Business-to-consumer automated advice platform, or so-called robo advisor, and asset management platform OpenInvest is launching a new tool for financial advisors to model separately managed accounts (SMAs) tailored to individual clients’ environmental, social and governance (ESG) preferences, according to the company. The service, called Optimus, provides advisors with a set of models based around themes like sustainability or human rights, as well as allowing advisors to serve as de facto direct indexing asset managers, providing tools for customizing clients’ holdings while measuring them against market benchmarks.

OpenInvest’s Optimus focuses on ESG solutions because of the values of the company, and as a solution to the plethora of ESG-focused funds littering the investing landscape, said co-founder and CSO Josh Levin. “When you get down to [social] values, it fundamentally stresses the ETF paradigm,” he explained. Because individuals’ values differ from person to person, a tool supporting direct indexing, like Optimus, is best suited for advisors wanting to provide that service to their clients, he added. The platform incorporates around 15 data sources on ESG factors.

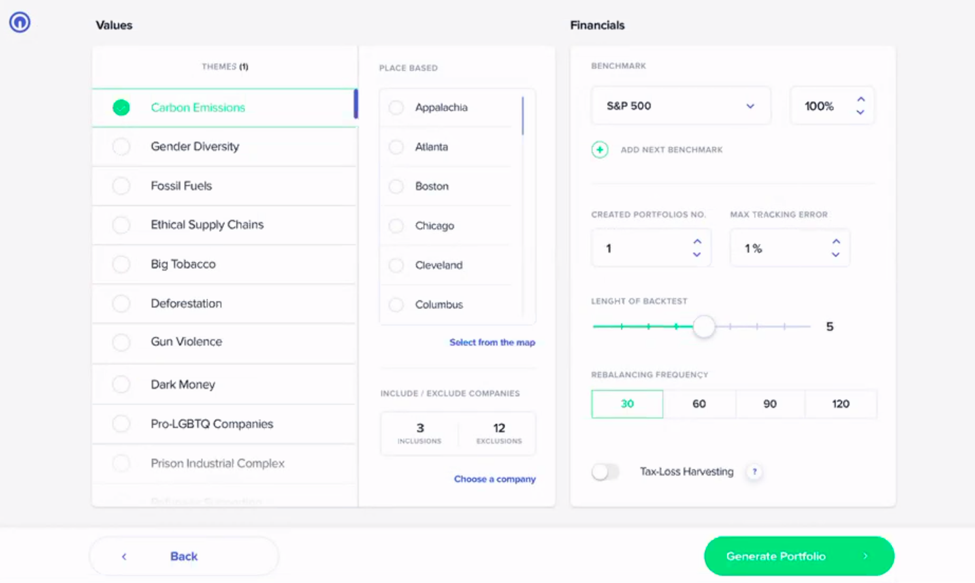

(From left to right) Advisors can start with a default model, include and exclude particular companies, or focus on a subcategory, like a geographic region, and then set the market benchmark to measure against, the degree of tracking error that can be tolerated and the frequency of rebalancing.

Models can be created by the advisor and should a client not want a certain polemic equity, such as a particular tech company or an airline, that stock can be removed and OpenInvest’s software will replace it with a correlated stock. Tracking error can be adjusted and within two months, the plan is to allow advisors to customize the benchmarks against which they track portfolio performance, said Levin. “We want to handle everything on a rules level,” he added. “In a sense, what we’re doing is taking something that’s been available to high-net-worth clients and bringing it down to mass market.” Currently the platform has “built in the most commonly requested benchmarks,” like the S&P 500 Index, Russell 1000 Index and MSCI World Index, noted Claire Veuthey, director of ESG + Impact at the firm, but it can “offer any benchmark.”

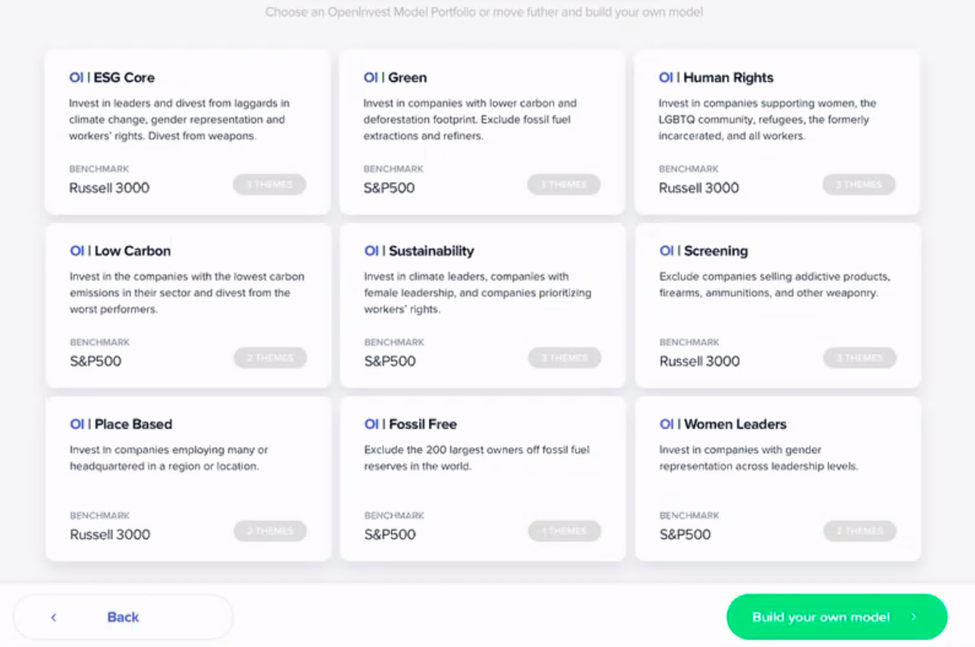

Pre-populated modeling themes

Direct indexing has gained in profile recently, with industry commentators calling it “the next $100 billion advisor opportunity.” ESG investing has also been gaining steam, to the tune of $502 billion globally, with the phenomenon being credited for everything from managing volatility to convincing millennials to invest.

The tool, which starts at a 40-basis-points fee, is primarily intended for registered investment advisors, but it will integrate with popular portfolio management systems and can send trade instructions to trading desks. There are currently integrations with Charles Schwab, Apex and Interactive Brokers. OpenInvest is adding a Fidelity integration in a few weeks and will have Envestnet integration over the summer.

“The future is very bright for financial advisors,” said Levin. “That’s why asset managers are racing downstream. Advisors are going to replace asset managers.”