The latest technology sure to evoke envy among financial advisors in the independent channel: on-demand personalized video presentations.

Called Digital Wealth Overview, it is the latest technology addition in a years-long development rollout by Bank of America Merrill Lynch for the fiduciary advisors within its Thundering Herd.

These personalized, interactive video presentations, three to four minutes long and narrated by Erica, Bank of America’s virtual assistant, are now available to advisors within the Investment Advisory Program (IAP), Merrill’s fiduciary business.

“Advisors decide who this goes to and when,” said Carl Swanson, head of advisor and client experience within the Investment Solutions Group at Bank of America.

With just a few mouse clicks, Merrill advisors can send a video containing client’s own real-time data, which is available securely through My Merrill. The new report ingests investment advisory accounts, bank and brokerage accounts, and held-away accounts aggregated with the client’s permission.

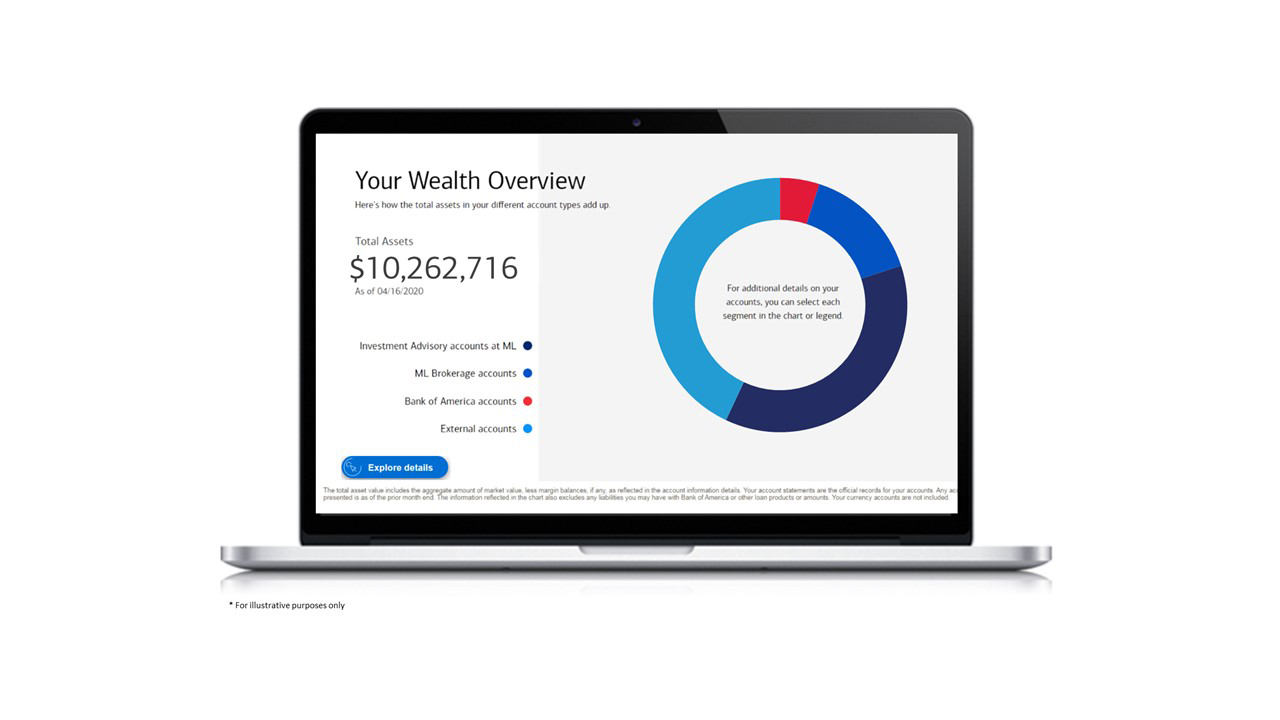

A screen from Merrill's Digital Wealth Overview

The videos are also interactive, with “explore details” buttons that appear, enabling clients to click for more information or to schedule a meeting with their advisor.

In pilot since August, the videos spring from foundational technology put into advisors’ hands at that time, part of the Merrill Personal Wealth Analysis platform, which combined financial planning and portfolio analysis into a single tool.

“We’ve found that lot of clients just don’t want to talk on the phone these days, so we think that maybe this is a way some clients would like to interact instead,” said Swanson, recalling a situation when a client (one that had regularly avoided both phone calls and requests to set up annual review appointments because of a heavy work-related travel schedule) not only reached out to his advisor but also set up account aggregation. It was the client’s own realization, noting the lack of a holistic, full picture due to the report missing his held-away accounts and assets that spurred him to action, according to Swanson.

When asked about the infrastructure required to support the scale for large numbers of such interactive reports and videos being generated by thousands of advisors, Swanson said the firm had built the needed capacity as the technology was developed.

“We built it to work with the business we have, so if every advisor on Monday wanted to they could send this video to every client,” he said.

“The DWO is really the latest example of us providing a more modern and personalized wealth management experience,” said Swanson, calling it a new experience that is both a less aggressive means of engagement (less than a phone call or direct communication) yet still provides the advisor a highly personalized touch point with the client.