Automated investment service Wealthfront, with $11 billion in assets under management, is officially adding a new offering, Time Off for travel, as part of its larger goals-based planning service, Path. This latest offering is in response to demand from its client base. As first reported by WealthManagement.com, the company’s CEO, Andy Rachleff, previously announced the development of Time Off in June.

This scenario-based financial planing opportunity is available alongside others, such as college savings for children, homeownership, and retirement, life-event changes that Wealthfront is attempting to plan for using software. The firm is addressing what they describe as an aspirational gap in financial planning: no longer is the American dream as simple as get married, buy a home, raise a family, and retire, as previous generations may have defined success. Today’s young adults consistently ranked taking time off for travel as a top life priority, behind only “achieving financial freedom” and “retiring comfortably and/or early,” according to Wealthfront.

“The Millennial generation is completely blowing up our parents’ definition of ‘The American Dream,’” said Dan Carroll, Wealthfront co-founder in a statement. “Life is no longer linear and work is no longer 9-to-5. We prefer collecting experiences to collecting assets, and retirement is no longer the ultimate goal.”

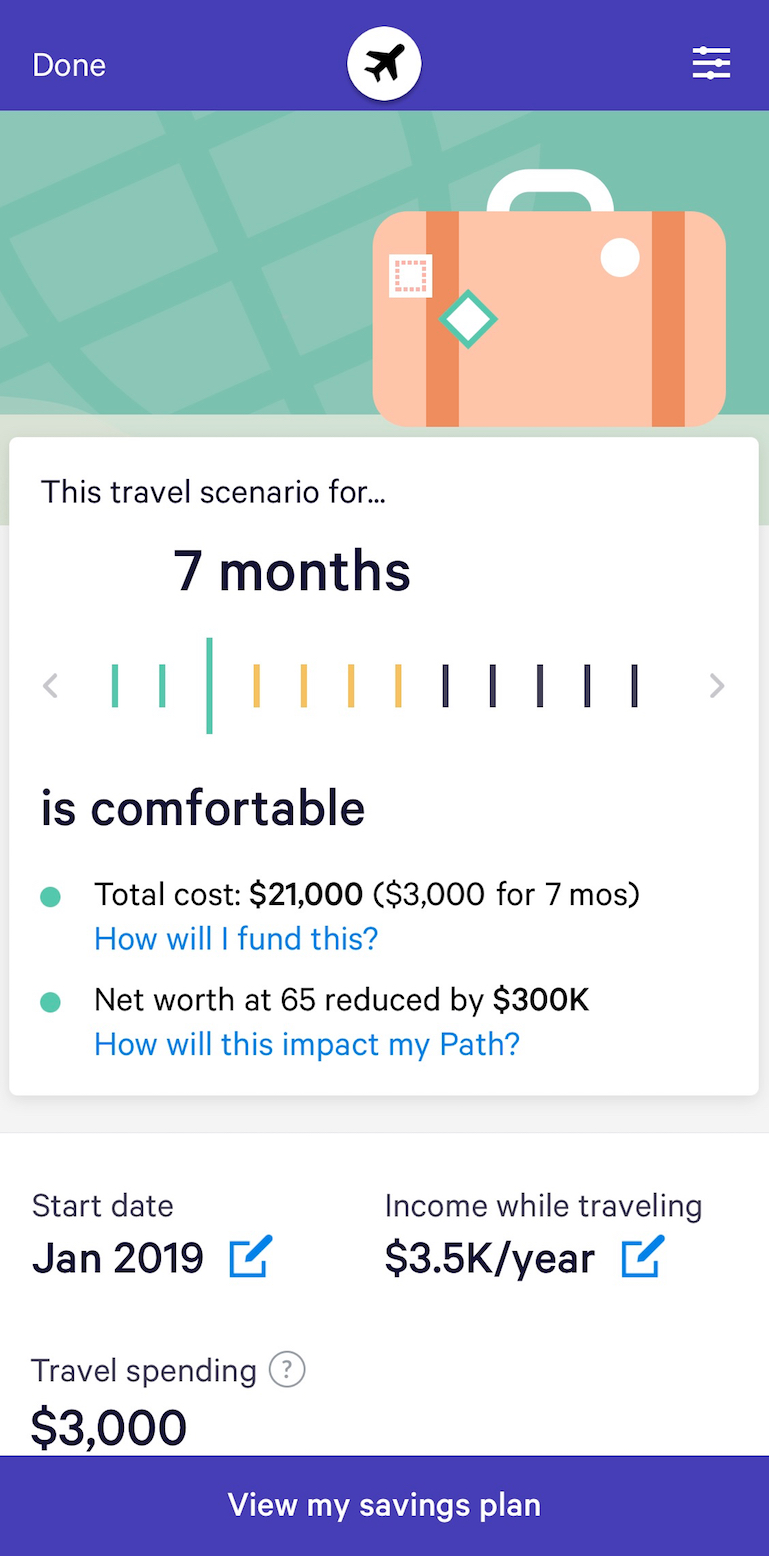

Wealthfront's new service, Time Off for Travel

Investors who present the firm with their overall financial picture, by linking their income along with financial accounts from both inside and outside Wealthfront, will receive the most nuanced results. The new tool is included with Path and helps investors decide if they can even afford time off: showing the financial impact of reduced income can have on retirement, college savings, and home purchase plans. Investors can evaluate the affordability of different budgets and the length of their travels by modifying housing plans and accounting for possible income while on the road. “Our whole concept with our financial planning is allowing clients to play to learn,” said Kate Wauck, head of Communications, referring to how clients using the product can adjust inputs to see how they will affect the results.

Although it could be tempting to use the tool for other purposes, like evaluating the impact of varying types of income interruptions, such as taking time off to raise children or to care for an aging parent, the tool is not designed for that, said Wauck, although plans for tools like that could be in store for the future. “Keep in mind we’re always launching new services,” she said.