Bank of America’s wealth unit had another lackluster quarter, with a 5 percent drop in profits and revenues in line with a year ago. The firm attributes the slide to low interest rates—even as the overall bank almost doubled its profits.

The Charlotte, N.C.-based bank reported a profit of $5.32 billion, or 45 cents a share, beating analysts' expectations by 5 cents, according to Seeking Alpha. That compares to $2.99 billion in profits a year ago.

A good quarter in mortgages and cost-cutting boosted profits, but the decline in legal costs accounted for a good portion of the gains. A year ago, Bank of America had to set aside $4 billion for legal costs; versus $175 million this quarter.

Meanwhile, the Global Wealth and Investment Management division, which includes the brokerage business, experienced continuing lower net interest income primarily due to the low interest rate environment, although the unit was partially offset by higher net interest income on higher asset management fees. Here are the highlights:

- GWIM reported a net income of $690 million during the second quarter, a 5 percent decline from a year ago. But it’s almost a 6 percent increase over the $651 million reported during the first quarter.

- Revenues fared slightly better, with the wealth business reporting $4.57 billion in revenues for the second quarter, essentially flat from the $4.58 billion reported a year ago and up just 1 percent sequentially.

- On a more granular level, Merrill Lynch Wealth Management reported revenues of $3.8 billion, which were also flat year-over-year and up 1.2 percent from the first quarter. The approximately $45 million quarterly rise in revenue was due to higher fee-based revenue and higher balances.

- Merrill reported client balances of $2.1 trillion for the second quarter, up $8.1 billion from prior quarter and an increase of $34.5 billion from the same period in 2014, according to spokesman Matthew Card.

- The brokerage business saw record asset management fees of $1.7 billion this quarter, an 11.4 percent increase over the past year, Card reported. Long-term AUM flows hit $9 billion, which were positive for the 26th consecutive quarter.

- Advisor productivity within Merrill was $1.36 million per "experienced" advisor (meaning those not still in the training program), a slight increase from the $1.35 million reported last quarter. Overall productivity held steady at $1.04 million for all advisors, including trainees.

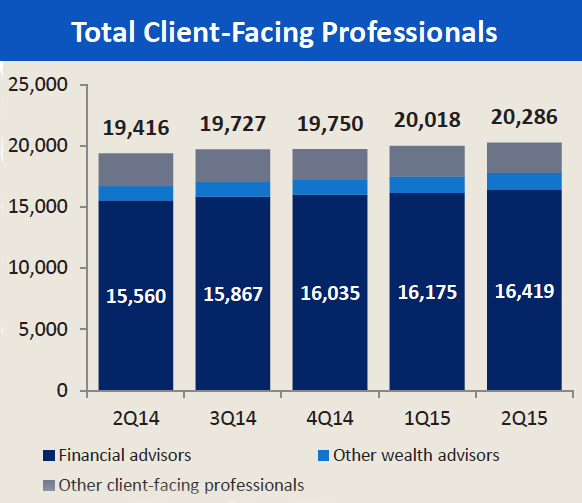

- Within the Merrill Lynch Wealth Management division, advisor headcount was up by 187 advisors for the quarter, bringing total headcount 14,370. Overall, GWIM reported headcount of 16,419, which includes advisors in U.S. Trust. For Merrill, it was the fifth consecutive quarter of advisor growth and the best quarter of hiring experienced advisors since the fall of 2011, according to Card. Attrition within the advisor population remains at historic lows, he said.

- Merrill’s practice management development program hired 480 new trainees during the second quarter. The program has graduated 132 trainees during the second quarter.