With the 2013 tax season behind us, many Americans are reflecting on how much more they paid in taxes compared to years past. As a result of the recent tax changes under the American Taxpayer Relief Act (ATRA), the top federal income tax rate increased from 35% to 39.6% for those that make over $400,000 (single filer) or $450,000 (joint filer).

For many taxpayers, the biggest tax increase was most likely on their investment income. The tax rates for long term capital gains and qualified dividends went from 15% to 20% for those in the top tax bracket. In addition, 2013 was the first year certain investment income became subject to the 3.8% Medicare surtax. With the additional surtax, the top tax rate for long-term capital gains and qualified dividends increased from 15% to 23.8%, a 59% increase. The top tax rate for short-term capital gains, interest and ordinary dividends increased to 43.4%.

The taxes an investor pays annually on capital gains, dividends and interest can significantly erode a portfolio’s return in the future. In addition, if the capital gains, dividends and interest are being automatically reinvested, the investor is paying taxes on money he/she isn’t currently using. While clients can’t eliminate all investment-related taxes, they can control them and improve a portfolio’s efficiency. If the investments are for retirement, it may be better to defer taxes until that time. The fundamental value of tax deferral is simple – the longer you defer the tax obligation and keep money invested, the better.

One solution offering tax deferral is a variable annuity. A variable annuity can help clients accumulate wealth very tax efficiently because gains that remain in the contract are not taxed every year. In addition, if the annuity is not part of a tax-advantaged retirement plan, there are generally no contribution limits, further illustrating the power of tax deferral. In addition, clients can transfer funds between investment options on a tax-free basis, meaning that changes in investment objectives or time horizons need not cause an investor to payout taxes before it’s time to put the savings to use.

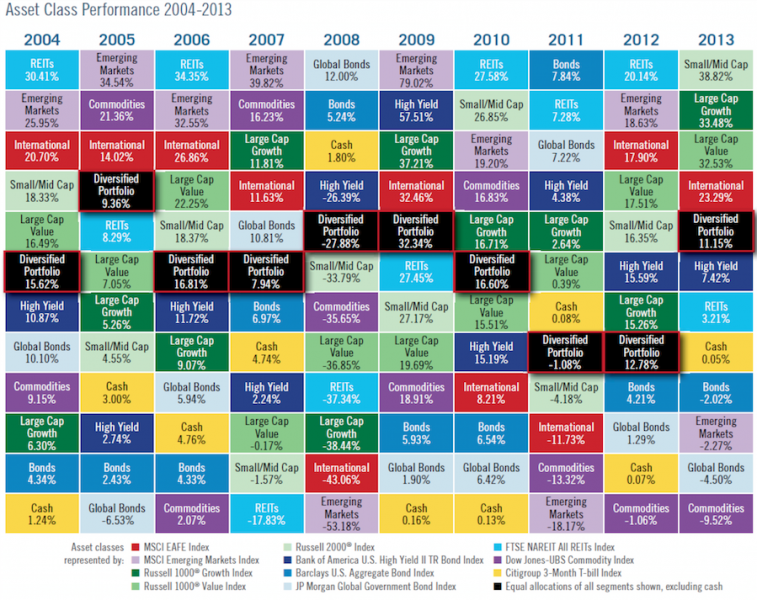

Variable annuity investment options have evolved greatly over the years. Early generations of variable annuities had few options and focused on more traditional strategies. Today, variable annuities typically offer a wider line-up of investment choices, which spans a broader array of asset classes, and offer greater diversification. 1 Lots of clients want to be invested in the best performing asset class all the time. We know that is a highly unlikely outcome. As the chart below illustrates, a diversified portfolio can have less volatility and smoother performance over time.

In addition, variable annuity investment options may include strategies typically available only to large institutions, such as endowments and pension funds. Beyond traditional equities and fixed income strategies, a variable annuity may also offer portfolios that have global exposure, as well as alternative investments. Alternative investments have become more popular, as they tend to move independently from traditional assets. This can help dampen volatility and help smooth investment returns over time. Examples of alternative investments include commodities, Real Estate Investment Trusts (REITs) and hedge fund strategies.

The recent tax increases for investment income may require a fresh look at more tax efficient investment alternatives. Many investors just spent countless hours and dollars finding ways to maximize their allowable income tax deductions and exclusions. Those will affect their income for that year only. Tax deferral, by contrast, affects taxes over many years. Talk with your clients and their tax advisors, and review clients’ recent tax returns. In particular, focus on lines 8a, 8b, 9a, 9b and 13 on IRS Form 1040 – taxable and tax-exempt interest, ordinary and qualified dividends, and capital gains and losses. Large numbers on these lines may help identify assets that could be repositioned to a variable annuity, and provide greater tax efficiency. After all, one of the main goals of retirement planning is to end up with the most after-tax money as possible.

1 Diversification does not assure against loss in a declining market. Asset allocation is a method of diversification that positions assets among major investment categories. Asset allocation can be used to manage investment risk and potentially enhance returns. However, use of asset allocation does not guarantee a profit or protect against a loss. Inclusion of a subaccount in an asset allocation model does not indicate that it is superior to a subaccount not included in a model.

Alternative investments include a high degree of risk and may increase the risk, size, and velocity of investment losses. Although certain alternative strategies seek to reduce risk by attempting to reduce correlation with equity and bond markets, no guarantee can be given that such efforts will be successful. The fees and expenses associated with alternative investments are generally higher than those for traditional investments.

A variable annuity is a long-term investment designed for retirement purposes. Investment returns and the principal value of an investment will fluctuate so that an investor's units, when redeemed, may be worth more or less than the original investment. Withdrawals or surrenders may be subject to contingent deferred sales charges.

Annuity contracts contain exclusions, limitations, reductions of benefits and terms for keeping them in force. Your licensed financial professional can provide you with complete details.

Prudential Annuities and its distributors and representatives do not provide tax, accounting, or legal advice. Please consult your own attorney or accountant.

Investors should consider the contract and the underlying portfolios' investment objectives, risks, charges and expenses carefully before investing. This and other important information is contained in the prospectus, which can be obtained on the prospectus page or from your financial professional. Please read the prospectus carefully before investing.

Commodities Risk – Commodities may experience more volatility than investments in traditional securities due to changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as weather conditions, livestock disease, embargoes, tariffs, acts of terrorism, and international economic, political and regulatory developments.

Hedge funds may involve a high degree of risk. They often engage in leveraging and other speculative investment practices that may increase the risk of investment loss. They can be highly illiquid and are not required to provide periodic pricing or valuation information to investors. They may involve complex tax structures and delays in distributing important tax information and are not subject to the same regulatory requirements as mutual funds. They often charge high fees which may offset any trading profits, and in many cases the underlying investments are not transparent and are known only to the investment manager.

International Equity/Debt Risk – In addition to risks inherent to investment in equity and fixed income securities, investments in international equity and debt securities involve risk of exposure to: changes in currency exchange rates, differing regulatory and taxation requirements, alternative financial reporting standards, and political, social and economic changes which may adversely affect the value of a portfolio’s international securities. International markets are generally more volatile than U.S. markets and have less publically available information. These risks are heightened for investments in the securities of emerging market issuers.

Real Estate Investment Trusts (REITs) Risk – Exposure to REITs involves risks such as refinancing, economic conditions in the real estate industry, changes in property values, dependency on real estate management, and other risks associated with a portfolio that concentrates its investments in one sector or geographic region.

Annuities are issued by Pruco Life Insurance Company (in New York, by Pruco Life Insurance Company of New Jersey), Newark, NJ (main office) and distributed by Prudential Annuities Distributors, Inc., Shelton, CT. All are Prudential Financial companies and each is solely responsible for its own financial condition and contractual obligations. Prudential Annuities is a business of Prudential Financial, Inc.

0262136-00001-00