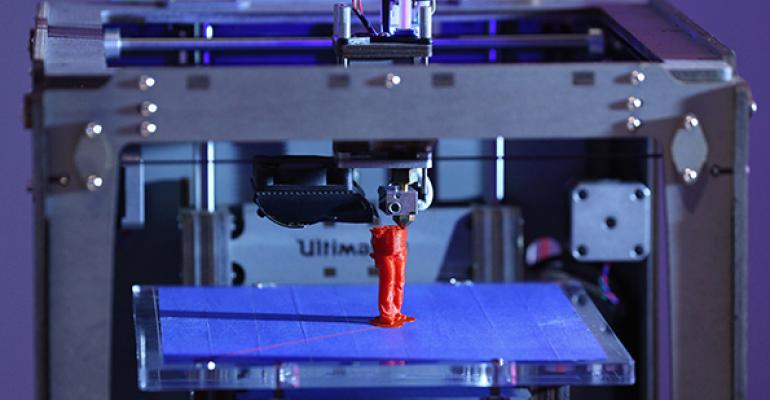

Ric Edelman’s “exponential technology” strategy for investment management is now a BlackRock ETF. The new iShares Exponential Technologies ETF (nysearca:XT) began with the Edelman Financial Services CEO’s belief that investing in radical new technologies is an important part of globally diversified portfolio in today’s economy. The ETF will track Morningstar’s Exponential Technologies Index, a collection of companies at the forefront of tech trends ranging from 3D printing, nanotechnology and robotics, to name a few. BlackRock said it was the first time they had worked so closely with an RIA, but neither Edelman nor his firm was compensated directly for the idea. The firm will, however, be able to invest some of the $13 billion of assets it manages into an ETF built around their CEO’s personal strategy.

Investing in sustainability can be a successful strategy, as it turns out. Morgan Stanley analyzed more than 10,000 sustainable equity mutual funds over the past seven years and found that sustainable equity funds met or exceeded median returns of traditional equity funds during 64 percent of the time periods examined. It seems investors are catching on. In 2014, $1 out of every $6 was invested in some form of sustainable investment, with a total of $6.57 trillion now invested sustainably.

This one might give new meaning to the term “alternative investment.” According to a study just released from the US Geological Survey (USGS), trace amounts of gold and other precious metals found in human feces could be worth, in aggregate, hundreds of millions of dollars. The research, which was presented at the national meeting of the American Chemical Society, notes that treated solid waste contains gold, silver and rare elements such as palladium and vanadium that are used in electronics and alloys. Scientists are currently investigating ways to extract the precious metals from poop. The gold found was at a level of a minimal mineral deposit, meaning that if it were in rock, it might be commercially viable to mine it, according to the report.

Demand for financial market research is on the rise, with global spending rising 4 percent to nearly $27 billion, according to a new report by Burton-Taylor International Consulting. This is the strongest growth in financial market news and data since 2011. Bloomberg was the market share leader, with 32 percent, followed by Thomson Reuters, at 26 percent. Risk and compliance professionals and investment bankers/corporate financiers were the fastest growing users of the news.