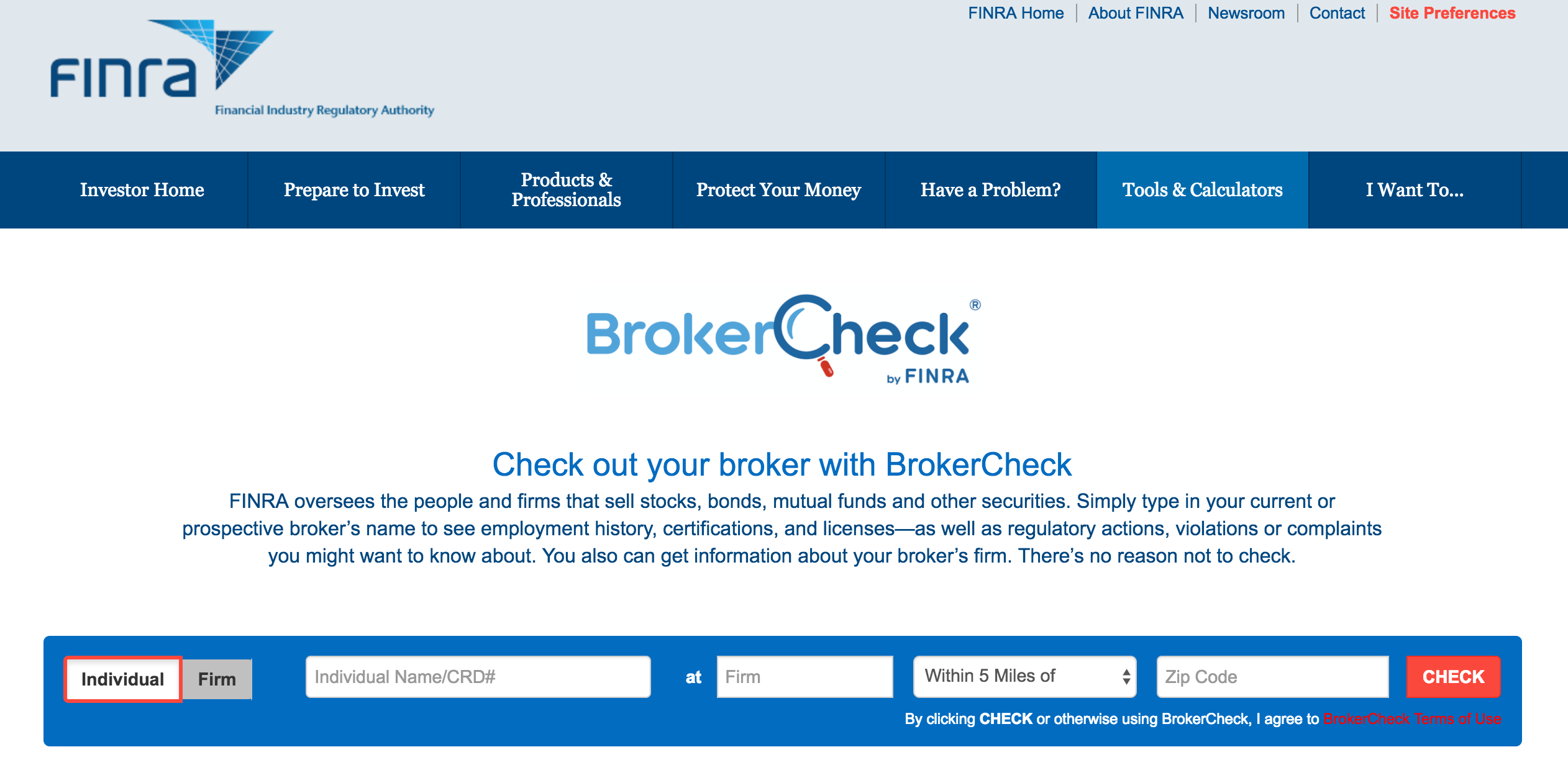

A 2014 report from the Public Investors Arbitration Bar Association (PIABA) criticized FINRA’s BrokerCheck system for not including information available from many state securities agencies, such as the circumstances behind a broker’s termination, bankruptcy filings, tax liens and test scores. Now, a new PIABA report chides the self-regulatory organization for not fixing the discrepancies, and the lawyers group says FINRA has even made things worse by advertising the “flawed BrokerCheck system.” If FINRA does not act to fix the problems, PIABA says Congress should step in. In a statement in response to the report, FINRA said a Board working group is currently considering a number of the issues raised in PIABA’s report and is developing recommendations to bring to the full Board. “FINRA is committed to investor protection and offers BrokerCheck as a free tool for investors to educate themselves about their brokers and brokerage firms. We are always looking for ways to make enhancements to BrokerCheck.”

RBC Wealth Management Adds New Investment Portfolios

Small retirement account clients with RBC Wealth Management are gaining three new suites of investment portfolios. The options include a suite of five ETF portfolios from Vanguard, five ETF portfolios from iShares and five mutual fund portfolios from American Funds. The portfolios are constructed by their respective fund managers and implemented and traded by RBC. The Vanguard and iShares ETF suites require a $10,000 minimum investment while the American Funds suite requires at least $25,000. This is part of RBC Wealth Management's push to boost smaller accounts. Less than a year ago, the firm lowered the minimum investment amount on its RBC Strategic ETF Portfolio to $10,000. As a result, accounts quadrupled and assets tripled within eight months. "Given how our clients responded to the lower minimums on our in-house ETF portfolio, it became clear that clients wanted more options for their smaller retirement accounts," said Sandy Duerre, director of U.S. advisory programs for RBC Wealth Management.

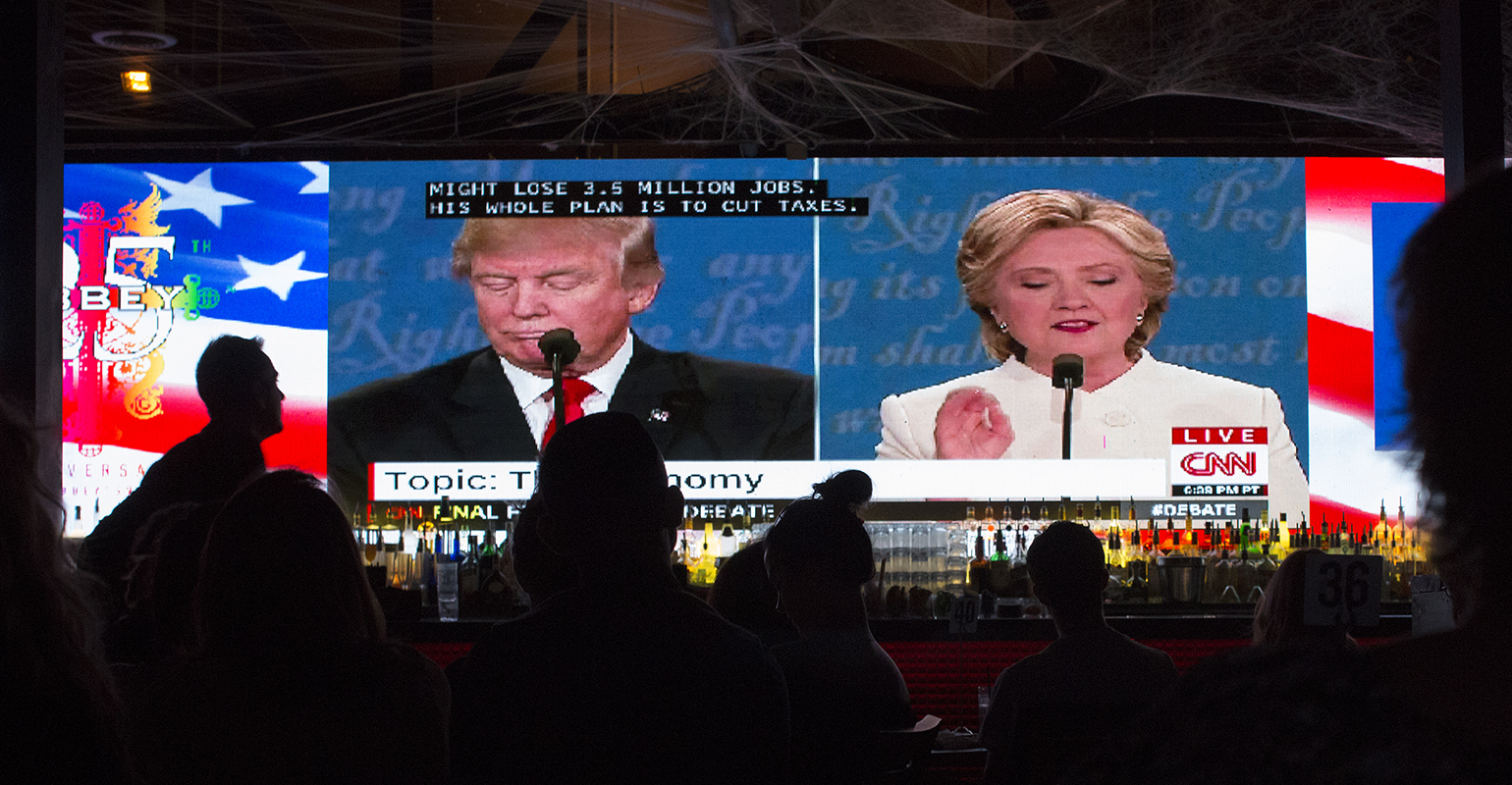

Don't Make Investment Changes Prior to the Election

Volatility in the stock market is a given in the three weeks or so until Election Day on Nov. 8, which is one of many reasons financial advisors need to recommend their clients not make any drastic changes to their portfolios prior to the election, writes George Sisti, founder of On Course Financial Planning, for MarketWatch. What does either potential winner mean for stocks? Sisti writes that no one knows and anyone making guesses is doing just that—guessing. Instead, he asks these two questions: "Will the election's outcome lead to a decline in corporate earnings because people will stop buying iPhones, shoes, automobiles, Big Macs or toothpaste?" and "Will entrepreneurs stop innovating and forgo all attempts at making life better for themselves and others?" The answer to both is no. That's why the best bet for investors is "to have a financial plan based on your goals, time horizon and risk tolerance, have a suitable asset allocation consisting of broadly diversified stock and bond funds and maintain a long-term perspective." If that's the case, the outcome of the election will have little impact on a client's portfolio.