Financial advisors have the ear of their wealthiest clients when it comes to making investment decisions, more so than family members or family office executives, according to a new study by Morgan Stanley Private Wealth Management and Campden Wealth Research. The study, which surveyed 59 individuals from families with net worths exceeding $25 million, found that a professional financial advisor is used in 41 percent of cases for overall asset allocation, as opposed to 38 percent for a family advisor or family office executive. The survey also found that 89 percent of ultra-high-net worth individuals were either strongly or partly influenced by their wealth advisors. “The fact that ultra-high-net-worth individuals appear to listen more to their financial advisors than their own family members shows the premium placed on good, professional investment advice,” said David Bokman, Head of Ultra-High Net Worth Resources for Morgan Stanley.

Crowdfunders Optimistic on Fourth Anniversary of JOBS Act

April 5 was the fourth anniversary of President Obama signing the Jumpstart Our Business Startups (JOBS) Act into law. On May 16, “Title III” of the bill will go into effect, allowing any small business to borrow money or sell shares to investors using crowdfunding websites. A number of technology companies have cropped up just waiting to take advantage, and a few crowdfunding lobbying groups are hosting a demonstration day on May 16 to highlight the benefits of their products in different verticals. Karen Kerrigan, the president and CEO of the Small Business & Entrepreneurship Council, said, “Our members look forward to this next chapter in crowdfunding, along with advocating for enhancements that will be beneficial for small businesses and investors.”

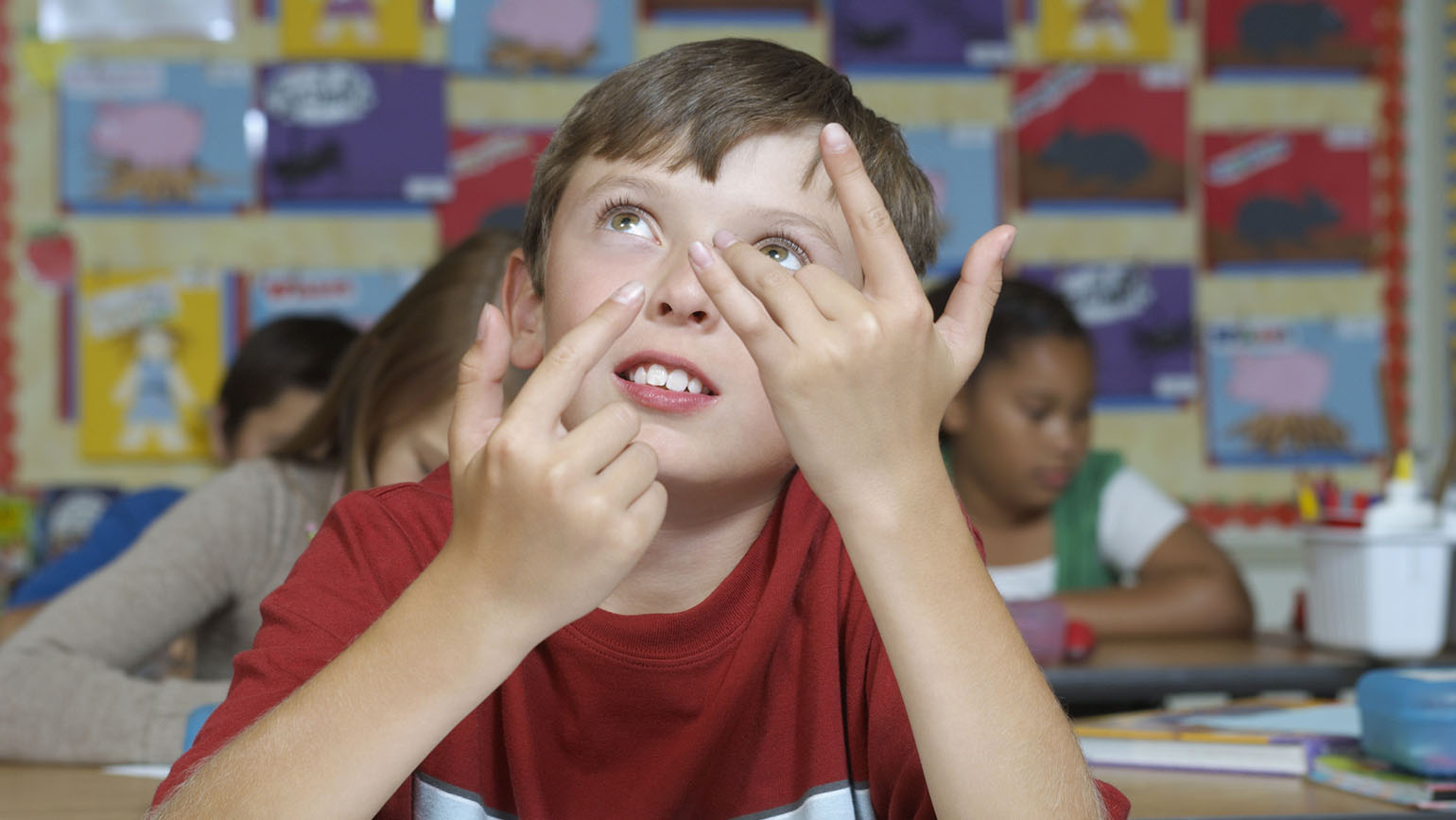

Schools Lag at Teaching Financial Education

Only 12 percent of teachers actually teach financial education in their classrooms, according to a new study by PricewaterhouseCoopers. The study, "Bridging the Financial Literacy Gap: Empowering Teachers to Support the Next Generation," states that while teachers view financial education as a shared responsibility for parents and educators, students are not getting it anywhere. According to Accounting Today, the study found that 65 percent of teachers believe it's unlikely students are being getting any financial education at home and only 31 percent of them actually feel "completely comfortable" teaching it. "In order to bridge the gap between educators’ support for financial education and the current lack of resources, we must advocate for systemic support of financial education, such as opportunities to teach business and economics at all levels, starting in elementary school," the study states.

I'll take a Slurpee, a Pack of Newports ... Oh, and I'll Pay My Taxes Too

The IRS announced yesterday a new program that will allow people to pay their taxes in cash at 7-Eleven stores. Partnerships with Official Payments (with whom the IRS has worked since 1999 to manage online payments) and PayNearMe will provide the electronic transaction network necessary to make the initiative possible. Actual payment is a multi-step process that should take several days and involves visiting the official payments site to verify taxpayer info and request a payment code, then taking that payment code to a participating store, having it scanned and paying the balance (again, in cash). No word on if participating taxpayers receive a free Slurpee (they should).