Serial entrepreneur Rob Foregger, best known as co-founder of Personal Capital and NextCapital, has a new gig: He and a couple of partners intend to create new approaches to smart beta-based direct indexing and help make existing direct indexing providers even better.

In his latest endeavor, Foregger and friend and business partner Jim MacIntyre along with their technology accelerator, Product Lab, announced this week a strategic partnership with MarketGrader, the fundamentals-based equity research and analysis platform and index provider founded by Carlos Diez.

“With this partnership we are building the next generation of smart beta and index investing,” said Diez.

In a nutshell, the partnership will oversee the design and development of direct indexing portfolio management capabilities and self-service index construction tools. MarketGrader has built some 52 smart beta indexes, based on its research methodology. Foregger and MacIntyre will help MarketGrader turn it into a smart beta-based direct indexing tool, one that could also be plugged into the direct indexing product of, say, a Schwab, for example.

The new direct indexing tool would allow advisors to create customizations within MarketGrader’s smart beta indexes, including customizations around client values, equity concentration and tax needs.

“What we are building is just taking the rating, classification framework that is already built and is easily consumable by advisors but will have this Smart Beta tilt to them—they [advisors and investors] will be a lot more disciplined than just owning the top performing stocks,” said Foregger.

Foregger likened the undertaking to the evolution of streaming platforms: “It was hot and sexy to build the platforms, but you next had to keep those platforms filled with content,” he said.

“Carlos has built the content, a fundamental scoring and grading of the entire stock market that is scalable across the globe, monitored and updated daily that you can produce portfolios based on, and that over time can create alpha based on ever more systematic stock selection,” said Foregger.

To date Foregger is known to many advisors as the co-founder of two digital advice businesses—Personal Capital and NextCapital—as well as online bank everbank.com.

Everbank was acquired by TIAA for $2.5 billion in 2017, Personal Capital by Empower Retirement (the No. 2 player in the retirement plan record-keeper space behind Fidelity) for $1 billion in June 2020, and NextCapital was bought by Goldman Sachs for an undisclosed sum in August 2022.

He joined Product La, LLC, which was founded in 2009, as a partner in 2022. The technology accelerator, he said, helped support the open source database startup FoundationDB, which in 2015 was acquired by Apple.

MacIntyre is a software and e-commerce entrepreneur, having co-founded Visual Sciences and several other software companies, in addition to serving as chief of e-commerce technology for GSI Commerce.

MarketGrader was founded in 1999 and launched the first version of its autonomous research platform, which covered 6,000 North American companies, in 2003. That same year it launched its first index as well, the MarketGrader 40.

Today, the company has three core business lines that include equity ratings, index licensing to asset managers and fund sponsors, and the direct indexing service it is building out. Its clients have included BMO, Dow Jones, SS&C ALPS and VanEck.

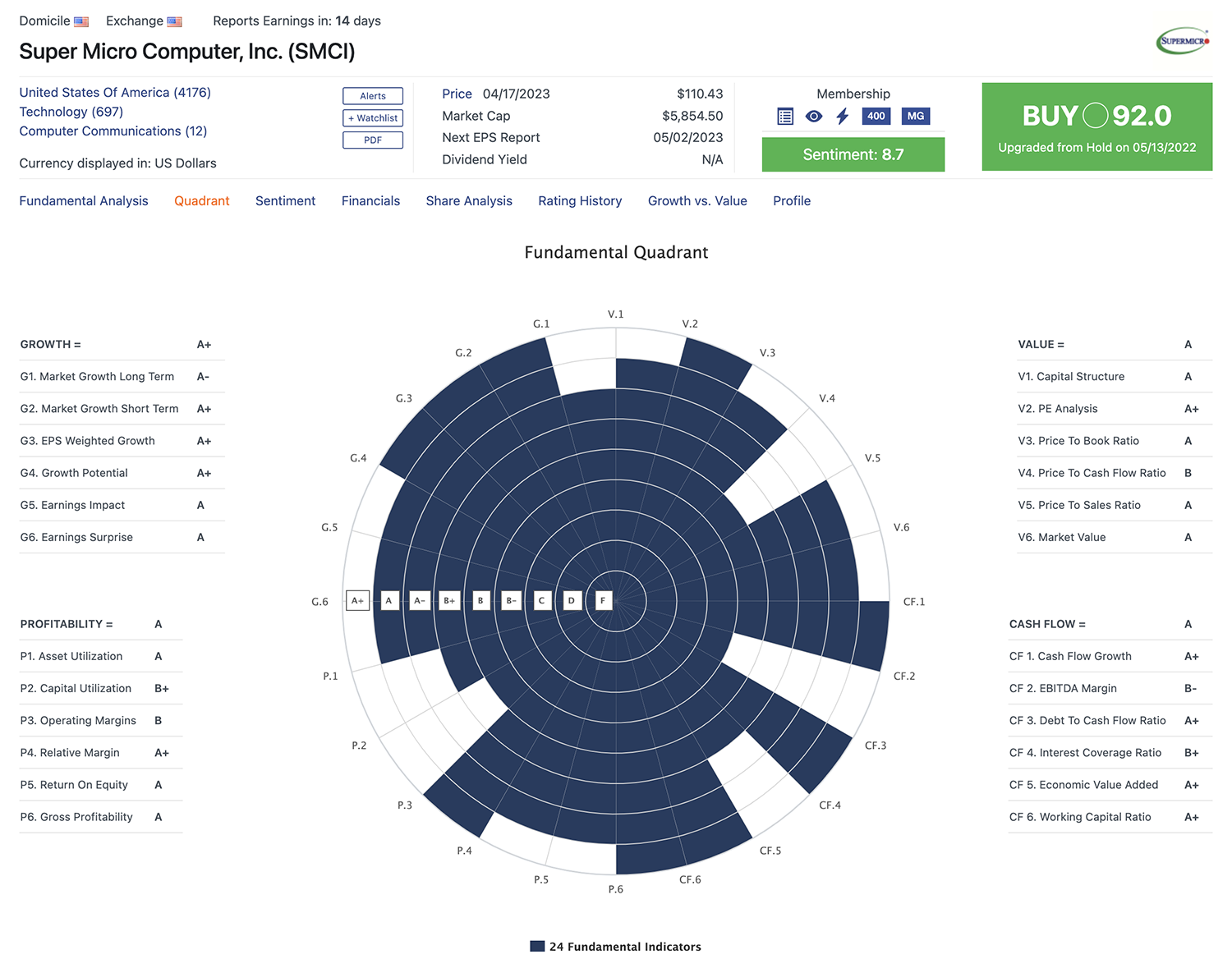

The MarketGrader platform today covers a global list of 41,000 public companies whose ratings are updated nightly based on 24 fundamental indicators, which fall into four categories: growth, value, profitability and cash flow, and is referred to as growth-at-a-reasonable price or GARP.

Diez said that 50% of MarketGrader’s diverse user base is made up of financial advisors and noted that a focus on fundamentals can put a spotlight on factors that can be overlooked when picking investments.

“When building portfolios, what to exclude is almost as important as what to include,” said Diez.

“We know Parametric and others are doing a great job with tax management—there is a ton of value being added there—but we are focusing on the Smart Beta IP, and that is something that is not competitive with but additive to much of what is available,” said Foregger referring to other direct indexing products already on the market that could benefit from integrating with MarketGrader.

“We are agnostic as to platform,” Diez said referring to being able to support integrations with other industry providers.

Competition in the direct indexing space has heated up over the last several years, and the technology is still little understood by advisors and even technologists. Despite that, Foregger said there is massive growth potential in the space.

Market research firm Cerulli, in its second annual report on direct indexing, estimates that assets flowing into the space will grow at an annualized rate of 12.3% over the next five years and exceed $800 billion by 2026. That is faster than ETFs, mutual funds, or retail separate accounts; and Cerulli also expects direct indexing to make up 33% of the retail separate account market by 2026.

Foregger and MacIntyre have taken a minority stake in MarketGrader and will be joining its board of directors.