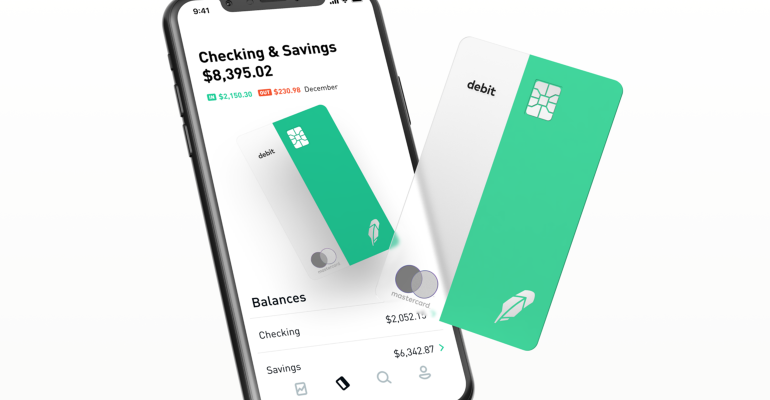

Financial technology and wealth management grew one step closer to the world of banking today, with the launch of “Robinhood Checking & Savings,” a brokerage account that earns 3 percent interest. The no-fee trading platform partners with Sutton Bank to issue a linked debit card, and cash in the account is insured up to $250,000 by the Securities Investor Protection Corporation, according to the firm.

The announcement comes a day after platform users angrily took to social media as accounts were shut down and options trades failed. The firm has made no secret about its intent to go public and has been on a tear in 2018, launching crypto support, options trading, a number of foreign-listed stocks and seeing its valuation surpass $5 billion.

Free trading has grown in popularity, with JPMorgan Chase launching its own free and discounted trading platform, You Invest. Square has also considered competing with Robinhood as it explores morphing into a bank-like company.

Robinhood will roll out the new feature in January 2019.