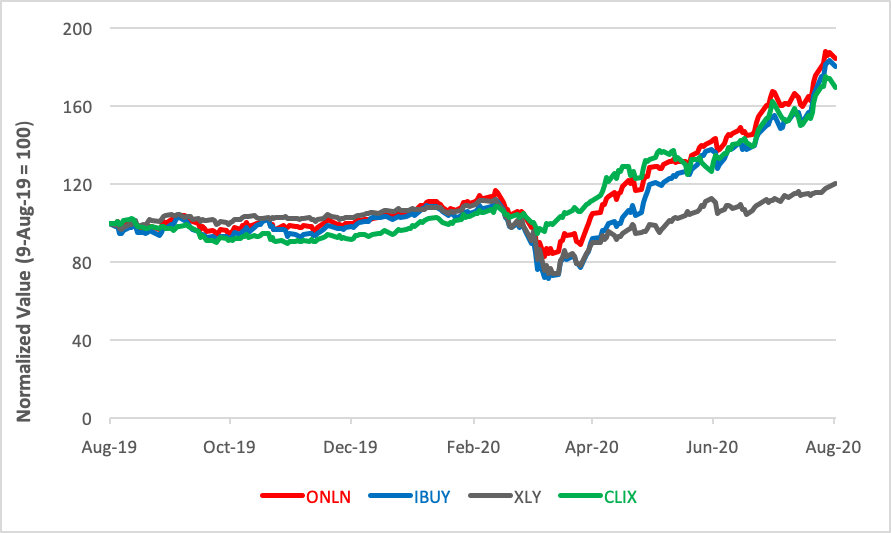

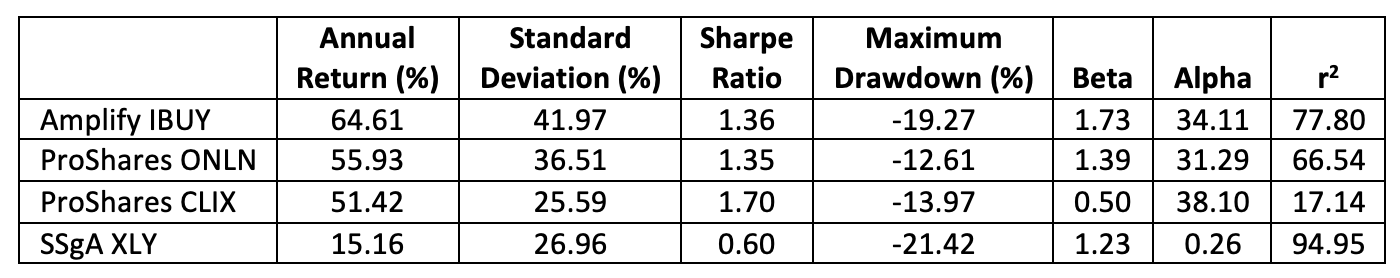

The eldest is the Amplify Online Retail ETF (Nasdaq: IBUY), a global portfolio of companies deriving at least 70% of their revenue from online or other nonstore channels. Domestic issues account for three-quarters of the asset mix; the balance is given over to foreign stocks. Within each basket, components are equally weighted, reducing the influence of behemoths like Amazon and giving more play to smaller stocks. Amazon, in fact, accounts for only a little over 2% of IBUY’s $973 million capitalization. Investors pay an annual expense of 65 basis points for holding the 48-stock index tracker. Year to date, IBUY’s gained 79%.

While IBUY’s equal-weight stratagem greatly reduces Amazon’s impact, the ProShares Online Retail ETF (NYSE Arca: ONLN) modified market capitalization scheme only slightly attenuates the firm’s influence compared with its leverage in XLY. Like IBUY, non-U.S. companies are limited to just 25% of ONLN’s total weight. Individual companies may not exceed 24% of the underlying index’s payload and the sum of all issues weighing more than 4.5% can’t account for more than half of the portfolio’s capitalization. Still, all this gives Amazon top billing—at 22%—in the ETF’s 26-stock cast, not much less than its influence in XLY. For the year, the $282 million ONLN portfolio’s up 81% and can be held for an annual cost of 58 basis points.

ProShares has yet another take on online retailing. The ProShares Long Online/Short Stores ETF (NYSE Arca: CLIX) affords investors two routes to alpha. On the long side of the portfolio is the 26-stock ONLN asset mix, offering exposure equivalent to 100% of the fund’s capitalization. The short side is a 50% exposure—obtained through swaps—to a mix of 45 retailers earning most of their revenue from in-store sales. The stocks on the short side of the CLIX ledger are equally weighted.

CLIX’s investment rationale is simple and aggressive: It’s a bet that in-store sales will continue to fade in favor of online transactions. This assertive philosophy yields surprising results. The fund’s 150/50 methodology cranks out a return pattern similar to that of the long-only portfolios but tempers the sector volatility considerably. Note its low beta and r-squared coefficients. CLIX clearly provides a better diversification benefit.

So, what’s the future for these funds? As long as the pandemic persists, and especially if shutdowns resume, online ordering of foodstuffs and other goods by consumers are likely to continue to clip in-store sales. And, as more and more consumers become accustomed to online ordering, a tipping point may be reached. At the present pace of brick-and-mortar store closings, there may be fewer retail outlets to return to once the pandemic subsides.

Brad Zigler is WealthManagement's alternative investments editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.