The financial follies of famous athletes have been widely documented over the years, with millions lost due to disastrous investments, excessive gambling and lavish purchases. A recent book from former NBA player Adonal Foyle outlined some of the most egregious examples. But many were surprised to see that Patriots tight end Rob Gronkowski, one of the least likely examples of financial frugality due to his excessive off-the-field partying, has reportedly managed his fortune quite well since he entered the NFL. According to excerpts published in Sports Illustrated from Gronkowski’s forthcoming autobiography, the Super Bowl champion tight end hasn’t spent a dime of the $16.3 million he has earned from his signing bonus or NFL contracts.

It was only a matter of time before Tinder’s swipe left/swipe right technology came to the accounting world. A new iOS-compatible app called Swipefin allows users to track their business expenses. The app links to a user’s personal and business transactions from more than 29,000 financial institutions. When a transaction comes through, a user swipes right for a business expense or left for a personal one. Swipefin may be appropriate for clients who are business owners or entrepreneurs, or for advisors themselves.

Don't just blame the Federal Reserve for the bubbles that have been created in the markets and the economy. They are everywhere, according to Marc Faber, editor of the Gloom, Boom and Doom Report. He tells Fox Business that the while the Fed has fueled the bubble locally, the ECB has done so in Europe with its sovereign debt and multiple bailouts of Greece. "This is the problem of central banking today-they do not solve problems, they postpone problems," he said. "It’s created huge market distortions, and I think eventually this will be resolved by a massive deflation in asset prices.”

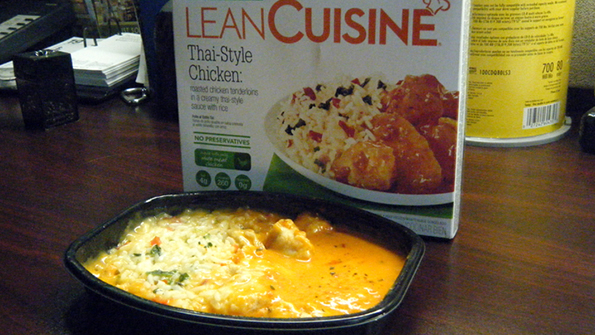

Many personal financial gurus over the years have advocated giving up that morning Starbucks run and bringing your lunch to work to boost savings. Mark Hamrick, the Washington bureau chief for Bankrate.com, recently tested out the latter part of this theory. His typical lunch? Microwaveable frozen entrees and a side salad. Hamrick found that he was spending about $32 a week, or about $6 per meal, on average for five Lean Cuisine and Amy's Organic frozen entrees and salad fixings such as kale, tomatoes, cucumber, red onion and salad dressing. Much more economical than the $10 Americans typically spend each time they go out for lunch, according to a 2013 VISA study. That comes out to about $70 in monthly savings. It probably won't fund a second home, but the habit could help lower the monthly credit card bill.