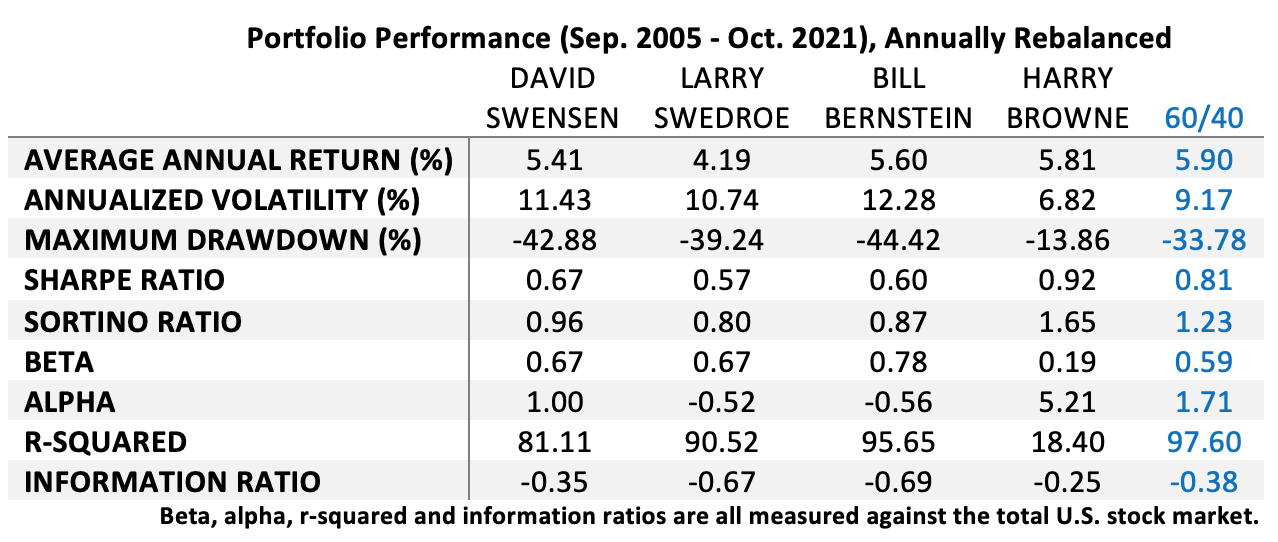

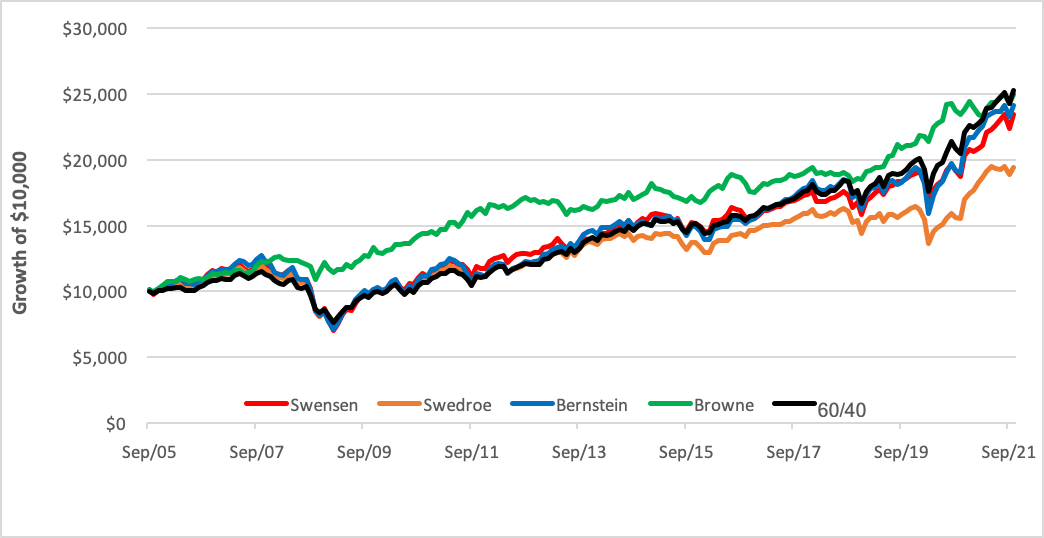

Three years ago, we took a deep dive into model portfolios advocated by a quartet of financial gurus to see which, if any, fared better against a very basic 60/40 asset mix. To make use of low-cost mutual and exchange traded funds, we traced the portfolios’ histories for the 13-year period between 2005 and 2018. We discovered two portfolios—David Swensen’s Yale model and Harry Browne’s so-called permanent portfolio—outperformed 60/40 on disparate characteristics and for very different reasons.

A lot’s happened since 2018, so curiosity compels us to update our analysis to see how recent market gyrations have tested these allocations.

What we see now is the 70/30 Yale model relinquishing its position as best producer of compound annual growth. Among the guru portfolios, Harry Browne’s mix—with only a quarter of its heft devoted to equities—now cranks out the best average annual return.

Volatility has clearly taken a toll on portfolios across the board but not equally. It’s not surprising, then, to find that the only two guru models exhibiting positive alpha saw the least increase in annualized volatility over the past three years. Again, those are the Swensen and Browne mixes.

Still, the traditional 60/40 allocation now beats the gurus on gross returns. Simply adding total U.S. bond market exposure to a broad domestic equity market allocation would have produced alpha in excess of the Yale model but not enough to exceed the risk-adjusted return of the permanent portfolio.

That’s the view from 30,000 feet. Or, over 16 years anyway. A more granular view, however, reveals a changing investment landscape.

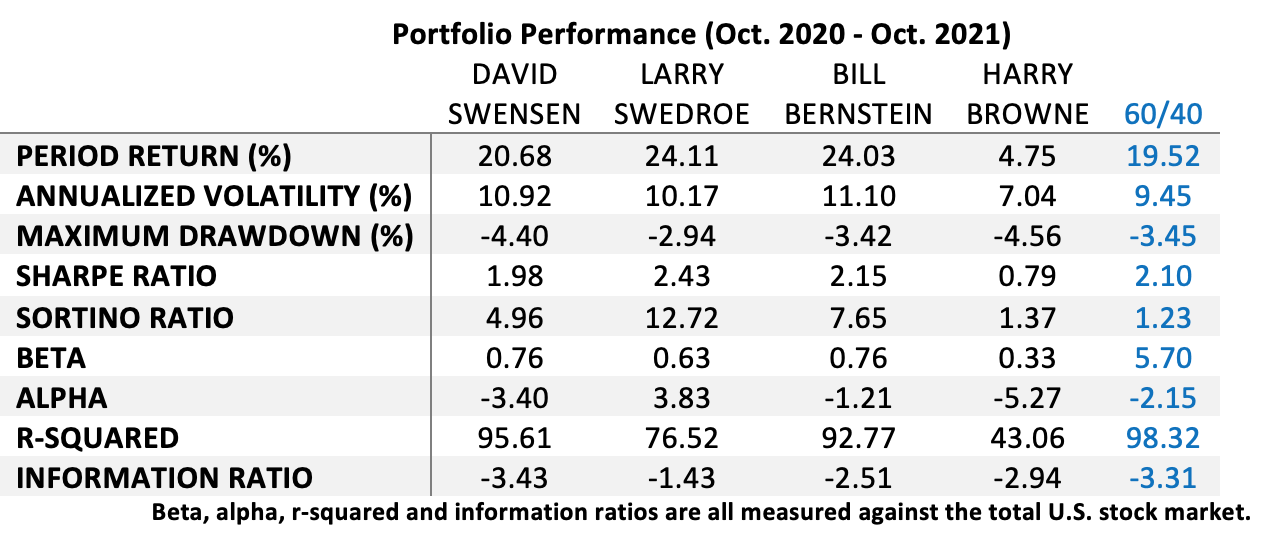

Over the past year, Larry Swedroe’s simple six-class portfolio has surged from the back of the pack to lead the field for both gross and risk-adjusted returns.

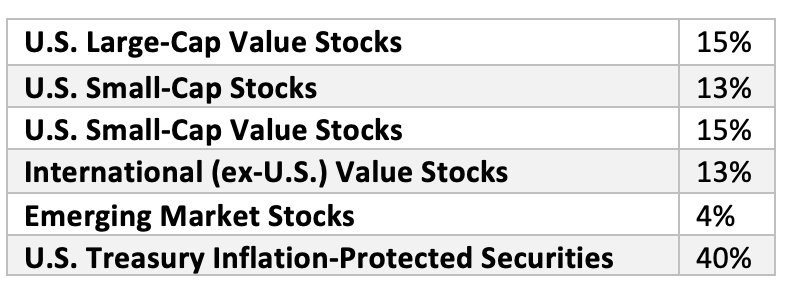

Swedroe directs research at Buckingham Strategic Wealth and has authored eight books on personal finance and investing. His basic approach entails using index funds to obtain exposure to U.S. large-cap, small-cap and small-cap value stocks, international (ex-U.S.) value and emerging market stocks, together with U.S. Treasury Inflation-Protected Securities (TIPS):

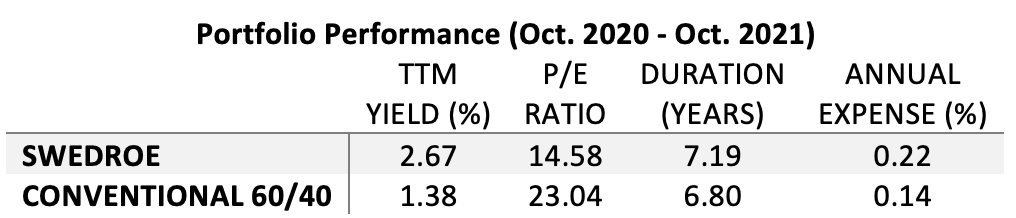

Swedroe, as you can see, actually advocates a 60/40 portfolio. His version, though, tilts toward small-cap and value stocks while supplanting broad bond market exposure with TIPS.

What accounts for Swedroe’s recent outperformance? Just this: Small-cap and value premia, long lost in the wilderness, have now come in from the cold. Moreover, TIPS have found purchase once more as consumer prices rise in the wake of COVID-induced supply chain disruptions.

So, is 60/40 still a viable strategy? Is a dosing of vitamins S, V, I, T (and a bit of E) all that’s needed? Those tweaks certainly make Swedroe’s portfolio a better version of 60/40 for the current market, but one has to wonder how it will perform over the longer term.

Given the equity market’s cyclicality, Swedroe’s tilt toward international, small-cap and value exposures could be worrisome. In fact, the equity side accounts for 97% of the portfolio’s risk attribution. Broad exposure to domestic stocks in a classic 60/40 allocation, in contrast, takes up 92% of the risk budget.

Fixed income’s the flip side of the risk coin. Swedroe’s reliance on TIPS more than halves the risk attribution that a broad bond market exposure would endow, despite a slight uptick in duration.

Going forward, there’s no doubt that virulent inflation, economic stagnation and rising interest rates could hurt investors’ portfolios across the board. But that’s not to say that a 60/40 portfolio should be abandoned. History, after all, is on the side of the diversification provided by a 60/40 allocation. Swedroe’s prescription for Vitamins S, V and the rest may be just enough to keep portfolios healthy over the upcoming market cycle.

We’ll keep our eye on it.

Brad Zigler is WealthManagement's alternative investments editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.