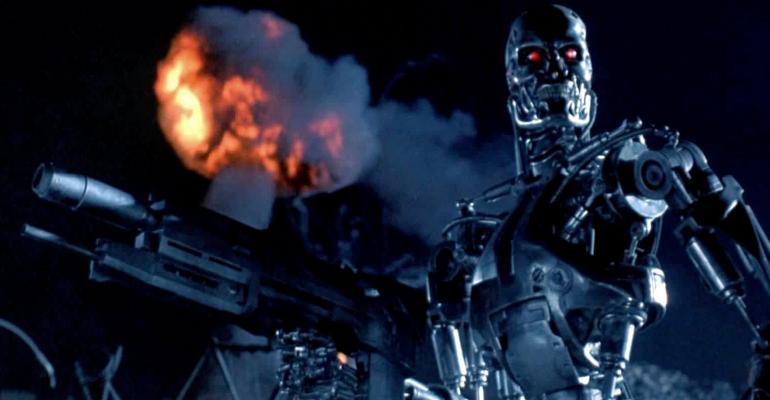

The CFP Board Center for Financial Planning put together a panel of thought leaders and executives to create a new report on the future impacts of digital advice on the financial planning industry. The group examined four different scenarios, taking into consideration the nature of consumer demand for a digital experience and integrated advice. The first is a scenario where everyone goes digital, with advisors using the same tech platforms as the direct-to-consumer models, but with regulatory concerns preventing a fully integrated experience. The group also imagined a “Rise of the Humans” scenario, where unforeseen market events damage the robos and create complexities only humans can solve, and a “Back to the Future” world where a cyberattack or other event turns consumers away from direct-to-consumer digital advice and back to humans. The one that will frighten advisors most, however, is “Judgment Day,” where machine learning advances to the point where the human advisor is rendered obsolete. “By looking at multiple probable outcomes—as opposed to just one scenario—we're not banking our future on just one outcome, and participants were encouraged to imagine alternate futures where their business models might not be as successful as they are today or hope to be in the future,” said Joe Maugeri, the managing director of corporate relations at CFP Board.

Advisors Must Consider Pricing

Fidelity Clearing and Custody Solutions 2016 RIA Benchmarking Study reveals that firm pricing models aren’t keeping up with the evolving landscape. Only 9 percent of the RIAs surveyed cited changing pricing structure as a strategic focus for their firm. With median revenue down to 69 bps, organic growth at its lowest level in the last five years (6.7 percent), and an aging client base, Fidelity says this lack of focus on pricing could prove costly. The study recommends advisors overcome pricing inertia, focus on transparency and align pricing with values. “We’re seeing a collision of changing investor preferences, technologies and regulations in the wealth management industry that will require advisors to consider fresh pricing formulas to remain competitive,” said David Canter, executive vice president of Fidelity Clearing & Custody Solutions. “By adopting technology and deploying the science of segmentation, advisors may be able to adjust their pricing while also increasing their ability to serve a broader group of clients.”

What HNW Investors Value the Most

It's not their wealth, but rather their health, according to InsuranceNewsNet. The 2016 U.S. Trust Wealth and Worth Survey found that 98 percent of high net worth investors claim the most valuable asset to have is their health. Financial advisors can help steer them in the right direction when it comes to insurance and costs, specifically regarding travel coverage, insurance against injury or wrongful termination suits from their private staff, and personal excess liability insurance. For a fulfilling life, the survey found that investors also listed wealth—amassing it and protecting it—family, philanthropy and impact investing as main motivators.

Want The Daily Brief delivered directly to your inbox? Sign up for WealthManagement.com's Morning Memo newsletter.