The financial TV news channel CNBC had one of its worst years on record in 2014, all while the stock markets continued to hit all-time highs. The two may be related, according to John Reeves on The Motley Fool. Reeves points to research from Daniel Kahneman's Thinking, Fast and Slow that shows that following financial news on a minute-by-minute (or even day-by-day) basis can result in poor investing performance.

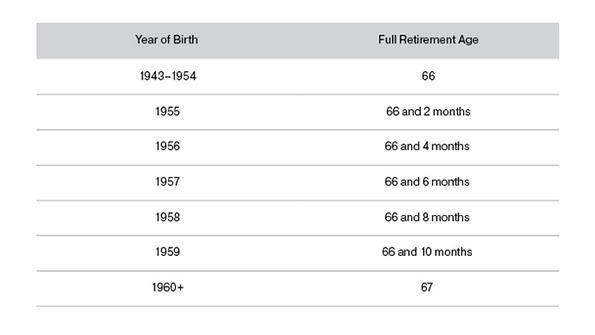

In order to qualify for full Social Security benefits, clients should plan on working until they're 66, according to research from Oppenheimer Funds. At least that's for anyone born between 1943 and 1954. The "magic" number goes up from there, rising two months for anyone born from 1955 to 1959. For anyone born in 1960 or later, the retirement age is 67.

DoubleLine Capital is in the planning stages of creating an infrastructure bond fund, Jeffrey Gundlach announced during a recent interview with Bloomberg. Gundlach said the firm is bullish on infrastructure as banks have cut back lending. One project DoubleLine would be interested in is the debt backing the $4 billion replacement of the Tappan Zee Bridge being built over the Hudson River 20 miles north of New York City.

TheStreet reported that its Quant Ratings, a service that uses an algorithm to evaluate more than 4,300 stocks and gives them an “A+” through “F” letter grade, handily beat the market in 2014. While the average diversified U.S.-stock fund had an average return of 7.6 percent, stocks that Quant Ratings labeled as “buy” on the S&P 500 yielded 16.56 percent, and stocks on the Russell 2000 yielded 9.5 percent.