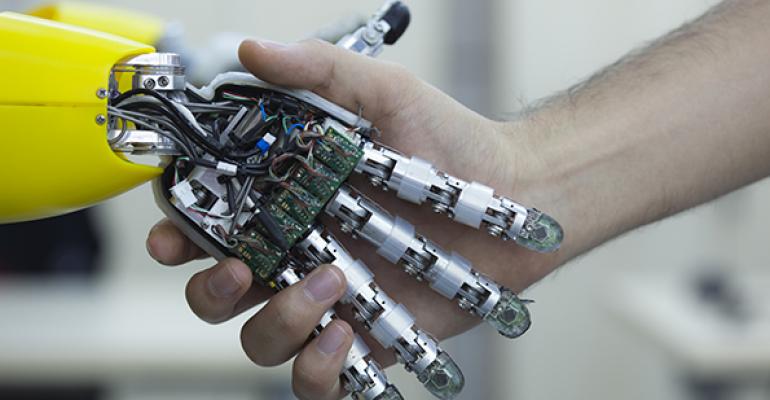

Financial advisors are reassessing their businesses for a number of reasons: the aging bull market and the Department of Labor’s new fiduciary rule are among major concerns. However, advancements in technology and increasing competitive pressure from robo advisors top the list. Customers are turning to robo advisors because they offer easy and fast access to information online, whether by desktop or mobile device, use the latest technology and are cost-effective.

This tech revolution signifies a shift in the industry, changing customer expectations and pushing advisors to adapt or be left behind.

“Under certain assumptions, advisors can be seen as dinosaurs,” said Tim Welsh, CFP, president and CEO at Nexus Strategy. “Dinosaurs as an analogy went extinct due to their inability to react to a rapidly changing environment. Thus, this new automation movement spurred on by the robo advisors is a wake-up call for the industry; we need to look at our business closely, look at operations and simplify the back office so it’s much easier to manage.”

B/d and RIA firms that are successfully navigating the changing landscape have something in common: They understand the allure of the robo advisor and embrace change by learning from it. “Robo-izing” administrative tasks and back-office operations leads to time and cost savings, enabling human advisors to offer clients convenient access and a higher-quality experience while keeping costs under control. Enterprise content management (ECM) is a key robo technology that helps firms:

- Eliminate paper and paper-driven processes;

- Centralize and secure digital content, allowing fast and easy access to information while reducing cyber risks; and

- Automate what are normally manual, complex processes such as new account opening, client communications, disaster recovery and compliance.

Going Digital

“Paper is a problem. Robo advisors can open accounts immediately and the entire process is completely paperless,” Welsh explained. The first step a firm can take to modernize its operations is eliminating paper, digitizing all of their client, operational and internal documents and centralizing them in an electronic repository.

Rehmann Financial, a part of one of the largest CPA, business consulting and financial services firms in the Midwest, uses enterprise content management software as its electronic repository that connects employees across 22 branches.

“We were spending a small fortune mailing documents back and forth and spending way too much time trying to figure out where a piece of paper was in the approval process” before implementing an enterprise content management system, Rehmann Financial operations manager Amy Flourry said.

Now, all of the organization’s documents live in that software program, where employees with the appropriate security clearance can access them. This gets rid of the need to shuffle through file cabinets, prevents risk of physical loss to a fire or flood, keeps all associates on the same page with updates and versions of documents, and also allows for Rehmann to track all access and actions taken on documents, thereby streamlining the audit process.

Beyond these internal benefits, Rehmann’s advisors offer more expeditious customer service because they can quickly retrieve client documents. Rehmann integrated its ECM system with the firm’s customer relationship management system (CRM), which accelerated finding and filing documents across the enterprise.

“We’re able to go to a client and say, ‘Here’s all the information we currently have on you,’” Flourry explained. “We’re prepared with everything from the client’s phone number to their net worth; that elevates the level of service we’re able to provide. Showing clients that we have accurate and readily available information is important when they are entrusting their investments and their money to our firm.”

The Automated Age

Firms that digitize and centralize documents can go a step further by automating processes, enabling staff to reclaim time from manually routing documents and maintain higher standards for accuracy, since much of the manual data entry required in traditional processes is eradicated.

Rehmann Financial automated day-to-day business processes, including new account opening, using its ECM solution. The software features an intuitive workflow designer for everything from simple tasks like renaming or filing documents, to entire processes, such as new rep onboarding. “It sounds small, but people used to set aside a day to get caught up on filing,” Flourry adds.

Firms can also leverage automation for compliance in the face of increasingly complex and costly regulatory requirements. At Rehmann Financial, hundreds of pieces of correspondence that compliance supervisors are tasked with reviewing every month are automatically routed to the appropriate reviewers to be approved with a digital signature. Compliance teams no longer need to travel to various branches to pull files and review documents on-site. “We can now audit from a central location, so we’ve eliminated those travel costs,” Flourry said.

Improving efficiency in these back-office operations has allowed Rehmann Financial to grow and compete in a market that’s being flooded with robo competition. “We’ve grown by merging with small firms, and one of the things that sells us is that we have these great business processes in place,” Flourry said. “It’s attractive to new and prospective staff. They love to see that we have processes and best practices in place, and that we have a progressive stance on implementing technology.”

The Bottom Line

A recent Gallup study released in early 2016, found that the majority of U.S. investors still prefer having a strong relationship with a personal financial advisor, but many investors would like an online or digital element to complement the human advisor experience.

By eliminating paper files and automating business processes, firms can offer the services—such as online client portals and increased client engagement—that position them as leaders in the marketplace. In addition, firms achieve higher revenues and greater business value from reducing paper storage costs, increasing productivity and efficiency, and simplifying compliance.

Technology—specifically digital repositories, strategic integrations and business process automation—is now an imperative for humans to compete with robo advisors. Smart firms are embracing the cost-effective way to beat the competition. Ultimately, these initiatives are investments that lead to increased focus on the personalized service that clients expect when choosing them over their robo competition.

Linda Ding is Senior Financial Program Strategist, Laserfiche.