Private wealth management firms were in high demand in 2015, dominating the financial transaction landscape among asset management firms with a record 59 deals, according to a new report by Sandler O’Neill. The firm attributes the increased activity to the greater stability of assets under management, organic growth and recognizing the benefits of scale. Mutual fund companies engaged in 50 percent more mergers in 2014, driven by the headwinds facing active-management shops. While pure-play asset managers were the dominant buyers, banks and financial sponsors stepped up more than they have in previous years, Sandler O’Neill notes. Broker dealers and insurance firms remained flat.

Managed Futures’ Time to Shine?

Managers of alternative investment funds have been waiting for this. The packagers of these retail versions of hedge-fund strategies say they are not meant to outperform the market when things are going well, but cushion the blow when things fall apart - and that's been a tough sell the past few years. But given the market rout so far this month, it’s a good opportunity to check in. Jason Kephart at Morningstar ran the numbers across a number of strategies; to be expected, short-equity funds are flying high. More relevant, managed futures funds are, indeed, behaving as advertised, up by 3.7 percent overall. (They were also up 1 percent in the fourth quarter of the year when the broader market fell over 6 percent.) But looking a bit deeper, Kephart notes the dispersion of returns across the managed futures category is broad: The best fund (from Natixis) gained over 7 percent. The worst (361 Capital’s) dropped almost 6 percent; Kephart points out 361 Capital’s fund is based on a mean reversion strategy and should not be expected to do well when markets make prolonged moves in one direction. Which proves the point made repeatedly; investors need to look beyond the category, and focus on what a specific fund is meant to accomplish, and how.

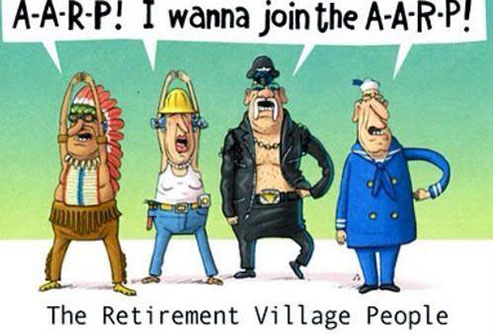

TD Offers Exclusive Deals For AARP

TD Ameritrade announced a new partnership with the AARP to offer special deals to the organization’s 38 million members. AARP members can now get commission-free trades, free investor education and up to $1,000 in cash or gift cards if they open a new TD account and fund it with at least $3,000 in the first 60 days. Management fees on Amerivest portfolios will also be waived for AARP members who invest more than $25,000, and TD will give a $75 fee rebate when members transfer $5,000 or more from another financial institution. Additionally TD said it would offer a customized list of mutual funds and ETFs that focus on income generation and target date goals. “The idea that retirement is a set date in your early 60s is a thing of the past,” said David Clingman, managing director of retirement and annuities at TD Ameritrade. “People are living longer, working longer and looking to live life to the fullest. We understand that and we want to help the millions of AARP members save and invest for all their financial goals, whether that’s a home improvement or saving for an exotic vacation, and give them the confidence that their financial life is in order.”

What Are Financial Advisors Good For? Retirement Planning

Investors who work with a financial advisor are twice as likely to be on track or ahead in saving for retirement than those who go at it alone, according to a new survey from John Hancock Retirement Services. Seventy percent of those who work with an advisor are on track, compared to 33 percent of those who do not, the data shows. Those who work with advisors not only are more likely to save for retirement, but also for emergencies (58 percent vs. 26 percent of those advisor-less) "People need advice, not just investment advice but also basic retirement planning guidance," said Patrick Murphy, president of John Hancock Retirement Plan Services. "It's very clear that engaging a financial advisor helps people take positive financial steps, from saving for emergencies to saving for retirement."