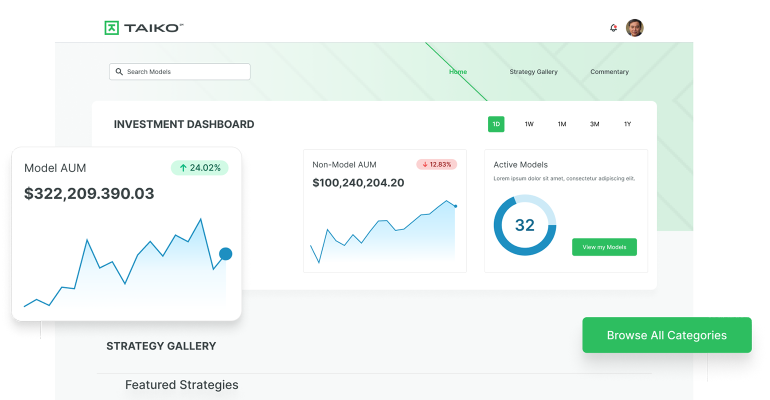

Taiko, an outsourced chief investment officer service for financial advisors, debuted its Strategy Gallery feature, “a platform upgrade that efficiently sources investment solutions for advisors,” according to the announcement this week.

The move comes just a few months after independent investment consulting firm Taiber Kosmala & Associates launched Taiko in November 2022.

Chris Horvath, a managing director at Taiber, said they currently work with 11 independent RIA firms ranging in size from standalone advisories with one to three advisors to multi-billion-dollar RIAs that have upwards of 100 to 120 spread across the country.

William Trout, director of wealth management at Javelin Strategy & Research, said regulatory pressure and the need to scale advice delivery are driving interest in the OCIO model among RIAs.

Taiko's new Strategy Gallery provides access to "exclusive" alternative investments, in addition to a wide range of separately managed accounts and custom portfolio strategies, said Horvath.

“That’s including custom models that are being collaborated on with the RIA and their investment team. And there’s a lineup of SMAs that we’ve done all the due diligence for,” he said. “A lot of these managers, we’ve had existing relationships with on the institutional side.”

Unlike a model marketplace, Horvath said, the goal was not to provide an overwhelming number of choices for advisors.

“We’re keeping it very simple and selecting managers that work well together too,” said Horvath. “They stay in their own lane in terms of asset classes.”

Servicing the growing call for alternative investments, especially among high-net-worth clients, was also a priority, he said.

“Any time there’s market volatility, that’s going to increase the interest and the overall need for alternative investments within portfolios and it also lets advisors provide a more personalized investment experience with their clients,” said Horvath. “Our intention … here is to have advisors feel empowered and understand that they have a team behind them to offer that scale and that confidence in incorporating alternative investments into client portfolios.”

Horvath said they had already rolled this feature out to their existing clients, many of whom are already collaborating with them to create specialized investment portfolios.

“That might be different model series that contain SMAs. Some might be more passive. Some might have more of an active/passive blend in their investment approach. They can view and source their own custom strategies in their gallery,” said Horvath.

While Javelin's Trout said he could not comment specifically on Taiko's new Gallery, he did note some of the advantages the OCIO model can provide.

“Outsourcing investment management does not eliminate fiduciary obligations for the advisor, it does put in place clean and transparent processes for asset allocation, manager selection and other key investments functions—it functions as a kind of safety net,” said Trout.

At the same time, Trout said, in shifting advisor attention from tactical activities related to portfolio implementation, the OCIO model helps the advisor to focus on higher-level, more powerful functions like financial planning.

“This more strategic approach to relationship management reinforces the value proposition of the financial advisor and helps deflect pressure on pricing," said Trout.

He said It also enables the advisor to respond more nimbly to shifting demographic trends and help them capture the "money in motion" generated by retirement and wealth transfer.

“Ultimately, the embrace of turnkey platforms like Taiko points to the increasing recognition among advisors that their value centers on the delivery of personalized advice to the client, and not trading or the pushing of buttons and levers," said Trout.

Looking ahead, the dollars served by OCIOs will increasingly flow from RIAs, said Trout, and even to smaller shops in particular, even as pension funds, endowments and other institutional entities continue to avail themselves of the support provided by OCIOs.

"The profile of the OCIO channel is being slowly redefined," Trout said.