The prolonged bull market has created unreasonable expectations among U.S. investors, and it could be eating into their savings. According to new research from Natixis Global Asset Management, investors now need an 8.5 percent annual return above inflation in order to meet investment goals, and 70 percent said they expect it to happen. Millennials were even more optimistic, saying they expect an 8.7 percent annual return after inflation. Most financial advisors, according to the same study, said a 5.9 percent return is more reasonable.

Father-Daughter-Son Team Breaks Away From UBS

A Waltham, Mass.-based family team with more than $300 million in client assets has broken away from UBS to start their own registered investment advisory, The Harvest Group. The team consists of Roger H. Ingwersen, son Todd M. Ingwersen, and daughter Laurie E. Ingwersen. The firm provides comprehensive wealth management services, including retirement planning, investment management, family needs planning, credit and lending, executive compensation, risk management and insurance, and estate planning. "The RIA space has grown exponentially over the past decade, giving independent advisors like us access to better technology, trading options, performance reporting tools, research and more," said Laurie Ingwersen, managing partner, in a statement. MarketCounsel and the Hamburger Law Firm helped launch the new RIA.

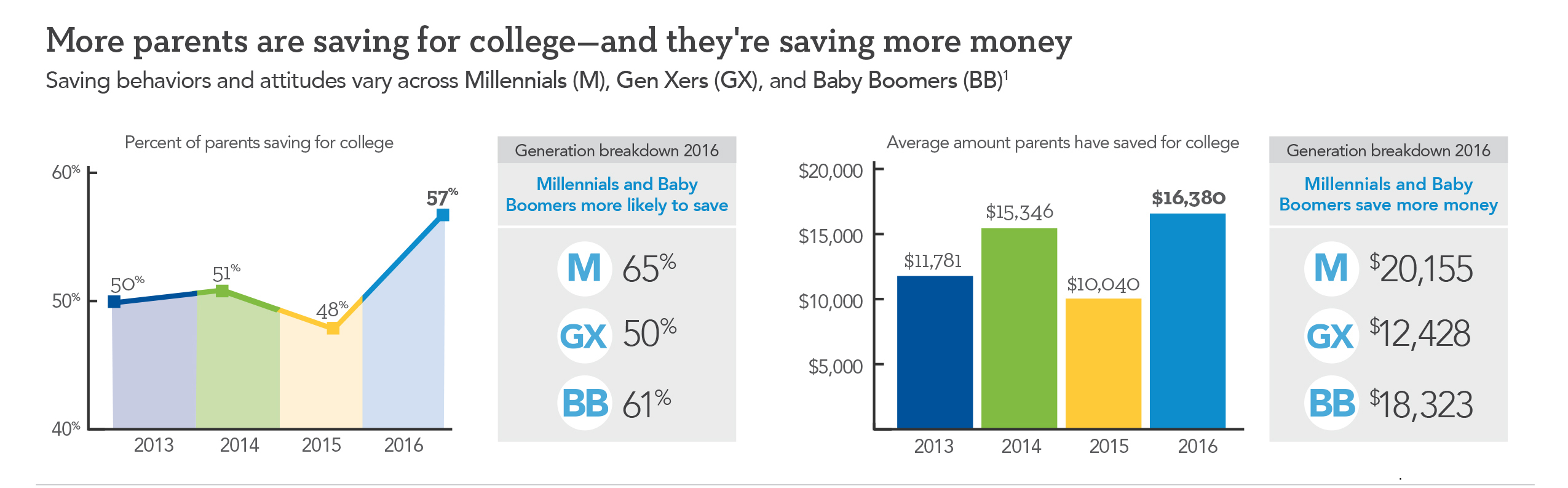

Millennial Parents Commit to Saving for College

Millennial parents are more committed to saving for college than Generation X and baby boomer parents, says a new study from Sallie Mae and Ipsos. On average, millennial parents are saving more—$20,155 compared to $12,428 for Generation Xers and $18,323 for baby boomers. And, a greater percentage of millennial parents are actively saving—65 percent compared to half of Generation X parents and 61 percent of boomer parents. Overall, though, the number of parents saving for college and the amounts they are saving have been increasing over the last four years, which is a good thing. “Preparing for college requires a significant personal and financial commitment,” said Raymond J. Quinlan, chairman and CEO of Sallie Mae, adding, “… it is very gratifying to see so many parents, and especially younger parents, taking proactive measures to make college possible and more affordable.”