Salesforce revealed the first of its planned industry-specific products on Tuesday with Salesforce Financial Services Cloud, a new enterprise product that seeks to be a “one-stop shop” for financial advisors.

Financial Services Cloud aims to combine tools such as calendar notifications, portfolio rebalancing, financial planning and client communication into a single, cloud-based portal. Like similar products from TD Ameritrade and eMoney, Salesforce says Financial Services Cloud will help advisors build deeper relationships with each client and increase their productivity.

“[We’re] putting all of our weight, our whole shoulder, behind wealth management,” said Simon Mulcahy, Salesforce’s senior vice president and general manager of Financial Services. “We think we can fundamentally transform this whole industry.”

But Salesforce has received mixed reactions from the financial services industry in the past and some think the new product could conflict with its existing business model.

“Salesforce is playing a huge game of chicken with their resellers, custodian and independent broker/dealer partners and anyone else who has integrated Salesforce," says Timothy Welsh, the president and founder of Nexus Strategy. He notes that the new product has the potential to create conflicts within the independent channel. “They must foresee a huge market here, which is a great validation for the independent advisor marketplace. Software is hot and it is definitely a major move."

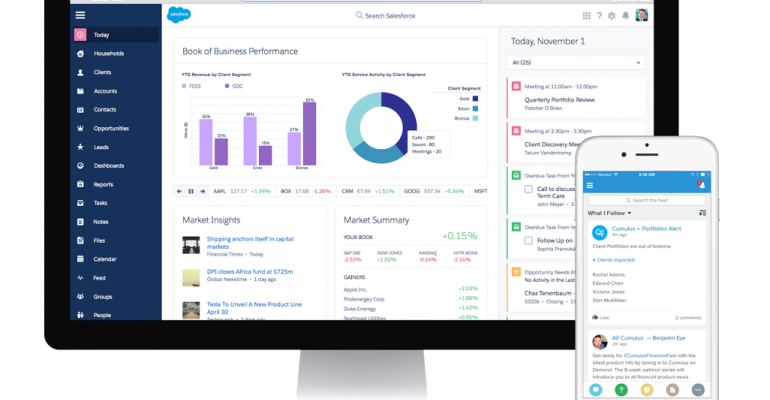

The Financial Services Cloud's home page features a visual summary of the assets under management, market analysis and relevant news articles, as well as a feed automatically populated with tasks, alerts and opportunities for the advisor. Salesforce calls this the Assistant and said it prioritizes important events.

Advisors can view their entire book of business on one page and filter clients by asset level, location, portfolio needs, and even interests like “golfing” or “sailing.” For example, advisors can use the tool to quickly breakdown which of their clients live in a certain area and enjoy golfing to organize a trip using the Communities tool built into the page. Or they can select the portfolios that need rebalancing and complete the task in one click.

Additionally, Financial Services Cloud provides detailed portfolios views for each client, along with “tear-sheets” that include name, client interests, and recent lifestyle events. These can be accessed on a mobile device and are printable and shareable.

'Opportunity Workflow'

Using the data aggregator tool Yodlee, which was recently purchased by Envestnet, Salesforce's Financial Services Cloud also can display account information from more than 14,000 sources to give advisors a more complete view of clients’ financial information, including held-away assets. Financial Service Cloud has a function to create an immediate “opportunity workflow” to access those assets.

The new platform features a relationship feature, which shows an advisor’s interactions with every family member and even third-party professionals like lawyers and CPAs. And Financial Services Cloud has goals-based planning tool that can be used with clients. The goal with these features is to help advisors take advantage of the upcoming generational wealth transfer.

Salesforce designed their new product with client engagement in mind. The Financial Services Cloud was built so that advisors can message, poll, or send documents to a client, group of clients, and other members of the firm with ease. Messages can be written and received on a mobile device to provide advice at any time without the need to schedule a quarterly meeting. Mulcahy said this can work within a big firm's existing mobile strategy, and can be a solution for smaller firms without a current mobile strategy.

“This is an industry that is a bunch of 55 year-old men serving a bunch of 55-year-old men,” Mulcahy said at a press event demonstrating the technology, adding that current advisor technology is not built to handle the expected wealth transfer to the next generation. “Women investors are completely underserved; millennials are completely underserved; Gen Xers are served, but with old technology. And baby boomers, in all of our research, want what the millennials have.”

Salesforce will initially run a small pilot program of Financial Services Cloud with a select group of advisors. The final public release is scheduled for February 2016.

Gregory Gardner, an advisor with The Gardner Group in Dallas, currently uses Salesforce as his firm’s CRM, as well as eMoney for financial planning, and Adhesion for trading. He said he would be interested in a single portal to access all of it, but hopes they are able to improve from their current financial services products, namely their document and email templates, as he didn't find Salesforce's previous financial services products to be appealing.

'By Far The Best'

“Their first shot at [financial services] was very unimpressive,” Gardner said, adding that his firm chose Salesforce as it “by far the best” at integrating with other programs. “Salesforce, the company, does not have a very good reputation in our industry. Salesforce the software product does.”

Salesforce seems to have taken this into consideration, and worked with wealth management firms like AIG Advisor Group, Northern Trust and United Capital to design its new product. The company worked with Advisor Software to provide a rebalancing function capable of handling thousands of clients from thousands of advisors, and Informatica to connect Financial Services Cloud with asset management, portfolio management, risk and trust operations. Accenture, Deloitte, PwC, and Silverline also partnered with Salesforce to help develop the product.

Joel Bruckenstein, a financial technology analyst and founder of the Technology Tools for Today conferences, said that while some of these new in-house solutions offered through the Financial Services Cloud are scalable and already integrated with Salesforce, they might not be the most powerful options in the industry. And it’s anyone guess as to what this means for Yodlee and its deal with Envestnet, as Financial Services Cloud appears to compete with Envestnet's Tamarac platform.

“All of these things are primarily speculation at this point, but this is the first time they’ve done something industry-specific and they’ve definitely identified an opportunity,” Bruckenstein said. “Whether or not they can cash in on it remains to be seen.”

Pricing for Financial Services Cloud is unknown at this point, but other, more advisor-focused CRM companies currently beat Salesforce when it comes to cost, according to Bruckenstein. A version of Salesforce tailored to advisors pre-loaded with tools could make it more attractive.

Welsh called Salesforce’s strategy “dubious,” saying it threatens to compete with part of its current sales pipeline. Keith Block, the president and vice chairman of Salesforce, said in a recent earnings call where the company hinted that a product would launch by the end of August, that the company has considered this.

“Over the last few years, we have been very carefully and very slowly moving to more and more of a vertical orientation,” Block said, adding that Salesforce is also targeting healthcare and life sciences. “So we've done this very carefully and very thoughtfully, and it's really paying out in our results.”

Salesforce also becomes another entry to the market in the battle for control over the advisor desktop, and could mean that the company is trying to do too many things at once.

“You can’t be all things to all people. When you bundle applications like this into one, you end up programming for the least common denominator and end up being nothing to everybody,” Welsh said. “History has shown time and time again, that the more you bundle something, the more advisors want to un-bundle your bundle.”