Much gets written about millennials and boomers, but what about the generation in between? Carol Hymowitz at Bloomberg takes a deep dive into the financial situation of Gen X, and it's not pretty. Forty percent do not feel financially secure, and 38 percent have more debt than assets, according to a recent survey by Northwestern Mutual. They were the generation hardest in the Great Recession, losing almost half their wealth when markets slumped, and many are burdened by caring for both young children and aging parents. "Six in 10 boomers and millennials think their generations are special but only one-third of Gen Xers do," says trend consultant Faith Popcorn. "You wouldn’t want to be a Gen Xer.”

Morgan Stanley Not Buying UBS Wealth Americas

Morgan Stanley CEO James Gorman has ruled out buying the brokerage arm of UBS, instead preferring to add brokers in a more piecemeal fashion, the Fox Business Network is reporting. If Morgan Stanley had agreed to buy UBS Wealth Americas, it would have created a mega-brokerage of more than 23,000 financial advisors, far surpassing No. 2 Merrill Lynch. But Gorman ruled out the deal because it would cost too much, and the firm would be better off growing organically by recruiting the right advisory teams, the news channel says, citing "people familiar with Gorman's thinking."

At the Elite Advisor Summit in San Diego, TD Ameritrade said it’s working on its own robo advisor, though it won’t be a purely digital experience like Wealthfront or Betterment. Instead, TD wants a premium platform similar to Vanguard’s, where clients can answer a risk questionnaire, set financial goals and build a portfolio online while being supported by human advisors. CEO Fred Tomczyk didn’t specific a release date, but said TD wants to build its robo into current tiered offering of its website, providing different service for different groups of clients.

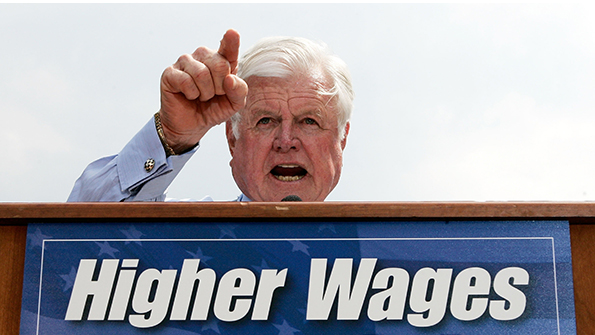

The quarterly survey from Duke University of over 1,000 international chief financial officers shows that the group is expecting both employment and wages to grow over the next year, with the level of expectation for wage growth hitting pre-Great Depression levels. Respondents said that they expect wage hikes of more than 3 percent, with hiring increasing by more than 2 percent. “Wage growth expectations the past few quarters have been the highest in the survey since 2007,” said John Graham, a finance professor at Duke’s Fuqua School of Business and director of the survey, in a statement. “In fact, CFOs indicate that difficulty in hiring and retaining qualified employees is a top three concern, especially in industries like tech and health care.” Yet CFOs rate the U.S. economy's outlook at 63 on a scale from zero to 100, which is down from 65 last quarter.