The thought of investing in the foreign debt of such countries as Brazil, Russia, Greece or Turkey may make most clients’ stomachs turn, given the geopolitical risks, negative headlines and high inflation. But these are the countries with the highest yields, a strategy that Mebane Faber, chief investment officer of Cambria Investment Management, is betting on.

Brazil, for example, is currently the cheapest market in the world because it’s gone down so much; its stock market is up 14 percent so far this year.

“It’s an example of the news flow being terrible but not matching necessarily to what the investment opportunity is,” Faber said. “The old maxim ‘investing when there’s blood on the streets’ is very appropriate to these sorts of investments.”

Most U.S. investors have a home bias, but it’s not an enticing opportunity set: U.S. stocks are currently expensive, and many analysts expect low single-digit returns for domestic stocks this year. And U.S. bond yields are probably going to stay low, Faber says.

Meanwhile, foreign bonds are the largest asset class in the world, according to Faber. But the vast majority of bond funds overweight countries with the most liquid debt, so you end up having most exposure in five countries—the U.S., France, Germany, the U.K. and Japan.

Faber believes a better mousetrap is to take a value approach to bonds, sorting instead based on yields. Some call it “carry.”

“Principles of value investing are familiar to many equity investors. These same principles can be applied successfully to fixed income—buying and holding attractively priced (high-yielding) bonds.”

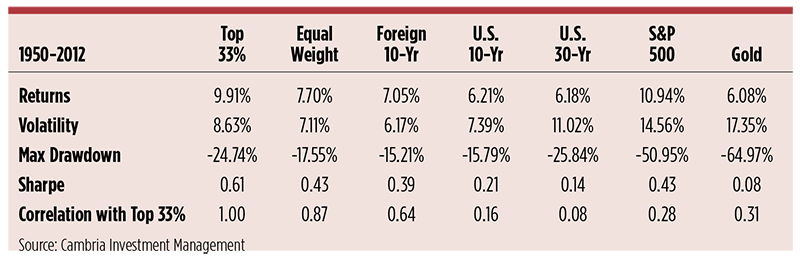

Faber analyzed a portfolio that would invest in the top 33 percent of countries by nominal yield, and compared its performance to that of an equal weight foreign bond portfolio as well as a GDP-weighted index of 10-year bonds from countries such as Australia, Austria, Belgium, Canada and others.

From 1950 to 2012, the top 33 percent portfolio returned 9.91 percent, compared to 7.7 percent for the equal weight portfolio and 7.05 percent for the foreign 10-year strategy. And while volatility of his portfolio was higher than the equal weight and foreign 10-year, it was lower than the U.S. 30-year portfolio, the S&P 500 index and gold.

“You’re essentially investing in countries—whether it’s Brazil or Russia or Mexico—that have an inflation premium but also a geopolitical headline risk premium,” Faber says.

Last month, Faber launched the Cambria Sovereign High Yield Bond ETF, based on the strategy. The fund has about 80 percent in emerging markets, because this tends to be where the highest yielders are.

But you shouldn’t just go out and buy Brazilian bonds; Faber suggests a basket of about 15.