Clients of UBS Wealth Management USA have access to a new iPad app, designed to streamline information gathering about the client’s goals, relationships and assets, while also providing insights and education to users. The app, which was one of the first projects at the bank to utilize Silicon Valley’s commonly employed iterative design strategy, instead of the slower, more traditional “waterfall” strategy, is meant to facilitate client conversations with advisors and provide clients with information and actionable objectives, according to the team behind the product.

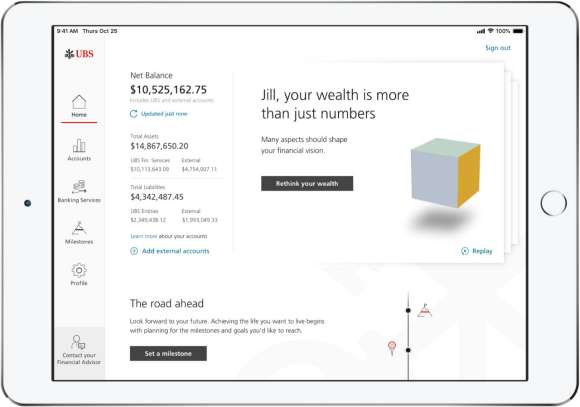

The app borrows a number of concepts from consumer-based apps, like creating a user profile and swiping between screens. Upon signing in, clients are asked to calibrate their experience by indicating what their financial motivations are, who else their wealth strategies might affect, what goals they have on the horizon and how much they expect those goals to cost, what UBS-held and external accounts they have, as well as what external professional relationships, such as accountants or lawyers, they have that could be related to their wealth profile.

That data is then pushed to the client’s advisor—one of UBS’s roughly 6,800—and as they fill in information, those same advisors receive daily and weekly email summaries. The client experience is the first step; a separate team is building out a corresponding advisor product.

Prior to this app, UBS’s first foray into an app designed specifically for a tablet, clients were accessing their wealth management information through a web-based portal, said Kraleigh Woodford, head of digital client experience at UBS Wealth Management USA. Some 20% of its users were already using a tablet to access the firm’s web portal. Woodford expects the client experience to be translated to an iPhone app next, followed by an update of the web portal and eventually an Android-based app.

“We want it to feel like a museum experience,” explained TJ Lim, the app’s chief product owner. “We were purposely looking for outside thinking,” including elements of high-end retail.

Some of the manifestations of that thinking may seem fairly intuitive for those used to consumer-focused apps, but are slowly becoming more common in financial services. The app has very few numbers and the top line figure is a client’s aggregated net worth, not the assets held at UBS, which is more in line with how clients understand their wealth, said Lim. “We know that clients have multiple accounts,” he added. UBS uses Yodlee for account aggregation.

Other features include a timeline with goals, called “milestones,” that are connected to an estimated cost and who would be affected by the goal. College savings goals for children, for example, show up next to plans for large purchases and international vacations. Digital wealth strategies are not built around the goals, however. Instead, the goals are fed to advisors, who can use them as conversation points. Clients can access advisor contact information with a few taps, and plans for a live chat or videocall feature are under consideration, said Woodford.

UBS Advice Advantage, the firm’s advisor-enabled digital advice feature that was designed by SigFig, is not currently included within the app, but there are plans for its integration. Advice Advantage was recently made available for all UBS financial advisors, not just at the UBS Wealth Advice Center, which operates two teams of remote financial advisors.

Common banking functions, like sending money and paying bills, are also incorporated into the app. Users will also see insights and content related to information the client has supplied to the app.

While a wealth management iPad app with a strong focus on client experience isn’t groundbreaking, the approach used in designing and building the app is relatively new territory for large institutions like UBS. Last year, Charles Schwab’s Andrew Salesky, head of advisory technology, also cited a switch from a traditional “waterfall” design strategy to more agile design and development. A recent survey found that HNW individuals are particularly demanding about the look and feel of their wealth management apps.

As users come to expect faster software development in the consumer sector, they’re taking notice of which financial services companies meet their expectations. Design professionals at leading fintech companies, large and small, point out that speed and providing users with products that work, rather than hitting a checklist of features that executives want to force onto users, are key to customer satisfaction.