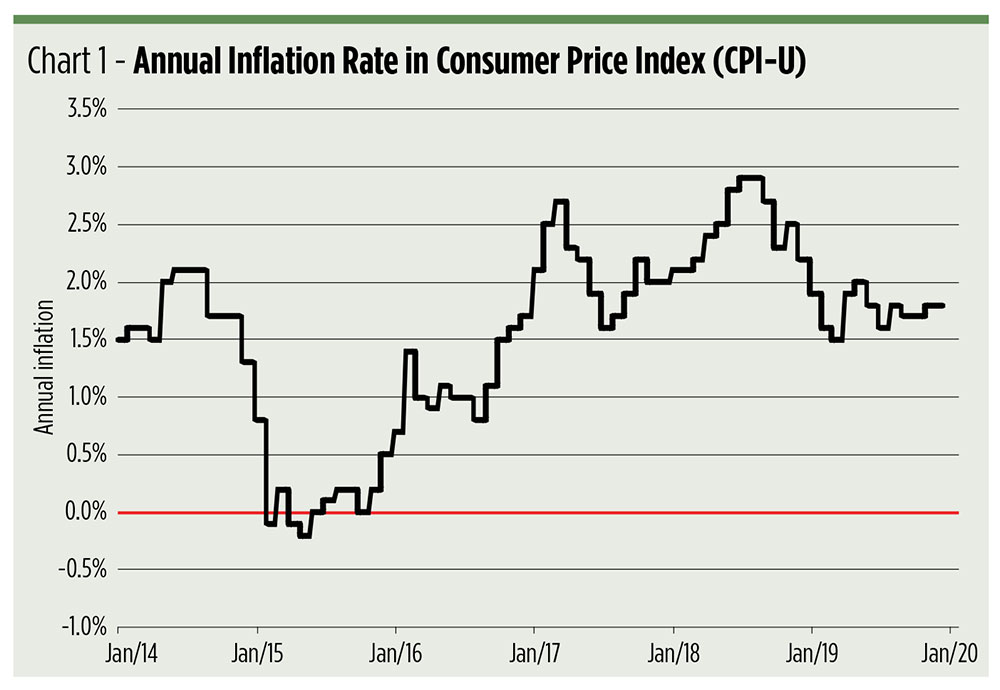

As 2019 fades from view, investors wade into the new year facing an inflationary undercurrent. Inflation may seem tame if you use the Consumer Price Index (CPI) as your gauge, but precursors are sending signals of rousing from their long slumbers.

The ultimate antecedent of movements in the CPI is commodity trends. Commodity prices directly influence the cost of goods in the CPI market basket.

Last summer, in a column entitled “Inflation? Really?” we highlighted a metric that tends to presage shifts in commodity prices. We observed the Pring Inflation Index (PRII) rising at a faster clip than the Pring Deflation Index (PRDI). So much so, in fact, that the PRII/PRDI ratio was then punching above its 50-day moving average for the first time in several weeks. It’s this ratio’s gyrations that often herald turning points in commodity benchmarks, like the Thomson Reuters Equal Weight Commodity Index (CRB).

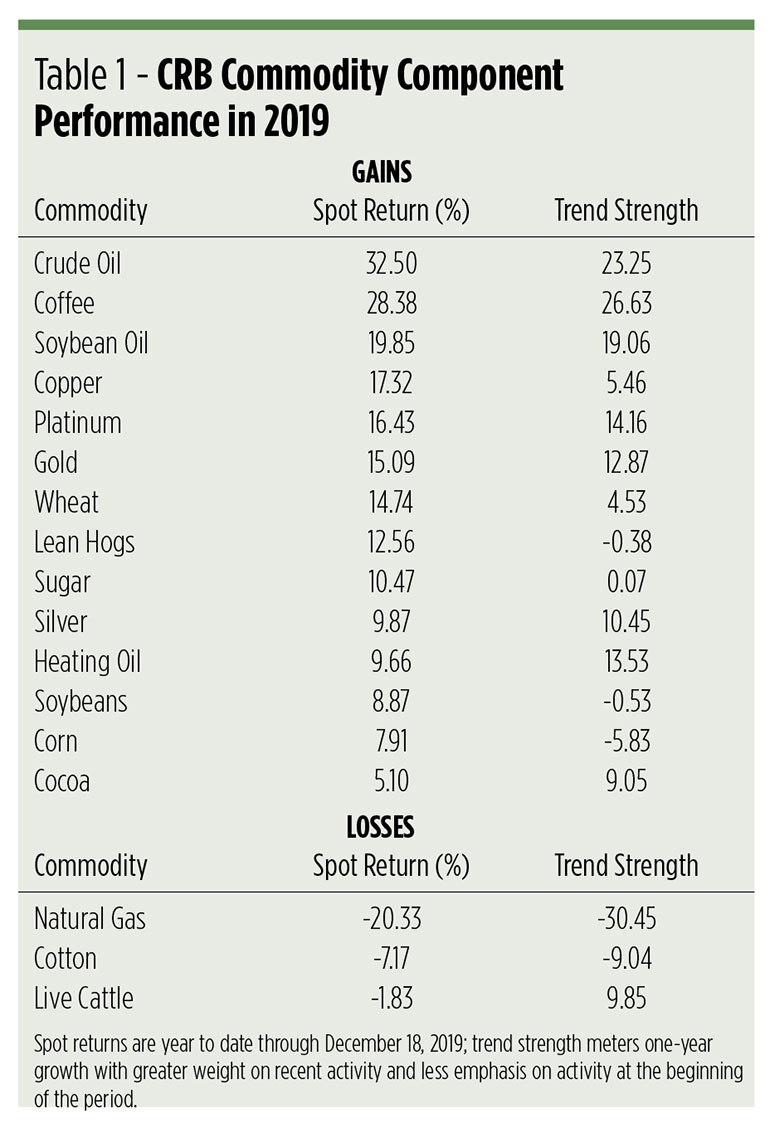

By year’s end, the ratio’s 50-day average was poised to cross to the upside of its 200-day mean, an event with yet more bullish implications for the commodity basket. Not that some commodities weren’t already stirring upward. Spot prices for 14 of the 17 CRB commodity components are in the black for the year. As seen in Table 1, crude oil leads the way, up better than 32%.

As many traders will attest, spot or cash market returns don’t necessarily translate well across a commodity’s delivery curve. Contango and backwardation, as well as seasonal factors, can skew prices for certain contract months. Still, a trend is a trend, and knowing the strength of a commodity’s current trend makes for better investment decisions.

As many traders will attest, spot or cash market returns don’t necessarily translate well across a commodity’s delivery curve. Contango and backwardation, as well as seasonal factors, can skew prices for certain contract months. Still, a trend is a trend, and knowing the strength of a commodity’s current trend makes for better investment decisions.

The “trend strength” indicator in Table 1 weights a commodity’s most recent price activity most heavily, much like the protocol for an exponential moving average. This gives a better sense of price momentum. Generally, a commodity with a strength reading that exceeds, positively or negatively, the spot return is in a strong trend. Small strength readings signal weak momentum, or even an impending trend change. When the spot return and the strength indicator are signed differently—one positive and one negative—either a trend has recently reversed or seasonal supply factors, e.g., “old crop” versus “new crop,” are at play.

Broad-Based Commodity ETPs

So, what of 2020? Should an investor concerned about nascent inflation look for a hedge—and if so, where? There are more than a score of broad-based commodity exchange traded products available, each with a unique composition and weighting scheme.

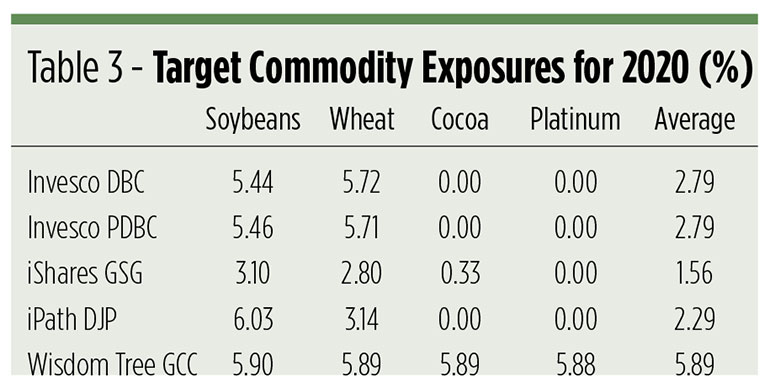

As we’ve seen, commodities are not monolithic. Some are trending up, some down. Certain trends are vigorous, while others seem mired. Among the commodities in Table 1 are a handful that seem particularly well positioned, on a technical basis, for bullish moves going into the new year. These items include soybeans, wheat, cocoa and platinum. We calculate these four commodities are setting up for gains that could average 28%. The most productive inflation hedge, we reason, should offer high exposure to this quartet.

So, which one is that? To find out, we focused on the most actively traded broad-based commodity ETPs to find one with the highest allocations to our target contracts. We set the Wisdom Tree Continuous Commodity Index ETF (NYSE Arca: GCC), an ETF tracking the CRB index, as our benchmark. The CRB index, an equal-weighted assortment of commodities, is the oldest extant futures benchmark, having gone through iterations as the Continuous Commodity Index and as the Commodity Research Bureau Index since its 1957 debut.

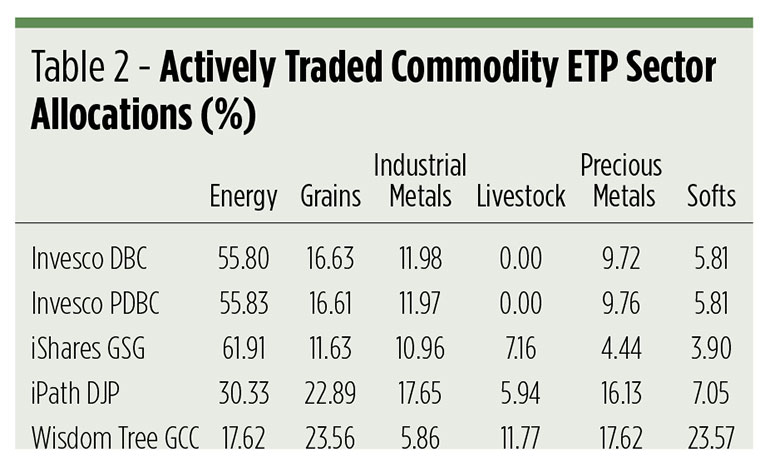

Topping the most active list is the Invesco DB Commodity Index Tracking Fund (NYSE Arca: DBC), which captures the return of a production-weighted 14-commodity index. Like many funds of its kind, DBC tilts heavily toward energy futures.

A sister fund, the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (Nasdaq: PDBC) is, putatively, an actively managed fund, but its allocations are nearly identical to DBC’s. PDBC’s essential distinction is its wrapper. PDBC is organized as a ’40 Act fund, while DBC is a commodity pool. There are no mark-to-market tax treatment or K-1 returns associated with a PDBC investment as there is with DBC.

The index underlying the iShares S&P GSCI Commodity Indexed Trust (NYSE Arca: GSG) is also production weighted, but, with 24 commodities, its landscape is broader. This commodity pool gets its exposure by way of a singular investment in GSCI futures rather than individual commodity contracts. Despite its more comprehensive index base, GSG is even more heavily skewed toward energy contracts than the DBC/PDBC pair.

The iPath Bloomberg Commodity Index Total Return ETN (NYSE Arca: DJP) is a note emulating the return of a 23-commodity production- and liquidity-weighted portfolio overlaid with diversification constraints. In the index, the weight of a commodity sector is capped at 33%, while a single commodity’s heft cannot exceed 15%.

As Table 2 indicates, an investor’s exposure to commodity sectors is entirely dependent on the ETP selected. Save for holders of the GCC fund, investors’ largest exposure is likely to be the energy segment. This was ideal for 2019 but may not be so rewarding in the months to come.

The contrast sharpens if we sort the products for our target commodities. Only one—the Wisdom Tree GCC fund—provides exposure to all four commodities. As Table 3 attests, the fund’s equal-weighting format offers substantial dollops of that.

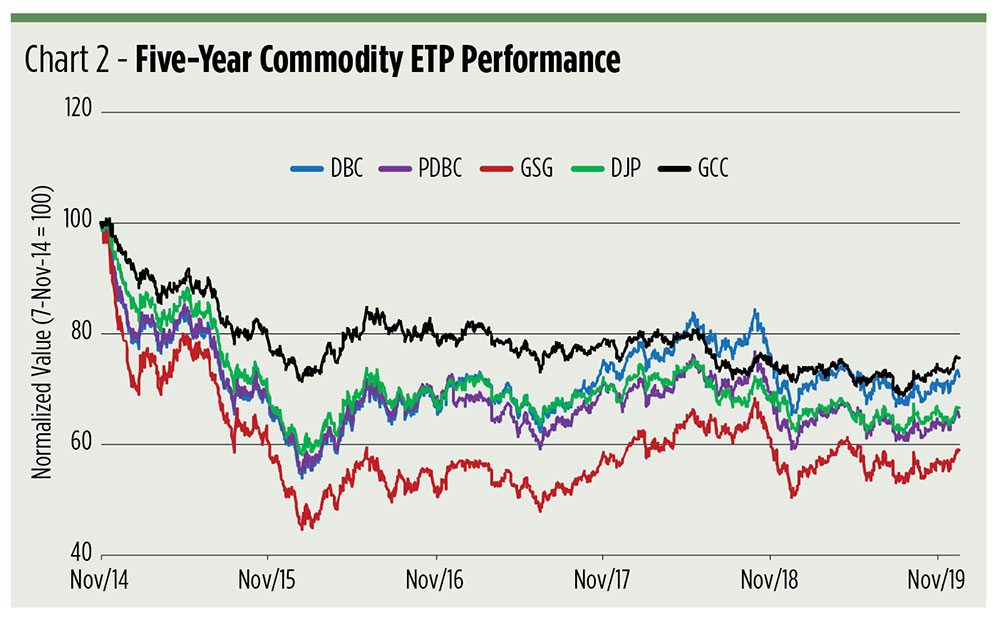

The Wisdom Tree fund’s egalitarianism gives it an edge over the other products for the upcoming year, assuming our technical prognostications are realized. But even if our forecasts don’t pan out, the CRB tracker may still be a safer bet. Historically, GCC’s hallmark has been its consistency, as can be seen in Chart 2.

An equal-weighted portfolio provides an investor with the ability to capture trends across the commodity spectrum, while also dampening the inherent volatility of the futures market. GCC could, therefore, be a more tolerable adjunct to a portfolio and a more effective hedge against inflation’s all-but-forgotten depredations.

Brad Zigler is WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.