The passification of the investment management industry continues to gain momentum though unevenly and not without limits or borders. Across the globe, regardless of type, clients are more discerning. In this hyper-low return environment, they are increasingly focused on fees. Clients are less patient when active management’s potential is not realized; too often, this is the norm.

While some investment categories are particularly likely to fall to index-linked strategies, others are resistant. Selectively, style boxes appear to have lost their pernicious dulling effect on active managers. In turn, the fundamental logic of ‘active share’ (or the Propinquity measure of ‘degree of investment freedom’) has gained traction conceptually.

The greatest opportunity for active managers is to actively form the new mold that will define investing for the next generation. Ultimately, the long-term role of the investment management industry is predicated on the framework for asset allocation—change the parameters and everything could be up for grabs. Long-established ‘passive’ indices have set the boundaries for the last 50+ years; indications are that they may prove susceptible to innovation. The dialogue around strategic beta's development and role in portfolios may in fact point to a larger opportunity to redefine just what we mean by the terms active and passive and who is the keeper of those definitions.

Besides launching/buying an index-linked business (which may still prove attractive for managers with distribution strength), active managers have several options; complacency is not one of them.

We identify three ways forward: (1) Focus on passive-resistant categories; (2) Employ high “degree of investment freedom” strategies; and/or (3) Redefine the current passive-biased framework.

1. Focus on passive-resistant categories.

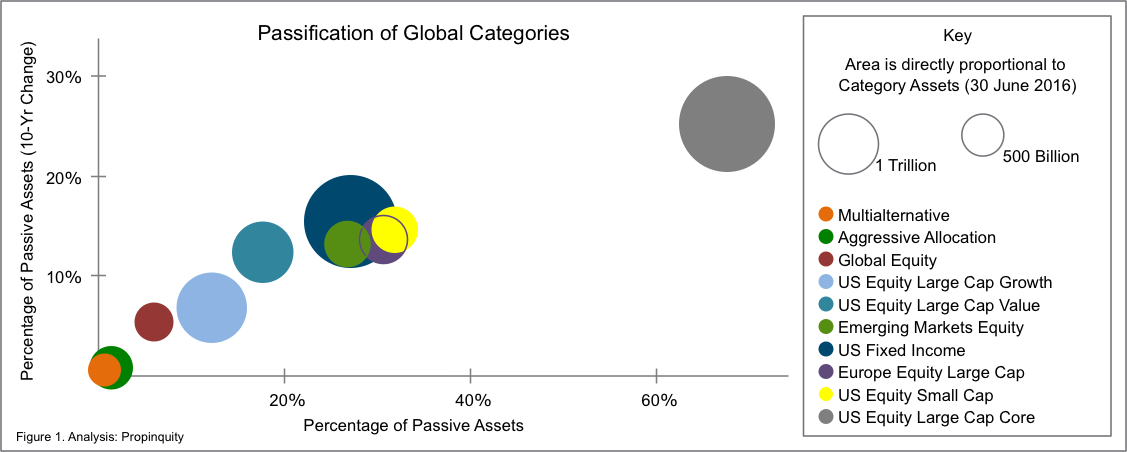

As outlined in Figure 1, passification has not been universally effective. Some categories are more likely than others to have a large portion of their assets go passive. This move to passive is already apparent in the U.S. while Europe is undergoing passification on a delayed timeframe.

Investment categories well suited to passive product development have several common characteristics. As such, efficiency, transparency and deep liquidity are the biggest threats to the business case for active managers—specifically in narrowly defined investment categories or single-market ‘building block’ strategies.

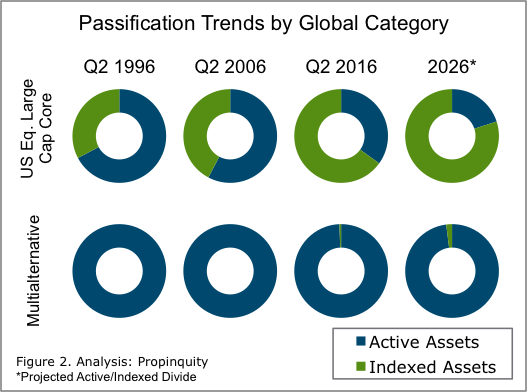

In terms of the rate of conversion to index-linked vehicles, the very worst category in the world from an active manager’s point of view is U.S. Large Cap Core. This category is the long-standing epicenter of passification. Passive strategies replicating the purportedly passive but arguably actively managed S&P 500 have dominated this space (Figure 2).

Why is this the case? U.S. Large Cap Core strategies are composed from a universe of companies that are highly efficient, thoroughly researched and very liquid. These criteria make the category ultra-scalable and a boon for low-margin, volume-driven product development. Think Vanguard, think ETFs, think passive. The S&P 500 is the best-known financial instrument in the world; its brand cache and ubiquity make its adoption easy. It’s the Coca-Cola of the investment industry (including a comparable ‘secret formula’).

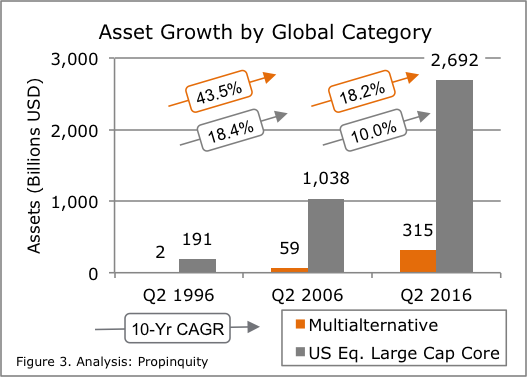

In Q2 1996, passive vehicles made up 31.4 percent of the U.S. Large Cap Core category’s AUM ($59.9 billion out of $190.7 billion). Today, passive vehicles have captured 65.4 percent ($1.8 trillion out of $2.7 trillion), the greatest of any investment segment included in our analysis (Figures 2 and 3).

Alternatives and some varieties of Multi-Asset are on the opposite end of the passification spectrum (Figure 1). These categories generally hold a motley group of heterogeneous investment strategies. They are impossible to systematically categorize and define within narrow terms—all good things for active management.

Further, ‘alternative’ and ‘allocation’ are categories that enable managers to employ a high degree of investment freedom. Managers of these strategies are often able to express views using a variety of instruments and techniques across multiple asset classes and geographies difficult to replicate systematically. In fact, they can use the ‘passive’ building blocks to express an increasingly broad set of investment views.

In Q2 1996, 100 percent of the global category ‘Multi-Alternative’ ($1.6 billion) was actively managed. The category has grown almost 200-fold over the past 20 years. Passive vehicles account for 0.6 percent of the total category AUM ($1.8 billion out of $315.4 billion). Naturally, the relative size of the categories is an important consideration (Figure 3). The AUM raised in liquid alternative funds is relatively small though the growth has been exceptionally strong. With a spotlight on fees, these strategies must prove their ability to produce differentiable alpha and to earn their places in skeptical investors’ asset allocation models.

Alternatives are ideally positioned for long-term sustainability as active strategies. Unlike U.S. Large Cap Core, they have the range of investment freedom to offer the potential of outperformance. Further, there is not a single branded index to use passively (such as the S&P 500). Heterogeneity, flexibility and the potential of deriving performance not solely from security selection will be hallmarks of active management in 2026.

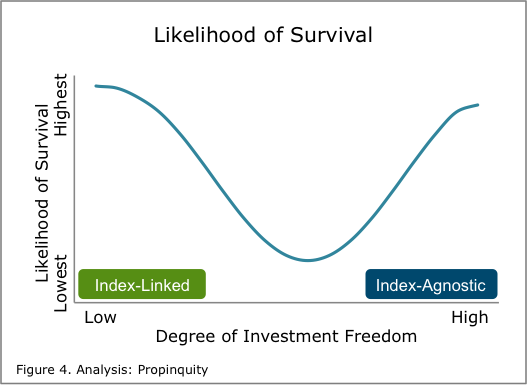

Active managers should focus on categories with an inherent bias toward a high degree of investment freedom—the single most important criterion needed for the survival of an active investment strategy and defense against passification. Categories in which managers are expected to employ a high degree of investment freedom are safe havens for active management. Funds that exhibit a high degree of investment freedom have seen high organic growth rates over the last 10 years relative to active funds in the middle of the DIF spectrum.

2. Employ a high “degree of investment freedom."

As shown in Figure 2, the entirety of even the most passified categories are not expected to convert to the ranks of passive investing over the next 10 years. Whether an active manager is in a susceptible or defensible investment category, ultimately it will be an ability to demonstrate effective use of a high degree of investment freedom that will drive investment and commercial success.

Some portion of the assets that remain dedicated to active managers in largely passified categories will be the product of investors who simply have not done their homework and ‘passively’ remain with a mediocre manager eating up any potential performance difference with hefty fees. This is a shame and will be a legacy issue. At the same time, managers who have the ability to distinguish themselves will be well positioned to manage the remaining assets.

Distinguishing features may include both performance and non-performance measures (such as client-driven interest in activism or ESG-focused investing). They may also include managers who, using a strong valuation discipline, actively use cash or other ‘hedging’ strategies to protect capital through long rolling periods of volatility. These types of strategies may prove attractive through long periods of rolling volatility.

The managers that will survive within passification-prone categories must demonstrate their ability to produce differentiated alpha through a philosophy and process that realizes the potential of a high degree of investment freedom. Active managers with products in categories in which mediocre is accepted as the norm need to be absolutely exceptional.

Active managers competing in categories most susceptible to passification need to focus intensely on their value proposition (and reposition it if necessary) or pivot their capabilities to meet evolving investor demands. The challenges posed will only continue to get more intense.

We believe that an active manager’s level of flexibility and demonstrated active decision-making provides an indication of the likelihood of survival over the next 10 years. These are necessary but not sufficient conditions—managers’ activity must produce results matching or exceeding the expectations of their investors. Managers must be cautious not to confuse movement with progress – investors are wary of overly complex, fee-laden structures. Funds of hedge funds are continuing to experience the impact of these changes in investor attitude.

3. Redefine the passive framework.

In addition to the investment rationale discussed above, a large part of the reason why U.S. Large Cap Core has been passified greater than any other category is the history, strength of brand and acceptance of the S&P 500 as ‘the market,’ a remarkably powerful and valuable position.

With the rise of factor-based investing (a.k.a. smart or strategic beta), the battle for the thin gray areas between active and what had heretofore been identified as ‘passive’ is growing. Current developments have the potential of displacing not only active strategies but the seemingly well-entrenched indices that have gained synonymous value with the passive movement.

A growing group of voices has pointed out that a good portion of the ‘passive’ indices are constructed using methodologies reminiscent more of active management of old than the factor-based strategies displacing them.

The dominance of the traditional indices—now the basis for trillions of dollars of investment product that use them as reference and billions of dollars in fees—are beginning to shift.

Overall, their strength is derived from the important role indices play in the risk/reward modeling and the development of strategic asset allocations (i.e., capital market assumptions). At the point that serious investors begin to use other indices as the basis for the ‘market’ and market segments in which they invest, a range of new possibilities and developments will open. If those indices are effectively as good or better at representing ‘the market’ (or segment thereof) and are able to provide slightly better outcomes, our reference points and framework will also begin to shift.

There are a growing number of forward-thinking and innovative institutional investors asking for more from investment managers. Recognizing that it is unduly limiting to focus on narrow asset classes, these investors are giving investment management companies broader mandates in order to potentially maximize results.

It may be an example of ‘back to the future,’ like the old days when trust departments reigned supreme, before investment consultants and style boxes and the clearly defined lines between asset allocation and security selection. Only now the opportunity may be driven by the managers who have for the last 30+ years been filling those boxes. Given the breadth of data and capital markets expertise coupled with the threats of being passified, this may look like a tenable option. The winners of the next 20 years will once again need to redefine the rules.

Conclusions

The movement towards passification is intense. Investment managers must be on their toes and be ready to pivot towards areas of future demand from investors. In all, whether steadfast in their commitment to traditional building block categories or towards the expanding ‘new’ allocation and alternative categories, active managers must demonstrate their ability and willingness to manage with a substantially high degree of investment freedom. The strategic asset allocation framework that has been in place for the last half century may in fact be the greatest opportunity for managers able to reset the framework for just how asset allocation and indexing is done.

To read more from Propinquity, go here.

Propinquity provides strategic research and advice to investment management companies.