Members of Gen Y may be the most scarred from the financial crisis and still very conservative with their investments, according to a recent survey by TIAA-CREF. About a third of Gen Y (those aged 18 to 34) say their top investment goal is to make sure their retirement savings are safe, no matter what happens in the market. Comparatively only 16 percent of those aged 35 to 44 and 22 percent of those aged 45 to 54 cite this as their top goal. Additionally, only 56 percent of Gen Y are counting on Social Security to provide income in their retirement, compared to about three quarters of older generations who are counting on taking Social Security.

The impulsive buying practices of Alyson Hannigan’s character in the smash comedy How I Met Your Mother led to her hiding massive amounts of credit card debt from her television husband, portrayed by Jason Segel. As it turns out, her character’s deception is also true to life, as one in five Americans reportedly hide financial debt from their partners, according to a new report from insurance site Haven Life. The study, first obtained by CNBC, also notes that 70 percent of respondents would rethink a relationship if the hidden debt were $5,000 or more. Income did not play much of a factor in the study, as 12 percent of respondents who earned less than $40,000 said they had debt their partner didn’t know about, while 10 percent of those making more than $80,000 said the same. Race also played into the research, as Hispanic respondents were twice as likely as blacks and six times as likely as whites to carry secret debt. The survey sampled 1,124 adults in the first quarter of 2015.

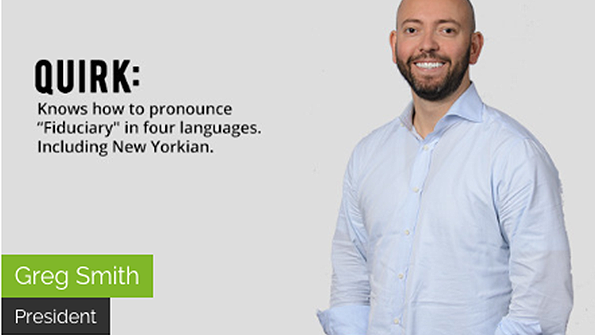

Former Goldman Banker To Help Retirement Blooom

Greg Smith, the former Goldman Sachs banker who quit his job with a scathing New York Times op-ed, has joined Blooom, a tech startup that wants to use robo technology to improve retirement accounts. For $15 a month, or $1 dollar a month for accounts with less than $20,000, Blooom takes control of a 401(k) plan and uses an algorithm to analyze the investment options in the plan and separate them into categories. It then allocates assets to the fund in each category with the lowest fees. The startup has attracted $80 million in retirement account assets since last fall. Smith will serve as Blooom’s president, and he told Fortune that he’s happy to be with a startup after his experience with Goldman.

They want to be a part of it—but only for so long. Two-thirds of New York City’s Generation X plans to kiss the Big Apple goodbye when they reach retirement, according to a new survey of 800 city voters commissioned by AARP. Seventy-eight percent of Gen Xers are worried about not saving enough, while 64 percent of them worry about being able to afford the rent or mortgage in the coming years. Members of the baby boomer generation are also struggling, with 56 percent of boomers saying they’re at least somewhat likely to move out of New York in retirement.