The conventional wisdom on automated investing platforms revolves around getting an advisor's hooks into millennials, the generation that loves technology, distrusts the financial industry, and has accounts too small to advise efficiently without the robo. Once they get older, like other wealthier clients, they will always prefer a human touch.

That may be another industry myth. According to a study from Jefferson National, 49 percent of robo-using advisors say they have boomers on the platform. The same percentage use it for millenials. Seven out of ten use it for Gen X clients.

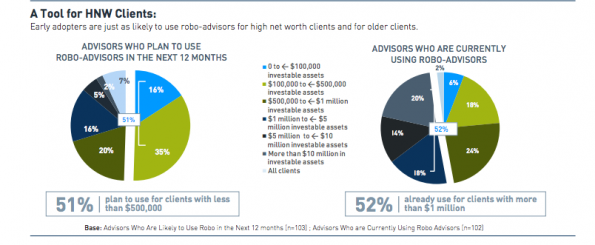

The study also found that 52 percent of advisors who use a robo use it most often for clients with at least $1 million in investable assets. Twenty percent use it most often for clients with more than $10 million.

“The most successful advisors—those who earn more and manage more assets—are forward thinkers and early adopters when it comes to using technology, including robo-advisors,” says Mitchell Caplan, CEO of Jefferson National.

Greg Meyer, the founder of New Wave Financial Services in Los Angeles, said he uses robo technology to serve clients ranging from their early 20s to their mid 50s, though most of his clients work in the tech industry.

“Larger clients will usually have other complimentary assets (hedge funds, private equity, real estate, etc.), but the core stock/bond allocation can be easily accomplished with a robo,” Meyer said in an email. That helps him run the growing practice without the immediate need to hire more staff.

While the robos would agree that their platforms could handle large accounts, the age data doesn’t really match how these services market themselves. Wealthfront, which has no advisor platform, said 90 percent of their customers are younger than 50, though its oldest client is over 90. Betterment said that between its retail and advisor businesses, only 25 percent are older than 50.

The data could be skewed by polling advisors who maintain account minimums and use the platform just as a part of their service for high-net-worth clients, or services like Vanguard Personal Advisor, a tool targeted at clients nearing or already in retirement, which is often called a “robo” despite not being a fully automated service.

Kyle Ryan, head of advisory services at Personal Capital, said the majority of his firms clients tend to be in their 30s, 40s and 50s, but have complicated finances that are beyond the power of a robo.

“Our clients want innovative technology and a great user experience but they also want the ability to talk to an expert and develop a financial strategy and plan,” Ryan said. Personal Capital has human advisors on staff available to clients.

This human/robo hybrid is becoming more common, said Caplan, and the research shows adding a robo makes a practice more efficient, yet only 19 percent of advisors use the automated investment platforms, and only 15 percent plan to implement one next year.

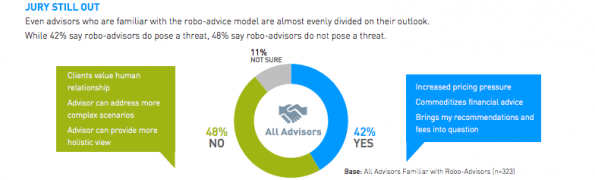

One reason for the relatively slow adoption is that 48 percent still see it as a threat.

Another reason may just be inertia. A recent report from Charles Schwab found that it was a “time of abundance” for RIAs; Fat and happy advisors don't see the need to invest the time and money neccessary to integrate a robo solution. Or, Ziemer said, advisors could just be waiting for dust to settle from the battle between various robo-advisors.

“Every company is coming out with their own solutions and products,” Ziemer said. “I think there are a lot of people waiting to see how things shake out, what [the market] is going to look like with pricing, etc. A large set of firms want to see the market before they pick one of them.”