The prediction markets have former Secretary of State and First Lady Hillary Clinton as the runaway winner of November’s presidential election, CNBC is reporting. Clinton, also a former U.S. Senator representing New York State, was chosen by more than 70 percent of Citigroup institutional clients during a recent survey. Just over 10 percent see Donald Trump becoming the 45th president, while the rest of the candidates still running barely register. Online prediction markets, such as PredictIt, placed Clinton at 59 cents a share on Wednesday (the cents per share equal the probability participants give each candidate to win). Trump is at 17 cents, with Sen. Bernie Sanders at 16 cents and Sen. Ted Cruz at 15 cents. Wall Street money also favors Clinton. She has received more than $21 million in contributions from Wall Street-related firms. The next closest is Cruz with $12.5 million.

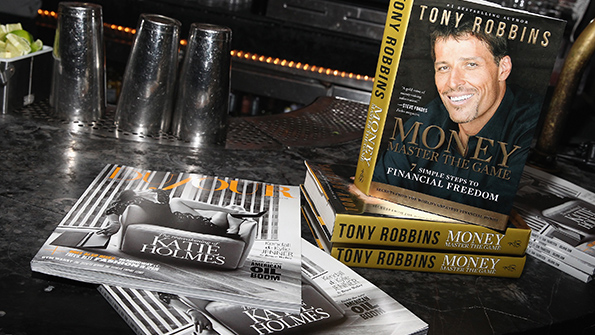

Tony Robbins Joins Creative Planning

Tony Robbins, the best-selling author and life strategist who recently started making his mark in the financial services space, has joined wealth management firm Creative Planning. Robbins, the author of the book, “Money: Master the Game Now,” joins the Kansas City-based firm as a member of its board of directors. He brings with him Ajay Gupta—his personal financial advisor—and Gupta Wealth Management, which has more than $1 billion in assets under management. Creative Planning, with more than $20 billion in AUM, caters mainly to multi-millionaire, high-net-worth and ultra-high-net-worth clients. In addition to his role as a board member, Robbins was also given the title of Chief of Investor Psychology.

Independent RIA Scooped Up by Virginia Bank

Old Dominion Capital Management, a Virginia-based independent RIA with more than $300 million in assets under management has been acquired by Richmond-based Union Bank & Trust. The acquisition is part of a bigger push for Union Bank into the wealth management space, according to RichmondBizSense.com. The bank already has about $1.9 billion in assets. Old Dominion, founded by University of Virginia graduates Jim Childress and Mark Thomas, will add to that and operate as a subsidiary of the bank. All seven of its employees will be retained. The RIA services clients in 29 states, mainly high-net-worth families.

Redstone Names Daughter Health Care Agent

Billionaire Viacom founder Sumner Redstone has designated his daughter Shari Redstone as his new health care agent, Bloomberg reports. Shari replaces longtime Redstone right-hand man and current Viacom chairman Philippe Dauman in the role, clearing up what many thought to be a dangerous conflict of interest, as the Viacom chairman held control over the life and death decisions of the company’s largest shareholder (Redstone still has an 80 percent voting interest). This change comes amid a lengthy and contentious lawsuit over Redstone’s competency brought by ex-girlfriend (and health care agent before Dauman) Manuela Herzer. Both Shari and Dauman have been asked to provide testimony in that case, which is set to go to trial on May 6.