“The pace of change is accelerating,” noted Joel Bruckenstein, setting a somewhat ominous tone in his opening remarks at the Technology Tools for Today (T3) conference, the largest industry gathering focused on technology in the wealth management space.

Bruckenstein, the founder of the conference, was speaking about the many innovations that are transforming the advisory business and how advisors need to "keep up" to stay relevant.

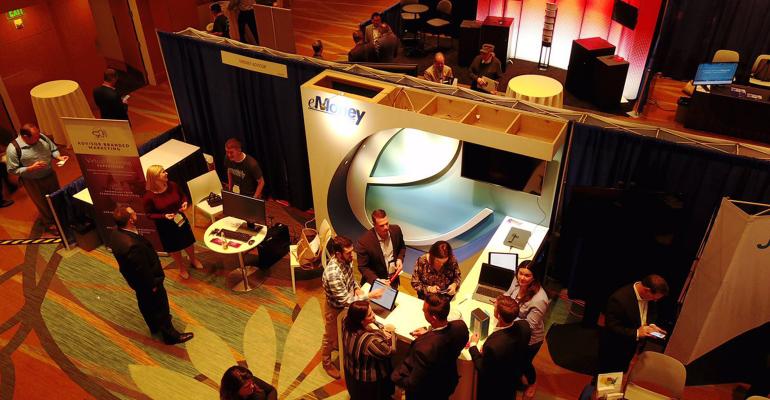

T3 is being held in Garden Grove, CA this year adjacent to Disneyland in warm and sunny Southern California—providing an apt backdrop for the future of advisor tech. Nearly 80 technology vendors are putting their innovations on display for over 600 attendees, gathered for 2 1/2 days of presentations, demonstrations, deal-making and networking.

A notable shift in the conference theme this year is an acknowledgment that “robo” technology—the digital automation of many of the advisors’ tasks, including investment allocation—should not be treated as competition, but as a complementary tool advisors can use to grow their practices through efficiencies and the ability to concentrate on client management. The theme was demonstrated in the many product enhancements from the vendors unveiled here, most designed to provide more online tools, client self-service capabilities and workflow automation.

Kicking off the first day was Riskalyze CEO Aaron Klein, who debuted new enhancements to his digital investment platform, Autopilot, including the launch of next generation tools and the “Autopilot Partner Store,” a marketplace that creates automated access to investment models, strategies and research from some of the industry’s top asset managers and research firms, including BlackRock, First Trust, Morningstar, State Street, American Funds and more.

According to Klein, the extension of digital tools into advisors’ workflows is critical because the demand for personal advice is increasing, but is also becoming more difficult to provide at volume. “The problem with personalization is that it doesn’t scale, and the problem with automation is that there is no personalization,” he said. “What is needed is an ‘automated account platform’ that streamlines the process to flexibly automate advice, while still personalizing the experience, which is what the Partner Store is all about.”

Following Klein were a series of presentations by the industry’s top financial planning platforms—Advicent, MoneyGuidePro and eMoney.

MoneyGuidePro President Kevin Null took the “commoditization” of robo advisors message even further by providing ample evidence that these automatic investment platforms were not going to win in the marketplace on their own, citing the recent slew of announcements that firms such as Financial Engines, Betterment and Schwab were all making human advisors available to users of their robo platforms. “The stand-alone, b-to-c robos will all be gone in the next 12 to 18 months,” he boldly predicted.

Null also presented research his firm had done to show how couples find talking about money and financial goals in front of their advisor is a stressful situation because they often do not agree on certain issues.

Adding a digital component can change that dynamic, he said. “Clients are much more relaxed and have less stress in planning conversations when parts of the process are conducted digitally,” Null noted.

Jessica Liberi, Vice President of Product Management for eMoney, presented the latest developments coming out of that firm including the expanded launch of Advisor Branded Marketing technology. The marketing toolkit offers custom-branded, multi-media marketing campaigns for generating and nurturing leads via the eMoney dashboard. Additionally, eMoney announced some high-profile platform integrations with industry heavyweights Black Diamond, Envestnet and Schwab.

In a high-risk presentation strategy, Liberi included Amazon’s Echo Alexa voice recognition technology to query the eMoney database about various client situations, status of retirement plans, and other account related information. Seeing the Echo in action, live on the stage, thrilled the crowd while also providing a glimpse into the future of how advisors will interface with their systems.

Rounding out the big name presentations on Day 1 was a timely update by Fidelity on the ambitious WealthScape total advisor platform. Last year at T3, Fidelity announced progress made on providing all of the technology an advisor would ever need—including the availability of performance measurement, deep integrations with eMoney, and the pilot of digital advice solutions all coming soon.

Highlighting the afternoon sessions was a panel on digital advice and how advisors can “reimagine the delivery of investment advice and the client experience.” Rich Cancro, CEO and founder of AdvisorEngine (formerly Vanare), fresh off the acquisition of Wealthminder, moderated the session challenging the panel and the audience to understand why firms need scale to exist in the new wealth management world.

Greg Friedman, of Junxure, Andy Putterman of 1812 Park LLC and Kendrick Wakeman of FinMason all provided actionable anecdotes on what they would do if they could start their firms again in 2017. The consensus? Deploy robo technology and use model portfolios, while employing younger advisors to connect with the next generation of investors.

Capping off the first day was the grand opening of the T3 exhibit hall, chock-full of the industry’s top vendors all vying for mindshare of the advisor attendees, as well as seeking out other tech firms for integration opportunities and partnership deals.

Up next: Day 2 of T3 2017 featuring rapid fire technology demonstrations and the highly anticipated reveal of Orion’s latest developments. In the meantime, check out the many tweets on the #T32017 hashtag on Twitter for all of the latest updates.

Timothy D. Welsh, CFP® is President and founder of Nexus Strategy, LLC, a leading consulting firm to the wealth management industry, and can be reached at [email protected] or on Twitter @NexusStrategy.