Attempting to capitalize on the hype surrounding so-called "Magnificent 7" tech stocks, Tidal Financial Group and ZEGA Financial launched an actively managed covered call ETF focused on those firms. So far, analysts and RIAs seem unimpressed, noting that the ETF’s covered call structure might mute any benefits investors could realize.

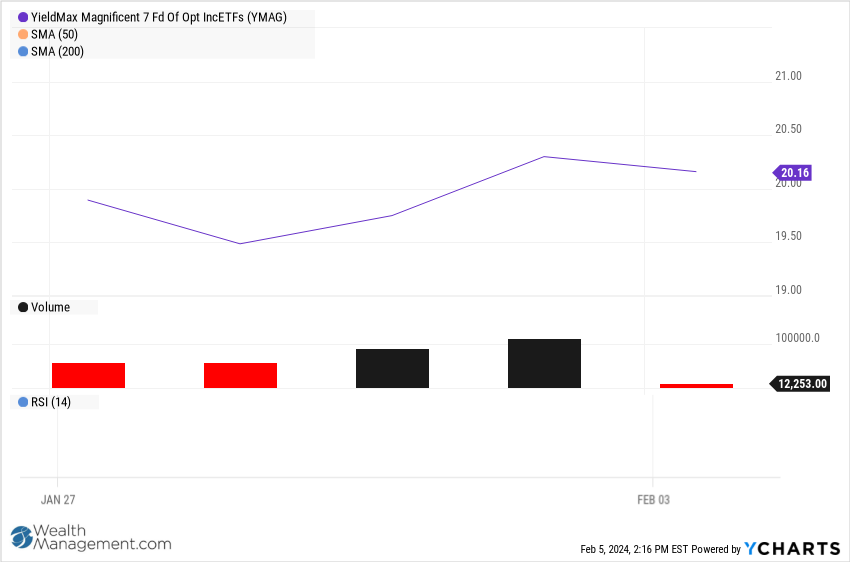

YieldMax Magnificent 7 Fund of Option Income ETFs (YMAG), which has about $4.5 million in assets, invests primarily in seven covered call single-stock YieldMax ETFs focused on Apple, Microsoft, Alphabet Inc., Meta Platforms, Tesla, Amazon and Nvidia stocks. Covered call ETFs generate income by selling call options on their shares. The Magnificent 7 stocks have risen more than 100% since the S&P 500 bottomed out in 2022, outperforming the rest of the index.

The YieldMax Magnificent 7 fund also focuses on current income and will be reallocated monthly, giving each single-stock ETF an equal weight.

Investing in stocks through an ETF rather than directly could offer tax advantages because the taxes are handled at the ETF level, according to Grant Engelbart, vice president and investment strategist with the Carson Group, an RIA headquartered in Omaha, Neb. The monthly reallocation of the weight given to each stock offers an added convenience because it happens automatically and will have limited tax consequences, he noted.

However, investors would also lose the flexibility to sell off the stocks individually whenever they want. The income from the short options distributed by the ETF would likely be taxed at the highest tax rates.

“This particular ETF seems to be more focused on generating high levels of current income from the Magnificent 7, versus investing in those stocks to capture their return,” Engelbart wrote in an email. “The prospectus states that options are sold 5%-15% out of the money, therefore limiting upside to the underlying stocks.”

Other drawbacks of covered call single-stock ETFs include high fees and potentially outsized losses, according to Bryan Armour, director of passive strategies research with Morningstar. Part of the ETF’s appeal is that it can get premiums from selling the call options. But like Engelbart, he noted it doesn’t allow investors to capitalize on gains past the options’ strike prices, creating a ceiling on the stocks’ performance.

“I wouldn’t recommend single-stock or single-stock covered call ETFs to anyone,” Armour wrote in an email. “Their fees are high, the potential benefits are limited, while the losses are not limited beyond the premium obtained.”