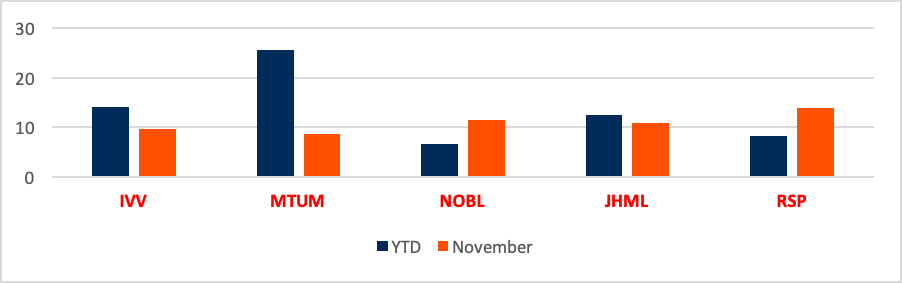

It has been a momentum-driven, market-cap-weighted 2020, with most alternatively weighted strategies lagging. iShares Core S&P 500 ETF (IVV) was up 14% year to date through November, outperforming many smart-beta ETFs. In the first 11 months of the year, the number of S&P 500 constituents that rose in value was 1.2 times as much as those that fell in value with 34 names climbing at least 50%. The stocks that are hefty positions in the S&P 500, including Apple, Amazon.com and Microsoft, can also be found in iShares MSCI USA Momentum Factor ETF (MTUM), which rose 26% year to date through November. Yet all three are not inside many other smart-beta funds. Not surprisingly, U.S. equity ETFs constructed based on dividends and certain other fundamental factors were out of favor. As a subcategory, these ETFs had $1 billion of net outflows in the first 11 months of 2020, in contrast to the $80 billion of net inflows for the broad market U.S. equity subcategory.

Market breadth improved in November, and CFRA predicts the trend will persist in 2021, thus helping smart beta. In November, there were 12 times as many stocks to increase in value as fall. CFRA has Strong Buy or Buy recommendations on 220 stocks with the S&P 500 Index. We still find AAPL, AMZN and MSFT attractive, but we also find Devon Energy, Martin Marietta Materials and Quanta Services appealing and they are among the smallest stocks in the U.S. benchmark.

Given our view that investors can find value in a wide range of large-cap stocks, Invesco S&P 500 Equal Weight ETF (RSP) is worth a closer look. The ETF is rebalanced quarterly but has similar exposure to more moderately sized companies as mega-caps, providing diversification in case the biggest winners stop climbing to record levels.

Chart 1: Select ETF Performance in 2020 (%)

Though RSP underperformed IVV in the first 11 months of 2020, rising just 8.2%, RSP’s 14% gain in November was ahead of the market-cap weighted version’s 8.7% gain.

Meanwhile, CFRA expects the S&P 500 Index to be up 11% from current levels in 2021, and, given low bond yields, we think dividends could return to prominence. ProShares S&P 500 Dividend Aristocrats ETF (NOBL) owns shares of S&P 500 constituents that raised their dividends 25 consecutive years. Though many companies cut or suspended dividends during 2020, due to the impact of COVID-19, only one Aristocrat was removed during the year, leaving 65 remaining members. Many of these are attractively valued to CFRA, including AT&T, Chubb and VF Corporation. NOBL will be reconstituted in January—potentially welcoming in new companies that hit the dividend growth milestone.

There are many smart-beta ETFs that combine multiple screens together much like a low-cost actively managed mutual fund. John Hancock Multifactor Large Cap ETF (JHML) is one example, bringing together value, profitability and small-size metrics. Though AAPL, AMZN and MSFT are the largest positions for JHML, they represent a smaller percentage of fund assets than in IVV. The ETF is rebalanced semiannually.

Conclusion

Many smart-beta investors likely are happy for 2020 to end, as they would have done better in broad-market-cap-weighted U.S. equity strategies. Yet, we think 2021 could prove to be a better year as market breadth improves. We encourage investors to look inside these funds to understand the risk and reward attributes of the portfolio.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.