After topping $2 trillion in U.S. assets, the ETF market still remains a mystery to many investors. In a recent survey by Fidelity and BlackRock, less than one-third (32 percent) of individual investors currently own ETFs in their portfolio. When asked why they were holding back, 61 percent of non-owners say it’s because they lack familiarity with the funds, don't know how to evaluate them and don't understand the benefits. For those who do invest in ETFs, almost half (46 percent) say they plan to increase their ETF investments in the next three years.

RCS Capital finalized the acquisition of independent broker/dealer Girard Securities, bringing the firm’s total b/d network to over $236 billion and nearly 9,600 advisors. The deal was announced last August, just two months before RCAP sister company American Realty Capital Properties told investors it had made $23 million worth of accounting errors. Since then, RCAP has tried to distance itself from ARCP; Nicholas Schorsch, who many credit with building RCAP’s large b/d network in a short amount of time, stepped down as chairman in December. The Girard acquisition completes all of RCAP’s pending deals, including VSR Financial, which closed last week.

What takes up the majority of your "mind share" -- money or love? According to research from Brodeur Partners, Americans think about money and finances nearly twice as much as they do sex and love. Almost 70 percent of the 600 survey respondents said that they think about money either "most or all of the time," while just 40 percent said the same about sex and love. Politics rounded out the top three. Two out of three Americans feel a moral obligation to manage their investments responsibly.

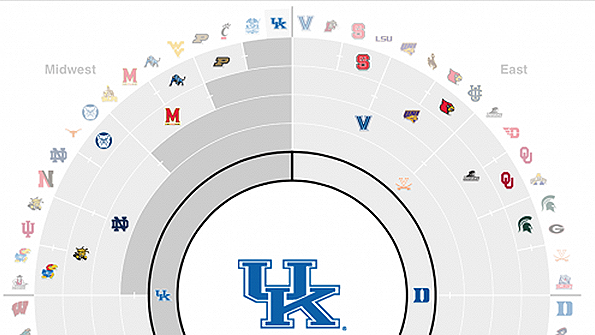

Bloomberg has rounded up over 35 executives to play in its March Madness tournament, including business heavyweights like AOL’s Tim Armstrong and Google’s Eric Schmidt and finance buffs such as Pershing Square’s Bill Ackerman and Goldman Sachs president Gary Cohn. Each participant donated $10,000 to play, with the pot going to the victor's charity of choice. Personal favorite? Schmidt is playing for Girls Who Code. Among these titans of industry, it’s no surprise that Kentucky is the favorite to win, followed by a number of folks selecting Wisconsin.