Robo advisor Wealthfront launched free financial planning in its application Tuesday, beating the deadline it set for itself when it announced the offering in October.

Now, investors can use the online service to begin creating a financial plan through the tracking of their assets in Wealthfront’s Path service. While most millennials will probably do this through the company’s mobile applications for the Apple and Android operating systems, it also works on a desktop web interface.

Central to the application’s planning engine is account aggregation, which appears to be similar to the service previously available only to those that had opened and funded an investment or retirement account. Those earlier iterations of Path used third-party aggregator Quovo for account aggregation.

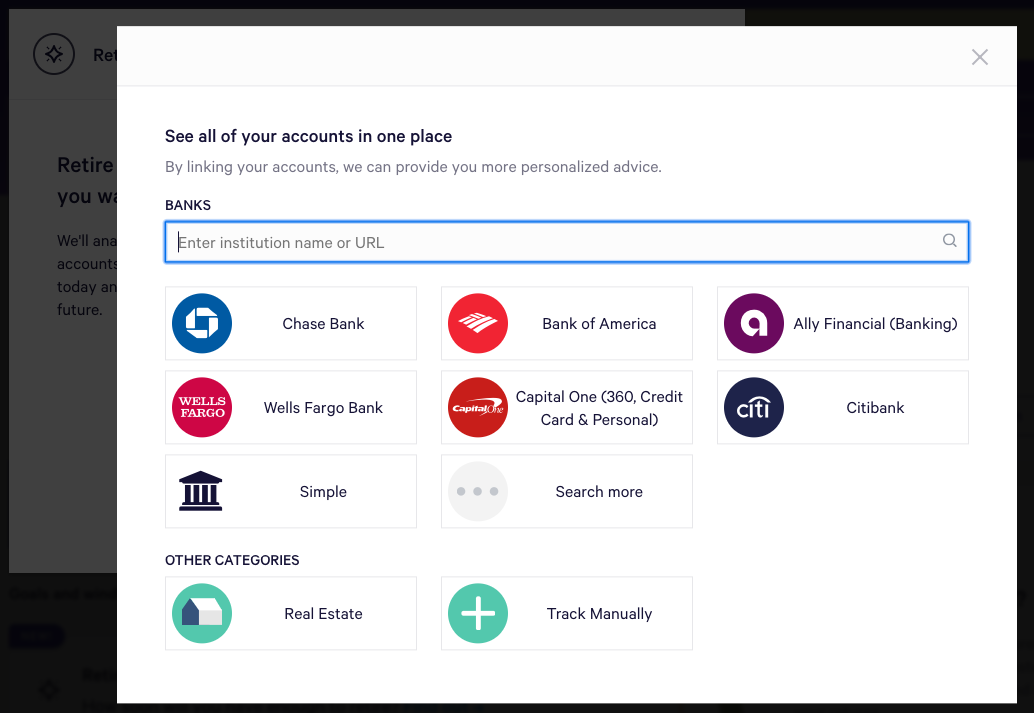

While those using Wealthfront's newly free Path planning engine can enter their financial account and asset information manually results will likely be far more accurate when the user takes advantage of the robo advisor's more automated account aggregation features (shown above).

With the new free service, those setting up an account can choose to enter accounts manually if they don’t have or want to share their actual held-away account details; however, that will likely result in less accurate planning results and projections (unless they have their account statements with values right in front of them).