It was early summer of 2020, the COVID-19 pandemic was devouring every business routine, and Hannah Moore, an action-oriented financial planner in Richardson, Texas, was alarmed. Advisories that had confirmed internships so critical to students pursuing careers in financial planning were one by one withdrawing the invitations.

In one sense, the loss of internships was small change compared with the wholesale upending of the economy, but it was one thing Moore was determined to do something about. So, Moore reconceptualized the notion of an internship in a virtual world.

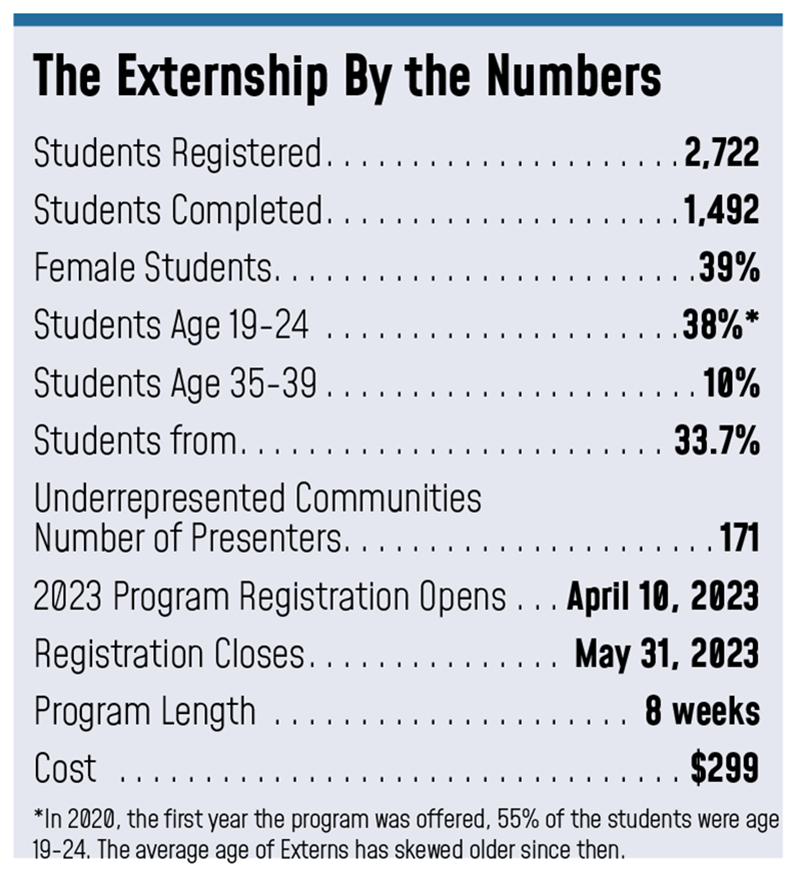

Thus was born the Virtual Externship, an eight-week learning experience covering eight financial planning topics designed to give students an experience comparable to the all-important financial planning internships the pandemic denied them.

READ: Meet the Externs

It was immediately obvious the program tapped into a real need. Over 1,950 people signed up for the initial offering.

Moore expected most of the registrants would be traditional college students. To her surprise, however, many were career changers—more mature people working in other professions with an interest in transitioning their careers to financial planning. With so many people working from home, the course offered a path for these people to realize their dreams.

Throwing Out Assumptions

Moore started conceptualizing the Virtual Externship by throwing out every assumption about what a financial planning internship should be. “We reimagined the whole experience,” she says. In a traditional internship, students generally get to experience one firm. The Externship exposes participants to 25 advisories. Each week, it introduces participants to three expert advisors who share their work flows and actual deliverables. Students watch life simulations of various processes, and they are tested periodically to ensure they understand the fundamental concepts of eight areas, including retirement planning, insurance and risk management, and tax and estate planning.

That said, developing technical skills is just one part of the process. The Virtual Externship asks participants to grapple with the bigger questions: Is financial planning a career I want to get into? Can I be passionate about it? For career changers, is financial planning the right path for me? And the biggest question of all: Textbook learning aside, how does financial planning actually work, and what does it look like in practice?

For Stephen Schiestel, professor of finance at Michigan State University Broad College of Business, the Virtual Externship was a godsend to help students fill the resume gap created by the pandemic. And, as part owner of an independent advisory in Michigan, Schiestel saw for himself the benefits of hires who completed the program.

“We had a young staffer who joined us just before COVID hit. He participated in The Virtual Externship, and I was able to see from the vantage point of both an educator and an employer how transformative the program is,” Schiestel says. “It’s still critical for finance students to get that junior year internship, but if it doesn’t work out for any reason, then the Externship is a great alternative.”

Professor Steve Schiestel

Widespread Industry Support

The Externship quickly won the support of financial planning industry heavyweights. Sponsors include Charles Schwab, The CFP Board, eMoney, Kaplan, Morningstar, XY Planning Network, Redtail, Income Lab and LPL. The sponsors enrich the Externship experience in different ways. For example, The CFP Board awards 180 experience hours for participants who complete the program and eMoney Advisor confers its eMoney certification.

Schwab views The Virtual Externship as aligned with its long-term advocacy to cultivate a pipeline of talent the RIA industry needs to grow and better serve a diverse population. “The program expands on Schwab’s work to increase gender, diversity and generational diversity in the RIA profession,” says Sherri Trombley, director, business consulting and education at Schwab Advisor Services. “We are always looking for ways to reach students and career changers.”

Paths to More Representation

Perhaps the most consequential benefit of The Virtual Externship is that it encourages diversity in a profession that badly needs more participation from underrepresented groups. The program offers critical tools to help advisors activate the talent pipeline, particularly when attracting talent from historically marginalized populations.

Perhaps the most consequential benefit of The Virtual Externship is that it encourages diversity in a profession that badly needs more participation from underrepresented groups. The program offers critical tools to help advisors activate the talent pipeline, particularly when attracting talent from historically marginalized populations.

For many members of underrepresented groups, a traditional internship is not possible because they cannot afford to give up the day jobs they depend on. The program not only allows them to maintain those day jobs, but also offers an entry point to those that can’t afford to live in the cities where internships are usually offered. By casting a wider net, the program offers an entry point to many who had been effectively shut out of the profession.

The demographics of the 2022 Externs offer a picture of a more diverse group (by financial planning industry standards at least), with over 40% identifying as women and 11% and 10% identifying as Black and Hispanic, respectively.

Moore believes that the sky is the limit for The Virtual Externship. “I believe this is a profession-changing program by virtue of how it trains, educates and encourages more financial planners to come into the profession,” she says. “It provides a framework for setting up for success the people the industry needs to thrive in the future.”