Lead generation service Zoe Financial won fund research firm Morningstar's annual fintech competition last week, beating out a field of 21 wealthtech firms in a sign that the startup is set to gain more traction with investors and financial advisors.

Prospective clients seeking a new financial advisor are driven to Zoe Financial by targeted by digital ads. They are then matched with a vetted pool of advisors, who pay Zoe Financial if a lead becomes a client. The fee depends on how the advisor charges for their services. For advisors who charge a flat annual fee, Zoe Financial will likewise charge them an annual fee for the first five years of that client's relationship with the advisor. Those who charge clients a fee based on a percentage of their assets pay Zoe Financial a share of the revenue for as long as the Zoe-converted prospect is a client. The firm declined to give specifics on what that percentage is.

Launched in February of 2018, the company began by building a small network of fee-only financial advisors. In the fall, it began connecting prospective clients to that group. Hundreds of clients have already handed over a total of more than $100 million to advisors using the platform, Andres Garcia-Amaya, the CEO and founder of Zoe Financial, told WealthManagement.com.

To be sure, there have been numerous attempts at digital referral platforms that sought to connect advisors with clients, with minimal success. Zoe Financial hopes to buck that trend by creating a more frictionless user experience as well as earning prospect trust by limiting the advisors it works with to only those who meet its qualifications. About 2,000 advisors have applied to join Zoe Financial so far this year, up from about 1,500 in all of 2018, Garcia-Amaya said. A low percentage of applicants "in the single digits" are accepted by the network. Advisors must be fee-only, have a CFP or CFA designation, and undergo a questionnaire and interview with the Zoe team. The platform is hoping a carefully vetted pool of advisors who meet their criteria will mean prospects see it as a credible source of good referrals. After prospective clients make contact with the platform, 88% take scheduled calls with the advisors they are matched with.

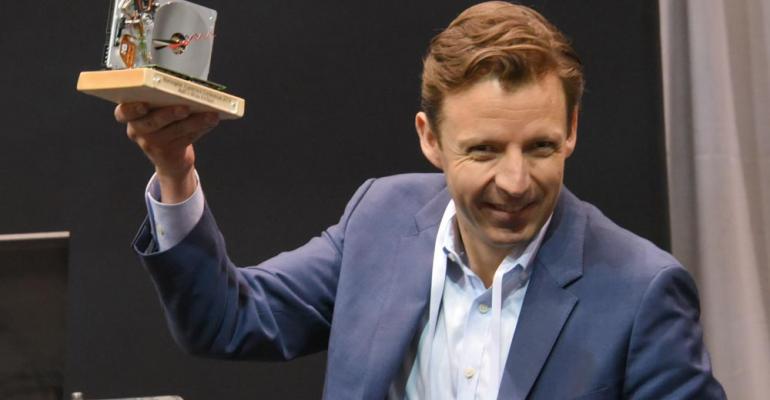

From a field of 21 companies invited to present at Morningstar's Fintech Theater this year during the research company's annual investor conference, a panel of judges chose Zoe Financial to receive the Best Fintech Award. As the winner, Garcia-Amaya got to have lunch with Morningstar CEO Kunal Kapoor, a prize he said was "better than cash."

Garcia-Amaya did not say whether the company plans to raise more funding. A former BlackRock executive and the chairman of the J.P. Morgan Exchange Traded Funds board were among a group of angel investors who raised a $2 million seed round of funding for Zoe Financial in September last year.