It’s not easy to find a ground floor opportunity in exchange-traded funds nowadays. There just aren’t a lot of early-stage bullish opportunities in non-leveraged or inverse portfolios.

That’s why the recent price action of the Van Eck Real Asset Allocation ETF (NYSE Arca: RAAX) caught our eye. RAAX is an actively managed fund-of-funds that invests in assets known to hold their value during inflationary periods. Among its primary investment targets are ETFs tracking commodities, natural resources, real estate and infrastructure.

Guiding the fund runners’ allocation decisions is a proprietary model that synthesizes technical, sentiment and macroeconomic indicators to produce a portrait of overall market risk. When the model apprehends rising risk, RAAX managers are cued to step up apportionments to safe-haven assets such as gold and cash. In extremis, the fund can even go entirely to cash.

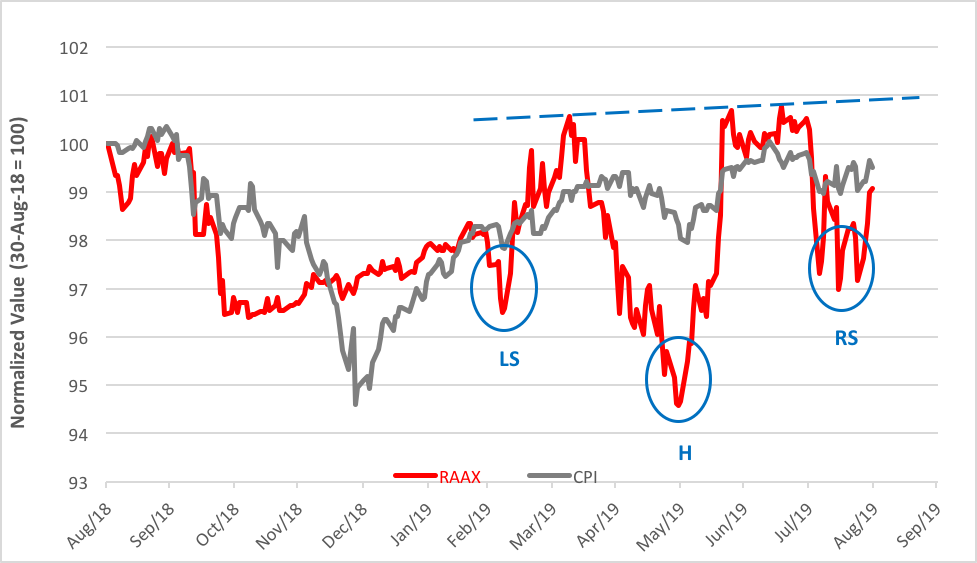

So what price action caught our eye? A head-and-shoulders bottom. Or, rather, what could become a bottom if the ETF’s price animates enough to break above the pattern’s neckline.

Above, RAAX’s one-year price history is shown plotted against that of the passively managed IQ Real Return ETF (NYSE Arca: CPI), another fund-of-funds that aims to consistently outpace inflation. As you can see, it’s been a tough year for the funds; RAAX and CPI are under water on a 12-month basis. Both have upside potential from here, though, given RAAX’s volatility, it’s likely that the VanEck fund’s bullishness will be more dramatically expressed than CPI’s. Historically, the standard deviation in RAAX’s daily returns is 50 percent greater than CPI’s.

But here’s the deal: CPI is pretty much a short-duration bond fund. Three-quarters of the fund’s assets are lodged in ETFs holding fixed income securities with average maturities of three months. The rest of the CPI portfolio is spread over ETFs tracking oil futures, domestic large-cap stocks and emerging market equities.

And the RAAX portfolio? The VanEck fund’s largest allocation is to gold. Between two bullion-holding grantor trusts and a gold mining stock ETF, RAAX devotes 28 percent of its real estate to the yellow metal.

That’s telling. Remember the fund’s model? The algorithm calls for increasing allocations to gold and cash as market risk increases. So far, RAAX’s managers haven’t flipped assets to cash, but they have ramped up gold exposure. If market conditions significantly worsen, RAAX may end up looking more and more like CPI.

So, why would you want an inflation-oriented ETF anyway? Because, believe it or not, there’s a nascent inflation trend afoot. We highlighted this development, signaled by a key ratio, in a recent column. While this background inflation may not be perceived by many retail investors, the effects of higher tariffs now trickling through the supply chain will soon make inflation real at the consumer level.

A cautionary note: Even if inflation surges, these two portfolios aren’t likely to become barnburners. That’s not in their designs. Rather, most investors will find their utility as risk-attenuating components in a diversified portfolio.

After all, there’s a fundamental problem with barnburners: Once the fire’s extinguished, all that’s likely to be left is ash and rubble.

Brad Zigler is WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.