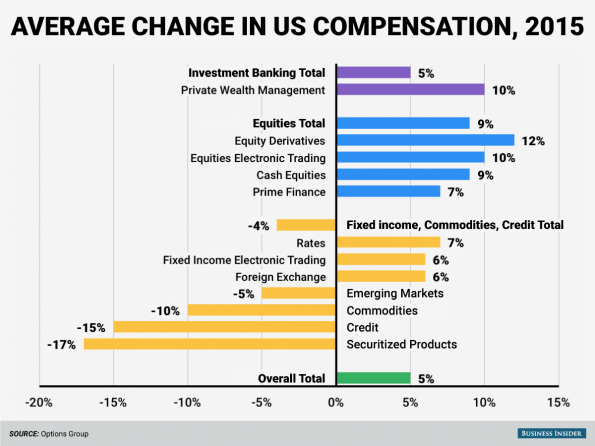

It’s been a good year for wealth management firms. According to Wall Street recruiting firm Options Group, which surveyed the top quartile of performers at top 10 firms, the top performers in private wealth management expect a 10 percent increase in their total compensation this year. Things were also good for equities traders, who expect an average increase of 9 percent, with the biggest increase (12 percent) expected by equities derivatives traders. But this year wasn’t as kind to financial professionals working on securitized products, credit, commodities or emerging markets, who all expect lower compensation than last year.

Why Clients Change Retirement Plans

More than any other reason, it's due to overspending, according to the American Institute of CPAs Personal Financial Planning Trends Survey. The survey of 400 CPA financial planners also found that healthcare costs, poor initial estimates of retirement income, financial assistance of family members and travel costs played a large role. CPA professionals said nearly half (46 percent) of their clients would change plans proactively, while, at the same time, 29 percent of CPAs believe their clients would not change their spending habits unless forced to do so. The changes clients are most likely to make are reducing gifting plans (56 percent), discretionary spending (54 percent) and travel (52 percent). More than half of clients also underestimated their life expectancy and that of their spouse as well.

While the use of passive investment strategies has been steadily rising over the last couple years, advisors believe now is the right time to boost their investments in active strategies. According to a survey of more than 200 advisors by active manager AllianceBernstein, 68 percent of advisors say market conditions favor an active approach. At the same time, 72 percent of advisors indicated that they currently use ETFs in client portfolios. The preference for active is particularly acute in the high yield bond space because of the asset class's illiquidity, AB says. “Being tied to an index means ETFs can't pick and choose their exposures to sectors or securities the way active managers can, and in less liquid asset classes like high yield, the average long-term investor really gets hurt going passive,” said Gershon Distenfeld, director of high yield at AB.

IRS Announces Data Protection Awareness Campaign

Responding to the rash of identity thefts during tax time in the past couple of years, the IRS announced today the launch of its data protection awareness campaign called Taxes. Security. Together. The purpose of the campaign is to “raise public awareness that even routine actions on the Internet and their personal devices can affect the safety of their financial and tax data.” The campaign will continue through April and includes several components, such as YouTube videos, weekly tax tips and local educational events across the country. Several IRS publications have also been added or updated to help taxpayers and tax professionals come to terms with and mitigate the identity theft threat.