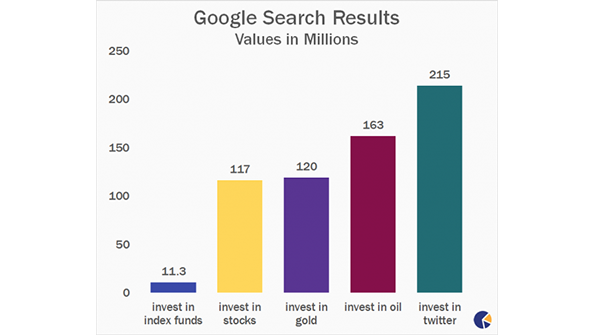

When it comes to investing advice, the Internet may be a financial advisors’ worst enemy. Like financial television, the web is overflowing with information on top stocks, hot trends, beating the market, and speculating in gold: and with very notable exceptions, there is far less information on buy-and-hold investing and portfolio diversification. Jimmy Atkinson at Fund Reference looked at Google Search results for phrases like “buy and hold” versus “how to time the market,” “value investing” versus “day trading,” and even “household budgeting” versus “home equity mortgages” and found shockingly different results: In each case, there were far more results for the riskier, trend-chasing search terms than the more conservative approaches. For instance, there were 120 million page results to the search “invest in gold;” only 11 million for the phrase “invest in index funds.”

Morgan Stanley, Scottrade Fined for Supervision Gaps

Wall Street’s financial watchdog fined both Morgan Stanley’s Smith Barney legacy brokerage unit and Scottrade a combined $1 million for supervision failures. The Financial Industry Regulatory Authority fined Morgan Stanley Smith Barney $650,000 and Scottrade $300,000, claiming the two firms failed to implement reasonable supervisory systems to monitor and control the transfer of customer funds. The regulator noted both firms were previously cited for weak supervisory systems by FINRA examination teams in 2011, but “neither took necessary steps to correct the supervisory gaps.”

How should financial services firms reach millennials? A recent Tech Crunch article suggests that virtual reality is one way to reach the generation that came of age with “The Matrix” and “Minority Report.” Writer Joseph McKenna says several firms are currently using virtual reality, although he doesn’t name them. At one firm, users of an investment app can see their portfolio in three dimensions, as it if were a city, with each position representing a building. Another firm has used the technology to show individuals what they would look like in retirement. “With VR technology now both affordable and functional, financial services providers should think of VR not just as an opportunity to showcase their ability to innovate, but also as an opportunity to transform the customer experience,” McKenna writes.

While executive pay has not risen to pre-financial crisis levels, top CEOs in the U.S. are still making 303.4 times more than the average worker in their sector, according to the Economic Policy Institute, a non-profit think tank based in Washington, D.C. The analysis took a look at the 350 biggest U.S. firms, noting that the ratio rose comparatively slowly in the 1960s and 1970s, before dramatically increasing from 1980 to 2000. Last year, CEOs earned an average annual compensation of over $16.3 million, as compared to the $53,200 earned by the average private-sector production/nonsupervisory worker. While critics of the study suggest looking at the pay of the average CEO, rather than CEOs of the largest firms, the author argues that the average firm is actually very small and therefore not a useful comparison to the pay of a typical worker who works in a firm of 1,000-plus employees. The disparity didn't change much from 2013, where CEOs earned 303.1 times more than the average industry employee.