The Securities and Exchange Commission’s arguments for bringing its recent case against Patriarch Partners and its founder and CEO, Lynn Tilton, are weak and specious, according to an op-ed published by a Yale Law professor. In the recent Hoover Institution article, Jonathan Macey contends that while the SEC claims Tilton and Patriarch committed fraud, in reality, the case rests merely on allegations of violation of contract. Patriarch exercised its contractual right to amend the terms of its loans to portfolio companies. But the SEC is apparently arguing the firm was prohibited from doing so, even though Patriarch specifically disclosed these actions to investors, according to Macey.

Chinese Americans represent a lucrative niche market for financial advisors, with a median household income that’s 30 percent above the rest of the U.S., according to CNBC. But this market is largely untapped because of the barriers to entry into the Chinese-American community, the publication argues. There’s a dearth of Chinese-speaking advisors; establishing trust with this community can be a challenge, and the community is not very knowledgeable about financial issues.

Vanguard is not done lowering fees for investors and it's not laying off anyone - unlike the rest of the industry, according to company CEO and Chairman Bill McNabb. Barry Ritholtz writes on Bloomberg View that the reason why Vanguard is in such a lofty position—with $3.1 trillion in AUM—is because of its mutual ownership structure that gives it a 30-40 percent cost advantage. McNabb, who took over as CEO just before Lehman Brothers imploded, has been a calming influence for the firm. Since the crisis ended, Vanguard has added 2,000 employees, Ritholtz writes.

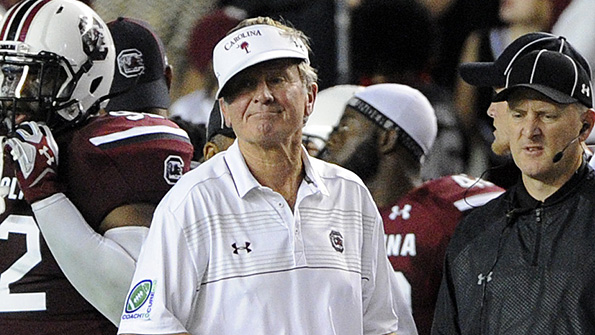

State universities are increasingly bucking their historic financial aid strategies, giving more grants to wealthy, smart, out-of-staters, according to a paper released today by New America. The study notes that the change in direction is driven by a desire for dollars and higher rankings. The author, Stephen Burd, calls the move an example of public colleges losing sight of their public mission. One example is the University of South Carolina. With annual funding to the university cut by 50 percent since 2007, there has been an influx of non-residents to the school. Today, 45 percent of the student body is composed of non-residents, more than double what it was in 2000.