Merrill Lynch has quietly rolled out yet another major chunk of technology that will, at least initially, most benefit the 15,000 advisors in its Thundering Herd, along with their clients and the firm’s client associates.

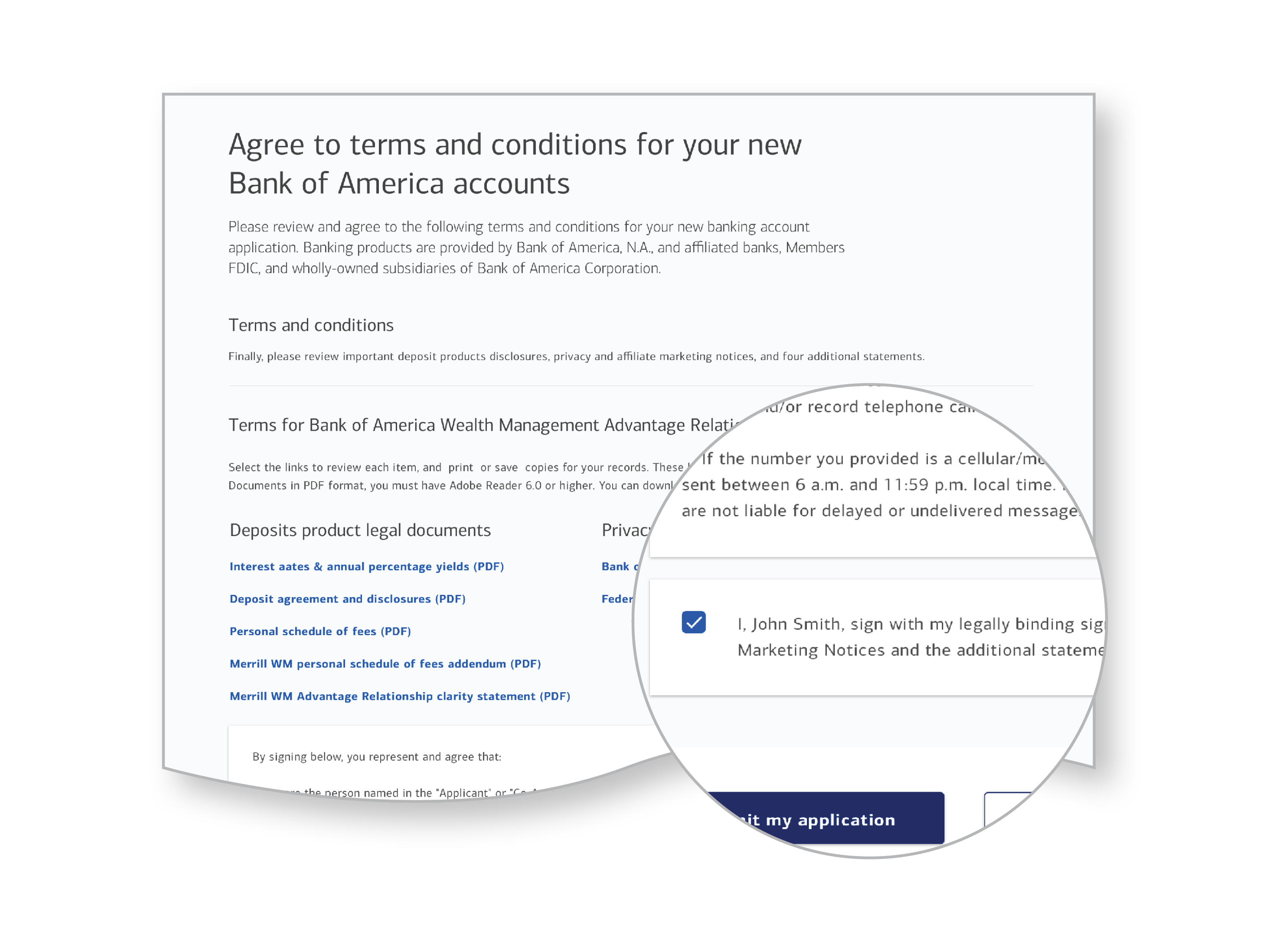

The Collaborative On-Boarding Experience, or COBE for short, streamlines and fully digitizes the client account opening and onboarding experience (no more wet signatures needed).

COBE’s overall development has been a years-long journey with more than 20,000 users across the country granted access to it since mid-April. Prior to that it had been in pilot with approximately 2,000 users beginning in mid-2020.

What was once routinely a paper-based, week-or-longer process can now be completed in minutes if collaborating with a prospect or client, according to the firm.

Similarly, in the case where a customer has at least a single account with the firm, a client associate should be able to open multiple other accounts on the client’s behalf, if requested, without having to bother the client for little in the way of initial data. And this means being able to open and manage accounts across the various wealth management groups within Merrill Lynch and, eventually, across banking services at Bank of America.

“This one is one of the toughest nuts to crack,” said Kabir Sethi, head of digital wealth management for Bank of America, Merrill Lynch.

“Taking that legacy process we have and digitizing it end to end where there can be multiple accounts is extremely hard—there is a lot of friction to work through,” he said, noting that the ultimate goal is to use this as an enterprise platform across the entire wealth business, digitizing workflows and integrating banking as well as the brokerage, ultimately eliminating forms (paper and digital). By year's end he said 80% of all wealth management account types should be available within COBE.

“Clients can be completely hands off if they want and let the advisor and client associates do everything based on previous accounts, or the client can be far more involved in a collaborative process,” said Sethi.

A major aspect of COBE that might go unnoticed by many is how it combines the client confirming their identity (“know your client” regulations) during onboarding, something that used to be two separate actions.

“Anytime in this process we have the ability to send a request to the client [or prospect] to collaborate,” said Georgio Vuolde, who heads wealth management digital onboarding for Merrill and led an online demonstration of COBE.

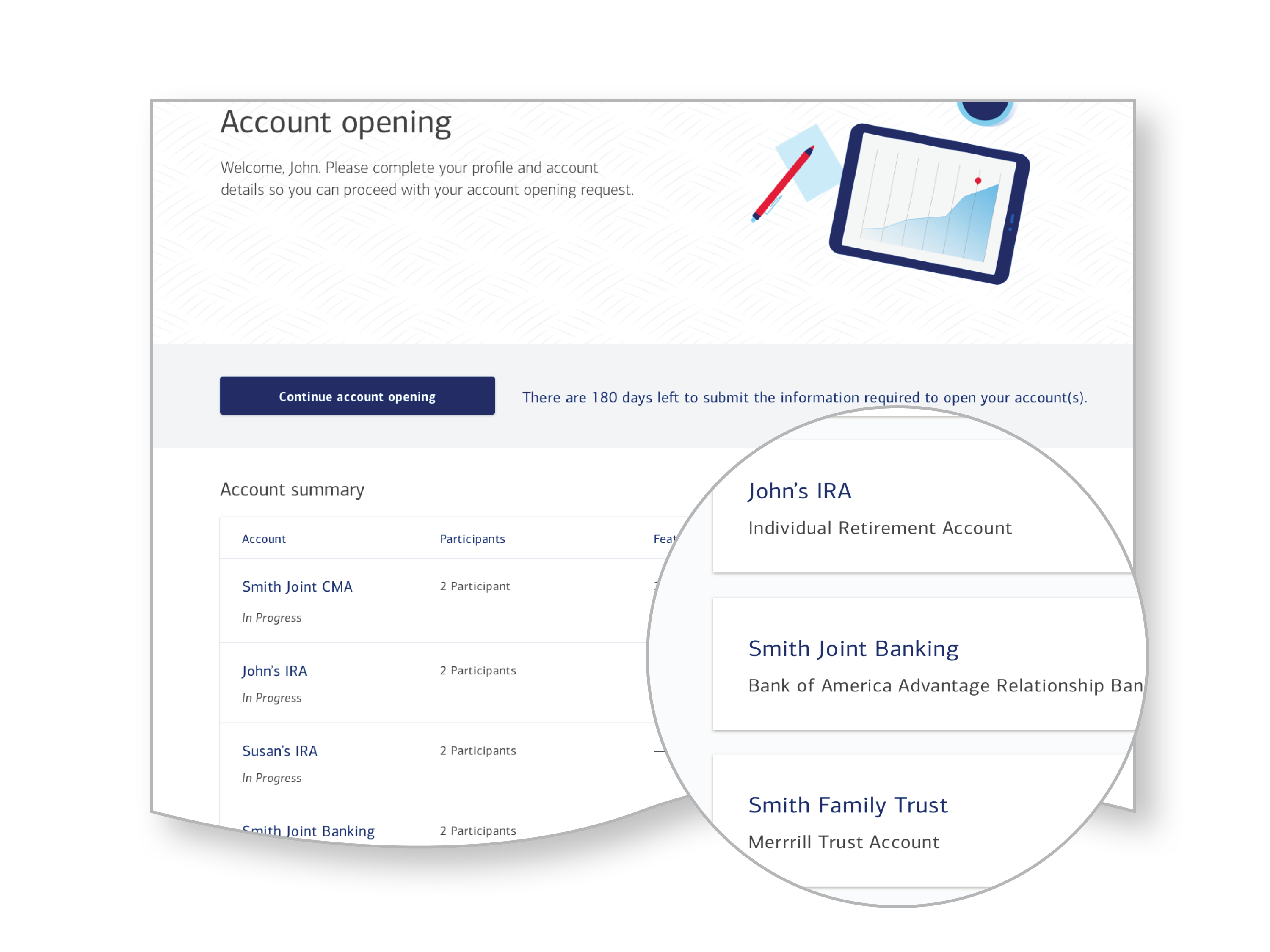

During the demo, he showed a hypothetical couple with one brokerage account who, having recently met with an advisor, now wanted to open five other accounts with the firm, including a CMA account, IRA, joint banking account and a custodial account.

Posing as a client associate, Vuolde easily picked the account types from a menu and was able to ‘bundle’ them into a single account opening process. This automated workflow allowed the user managing the procedure to easily answer what they could with existing data or information and initiate a request to collaborate with the client for anything missing.

Carrying out the same operation years ago would have required a stack of paperwork mailed or messengered to the client full of sticky notes indicating the need for additional information or signatures. While more recent digital iterations had simplified that process, it was often still siloed and form-based (even if digital).

At the end of the action, the client associate (or other staffer) sees a playback, summarizing everything completed thus far.

Collaboration requests can originate with advisors or client associates who may need additional information or who know that the client wants to be more involved.

Initiating such collaboration simply requires a message to clients via their designated email address or through the platform if they are logged in. Also important is that clients will now have a single ID across their wealth, brokerage and banking accounts. Staff and clients alike, it should be noted, see the same view in the interface with the same data fields when collaborating.

COBE has been built with responsive design, meaning that is available on a smart tablet, smartphone or desktop computer.

This is just the latest technology addition in a years-long development rollout by Bank of America Merrill Lynch for its advisors and clients. In August 2020 the firm introduced its Personal Wealth Analysis technology that melded financial planning and asset management features and processes into a single experience. And most recently, in March, the firm rolled out its Digital Wealth Overview, composed of automated personalized, interactive video presentations produced for individual clients.