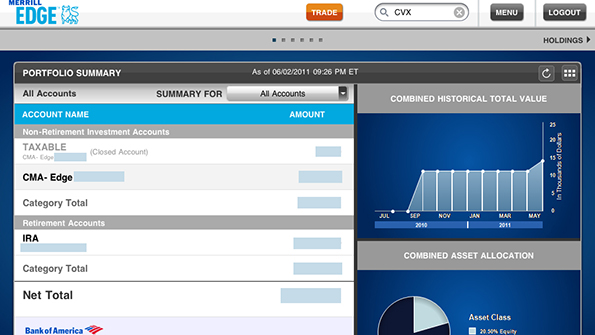

According to two anonymous sources cited by Bloomberg, Bank of America’s Merrill Edge has put dozens of employees to work on a robo advisor prototype that will service accounts with less than $250,000. Bank of America plans to unveil the service next year. While few details were given, the news should hardly come as a surprise to those following the industry. Automated investment services from both independent startups and traditional financial services firms continue their rapid growth, and executives with Wells Fargo and Morgan Stanley have both indicated an interest in developing or acquiring a robo advisor. “We’re actively looking at any and all potential options to continue to make sure we’re at the forefront of the industry," said Aron Levin, the head of Merrill Edge, in June. "The question is at what point do you decide to evolve that and explore that.”

Turns out millennials (born between 1980 and 1995) are highly successful entrepreneurs. According to a recent survey of almost 2,600 multimillionaire entrepreneurs in 18 countries released by BNP Paribas, millennial-run businesses outperform those led by baby boomers by 43 percent, although that varies greatly by region. In Asia, millennial entrepreneurs posted annual revenues 6 percent higher than baby boomer-led businesses. In the U.S. millennials outperform boomers by 318 percent. And millennials tend to start younger. The average age of a millennial business entrepreneur is 27.7 years, compared to 35.3 years for baby boomers.

The Active Part of Passive Management

Passive management is not, in fact, passive—not entirely. At least that’s the argument of Jason Voss, content director for the CFA Institute, in a recent blog post. Voss says that in every index and exchange traded fund, “human choice is involved.” Take the S&P 500 Index, for instance. The index, Voss writes, is maintained by the U.S. Index Committee, which meets monthly and reviews pending corporate actions, statistics, companies being considered for the index, and significant market events. “‘The Index Committee may revise index policy covering rules for selecting companies, treatment of dividends, share counts or other matters.’ To me this sounds very similar to a description of the activities of an investment committee at an actively managed mutual fund,” Voss said.

Wal-Mart Heir's Net-Worth Slashed By $27 Billion

It’s been a tough couple of months for the public perception of Christy Walton. First, she was dethroned as America’s richest woman by her sister-in-law Alice; now it turns out that she never actually held that lofty title in the first place. Since Wal-Mart heir John T. Walton's death in a plane crash 10 years ago, it’s been widely assumed that his wife, Christy, was the beneficiary of most of his estate. However, Bloomberg News managed to get the Wyoming court filings unsealed, and our assumptions about John’s estate turned out to be mistaken. According to the documents, he left half of his $17 billion fortune to a charitable trust and a third to only child Lukas. Christy got the rest. So, her fortune sits at a mere $5 billion, not the $32 billion it was thought to be. Hardly even worth mentioning anymore, really.