Most equities in the U.S. are owned in tax-deferred retirement accounts like 401(k)s and IRAs rather than taxable accounts. Compared to 1965, according to a study by the Tax Policy Center, ownership of equities in taxable accounts is down 80 percent, and retirement accounts now hold 37 percent of all outstanding stock. Why does that matter? Firm principal Lawrence Hamtil, writing on the Fortune Financial blog, says the retirement account tax-deferral benefit covers such a large portion of the equity market, that investors’ realized net returns (or the returns investors experience after taking taxes, inflation and fees into account) may not be much lower than historical averages, contrary to what many market watchers predict. “It is conceivable that valuation multiples will remain above their long-term historical averages because most investors, by virtue of their tax-deferred holdings, do not have to clear the tax obstacle each year on their way to achieving historically similar returns,” he writes. That’s not to say the market is fairly valued, or that a downturn won’t occur. Yet, the dire predictions of some that we’re headed toward a long period of below-average performance may not be true after all.

New Administration Brings Hope, Uncertainty for Advisors

Despite growing political uncertainty, 56 percent of advisors are bullish about the year ahead, according to the latest Eaton Vance Advisor Top-of-Mind Index (ATOMIX) survey, a quarterly survey of more than 1,000 financial advisors. At the same time, 65 percent of advisors believe the Trump administration will be a major driver of volatility. "Politics have moved to the front of the national discussion right now, and advisors are addressing the topic to better understand client motivations and financial planning concerns," said John Moninger, managing director of retail sales at Eaton Vance. Sixty-three percent of advisors said they discuss politics with their clients in the context of investment choices, with 17 percent raising the topic in almost all of their client conversations and 16 percent using political side conversations to better connect with clients.

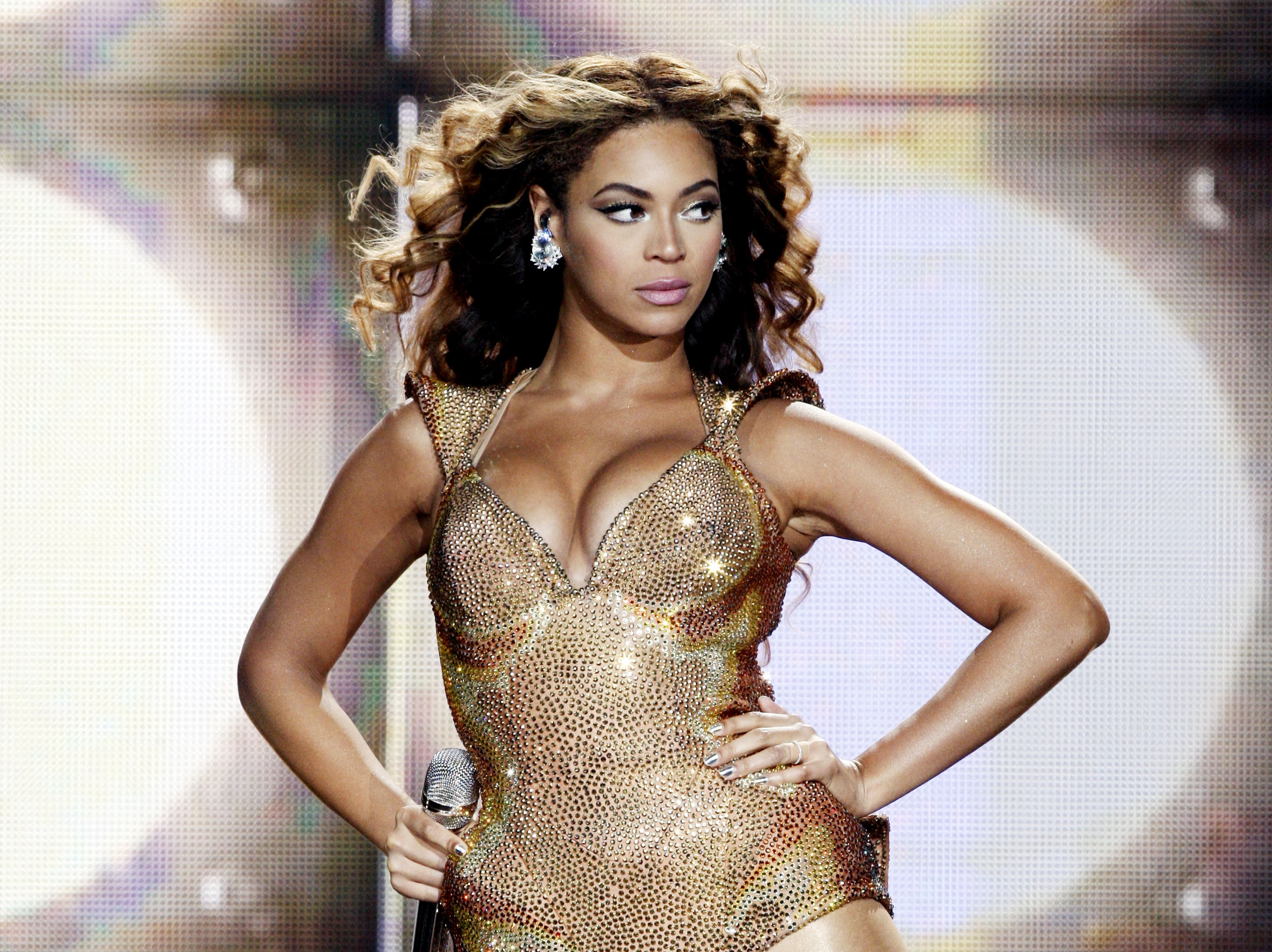

Do You Want Beyonce As Your Financial Advisor?

A new report from Merrill Lynch and Age Wave—apart from including research on growing trends related to financial planning—also included a poll on the ideal hypothetical financial advisor. Researchers asked investors to select from a list of seven famous and financially successful people. The winner was Warren Buffett, beating out Suze Orman, Mark Zuckerberg, Oprah Winfrey, Jim Cramer, Janet Yellen and Beyonce (Queen B came in last). The Oracle of Omaha attracted 70 percent of the boat, while Orman came in second with 37 percent. So if the billionaire-investor decides to drop everything and become an indie advisor, you better watch out.